He’s up 25% so far this year thanks to some key new stakes and outperformance with prior investments.

Activist investor Bill Ackman’s Pershing Square Holdings is off to one heck of a start this year with its strongest ever start to a year, reporting a return of nearly 25% on its investments so far in 2019.

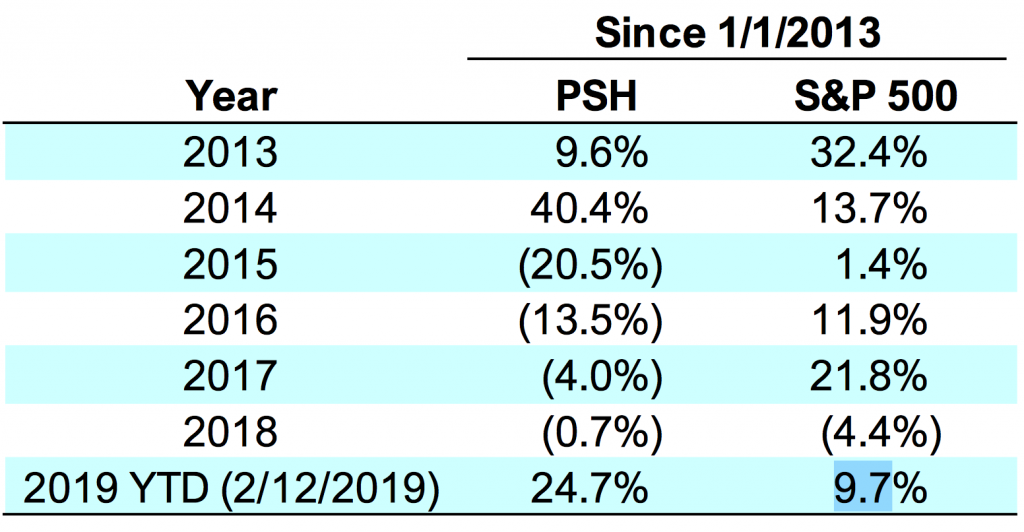

The hedge fund reported Wednesday that its portfolio is up 24.7% so far this year, more than doubling the S&P 500’s return of 9.7%.

The fund said in a presentation that the biggest contributors to these gains were thanks to its investments in Chipotle Mexican Grill (NYSE: CMG), Automatic Data Processing (NASDAQ: ADP), Starbucks (NASDAQ: SBUX), Lowe’s (NYSE: LOW), and United Technologies (NYSE: UTX), in addition to its share buyback program. Pershing’s total assets under management rose to $7.93 billion, up from $6.45 billion at the end of December.

Chipotle has proven to be a lucrative investment for Ackman, who remains one of the restaurant’s largest shareholders. So far this year, Chipotle is up nearly 40% and buoyed Pershing’s gross returns by 6.2% last year.

Ackman helped bring Brian Niccol on board as Chipotle’s CEO last March. The former Taco Bell executive has been pushing digital and marketing investments to bring consistent growth back to the burrito chain, as digital orders typically equal a higher check while also reducing in-store lines.

“Brian and his team have made significant progress turning around Chipotle and reaccelerating growth,” Ackman wrote in Pershing’s shareholder presentation. “Reigniting same-store sales growth is the key priority for 2019.”

United Technologies has also had a strong performance this year, and is currently up 16.58% year-to-date.

Pershing’s presentation noted that UTX is a “high-quality industrial conglomerate with market-leading businesses in aerospace, elevators and heating, ventilation, and air conditioning,” and said that the “upcoming business separation should be a catalyst for significant share price appreciation.”

Ackman has been building a stake in the company since last year and encouraged the conglomerate to split up key parts of its business. United Technologies announced its intention to do just that in November separating into three independent companies, Aerospace, Otis, and Carrier, by the first half of 2020.

The activist shareholder also noted that UTX appears well insulated from the ongoing trade war between the United States and China, and has seen “limited impact” from tariffs. Pershing’s presentation also noted that the company boasts a “multi-year order backlog and long-term service contracts” that “underpin future growth and moderate cyclicality.”