In a week filled with tech companies making huge post-earnings moves, investors took a break from that sector’s dominance on Wednesday when Royal Caribbean Cruises Ltd. (RCL) released its first-quarter earnings report. The world’s largest cruise operator by revenue surpassed analyst expectations on the top and bottom lines, galvanizing investors to push RCL stock to a more than seven-month high.

The market for cruise vacations is a sector of the consumer economy that largely goes unnoticed by the media. With tech and industrials known to dominate earnings season, investors are interested now more than ever after Royal Caribbean’s Q1 success in whether or not the cruise industry boasts long-term momentum.

Here’s a detailed look at Royal Caribbean’s big release on Wednesday – and what it means for the sector moving forward…

The News

The company reported earnings per share (EPS) of $1.31 for the January-March period, beating Wall Street’s expected $1.11 by 18% and climbing more than 20% year-over-year from $1.09. Revenue increased 20.2% from $2.03 billion in the first quarter of 2018 to $2.44 billion. That also edged past Wall Street’s estimate of $2.38 billion by a decent 2.5%. Most major revenue segments experienced sizable growth, including passenger ticket revenue and onboard revenue, which increased 19.9% and 21.2%, respectively.

Royal Caribbean’s sore spot was earnings guidance, which it revised to the range of $9.65 to $9.85 per share. That’s down from the previous range of $10.15 to $10.35, with the downward revision largely due to a stronger U.S. dollar and climbing fuel prices. With West Texas Intermediate (WTI) crude oil prices currently near a six-month high of $64 a barrel, fuel-consuming companies like cruise operators and airlines will likely get pinched by higher prices for refined products like gasoline.

How Investors Reacted

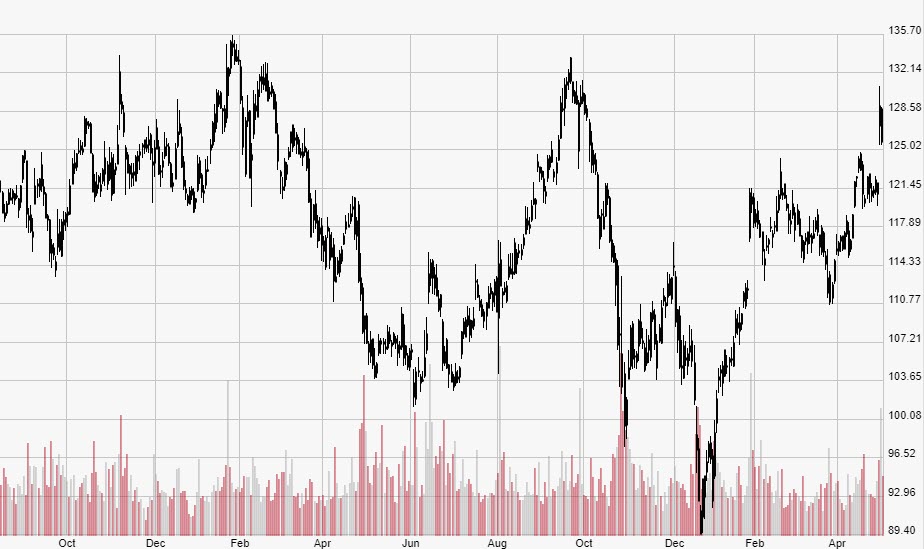

Shares of RCL stock rocketed 6.7% on the day from $120.94 at the April 30 close to $129.03 on Wednesday. Royal Caribbean was the S&P 500’s top performer during Wednesday’s session, beating out Harris Corp.’s (HRS) 6.6% return and Hilton Worldwide Holdings Inc.’s (HLT) 6.5% gain. At $129.03, Royal Caribbean stock is now up 32% from the Dec. 31 close of $97.79.

RCL’s performance lifted other sector heavyweights, particularly Carnival Corp. (CCL) and Norwegian Cruise Line Holdings Ltd. (NCLH). Those rivals respectively jumped 1.6% and 5.1% on the day.

The Bigger Picture

It’s surprising how little coverage the commercial cruise industry gets considering just how buoyant it’s become in recent years. The global ocean cruise industry hit $45.6 billion last year, up 4.6% year-over-year, and Royal Caribbean remains a large component of that. While its 4.99 million passengers in 2018 lagged behind Carnival’s 5.72 million, Royal Caribbean’s revenue of $6.53 billion smashed Carnival’s $4.17 billion, according to industry researcher Cruise Market Watch.

Still, the media only seems to cover the sector when an incident occurs. Like airlines, nearly every major cruise line has seen its fair share of high-profile incidents over the years, but Royal Caribbean unfortunately happens to have experienced the most recent one. On April 1, the company’s Oasis of the Seas cruise liner experienced heavy damage at the Grand Bahama Shipyard in Freeport, Bahamas when two construction cranes collapsed and fell onto the ship. While no serious injuries were reported, Royal Caribbean had to cancel three sailings due to extensive repairs. The revenue missed from the ship’s dormancy influenced the company’s lowered earnings guidance for the year, but executives ensured that repairs would finish in time for a May 5 departure.

The revised guidance notwithstanding, demand for Royal Caribbean cruises and cruises in general looks strong moving forward in 2019. According to analysts from Bernstein Research, booking levels are on the rise across major industry players like Royal Caribbean and Carnival. Additionally, Cruise Lines International Association (CLIA) – the world’s largest cruise industry trade organization – expects 30 million travelers to board cruises this year. That marks a 6% increase from 2018.

Looking Ahead

As the world’s second-largest cruise operator by total passengers, Royal Caribbean looks poised for more growth in the long term. If Royal Caribbean theoretically maintains 4.99 million passengers again this year and the CLIA’s global estimate of 30 million passengers holds true, the company looks set to corner nearly 17% of the market in 2019. With consumer spending on the rise, Royal Caribbean is surely on track to corner a much higher percentage than that, indicating rising profits and a rising tide of investor enthusiasm on the horizon.