As the trade war between the U.S. and its largest trading partners, most notably China, has extended into well over a year, with no expectation at this point of a compromise before the end of 2019, it’s been interesting to observe and pay attention to the stocks in different sectors and industries that are exposed to trade risk. Some, like Consumer Staples and even the Discretionary sector, have weathered the storm relatively well, despite concerns about the long-term, ripple effects tariffs may have on consumer prices. Others that are closer to the bleeding edge of trade have seen quite a bit more volatility.

Industrial stocks are an example of a sector where trade uncertainty has contributed a significant degree of volatility. That includes companies that fabrication steel and metal products. While part of the Trump’s administration argument for tariffs has included trying to level the playing field for American companies that operate in this sector, there is a considerable case to be made that tariffs have also had an opposite, negative effect than some expected at the early stages of the trade war. That is the reasonable explanation for the reason that stocks like Kaiser Aluminum Corp (KALU) have underperformed the market year to date. While KALU is up about 6% from its starting point at the beginning of 2019, it has also dropped significantly off its 52-week high price, which was reached in late February at around $115 per share. That puts the stock nearly -18% off of that high point.

KALU is an interesting company in this sector. Formed in 1946 after the end of World War II in California, the stock is fairly recognizable among U.S. metal producers, and despite its small-cap size, has a solid fundamental profile, with a balance sheet that is better than many other companies in the industry, and a conservative approach to leverage. While the company bottom line is showing some negative effects from trade exposure, it also appears to be well-positioned to ride out the storm, even if it lingers well into 2020. Does that mean that the stock’s decline since February offers a useful value proposition as well?

Fundamental and Value Profile

Kaiser Aluminum Corporation manufactures and sells semi-fabricated specialty aluminum mill products. The Company operates in the Fabricated Products segment. The Company’s Fabricated Products segment focuses on producing rolled, extruded and drawn aluminum products used principally for aerospace and defense, automotive and general engineering products that include consumer durables, electronics, electrical and machinery and equipment applications. The Company offers its products for various end market applications, such as aerospace and high strength (Aero/HS products); automotive (Automotive Extrusions); general engineering (GE products), and other industrial (Other products). The Company’s fabricated aluminum mill products include flat-rolled (plate and sheet), extruded (rod, bar, hollows and shapes), drawn (rod, bar, pipe and tube) and cast aluminum products. KALU’s current market cap is $1.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both declined, with earnings dropping about -16.6%, and sales declining almost -10%. The company operates with an adequate, but modest margin profile; over the last twelve months, Net Income was 5.95% of Revenues over the past year, and declined somewhat in the last quarter to about 5.11%.

Dividend Yield: KALU pays a yearly dividend of $2.40 per share, which translates to an annual dividend of around 2.45% at the stock’s current price.

Free Cash Flow: KALU’s free cash flow, like their operating margins is adequate, if not quite as high as I’d normally prefer to see, at $69.3 million. This number has declined since March of 2019, when it was around $79.5 million. Its current level translates to a Free Cash Flow Yield of 4.41%.

Debt to Equity: KALU has a debt/equity ratio of .53. This is a low number that generally suggests debt management shouldn’t be a problem. The company’s balance sheet shows about $146.6 million in cash and liquid assets against $396.9 million in long-term debt. KALU has generally good liquidity, and the company’s operating margins are adequate to cover short-term cash needs as well as to service long-term debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for KALU is $46.63 per share, and which translates to a Price/Book ratio of 2.02. Their average Price/Book Value ratio is 2.09, which means the stock is pretty fairly valued, and only slightly below its “fair value” price at around $98 per share. That also means that in terms of long-term value, the stock would need to drop to about $78 to offer what I would consider to be a useful, compelling value proposition.

Technical Profile

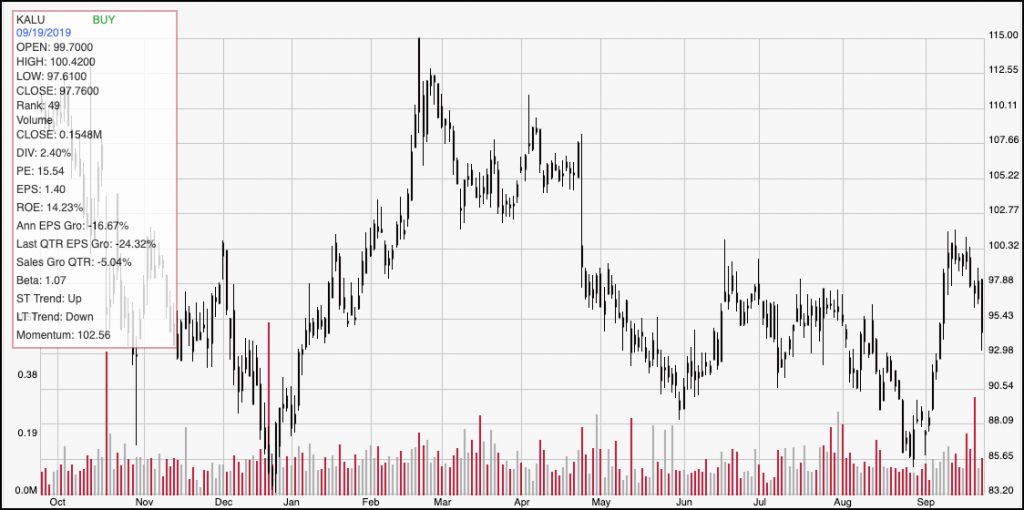

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year’s worth of price movement for KALU. After dropping to a trend low at around $86 per share at the end of August, the stock has rebounded, finding a short-term peak at around $100 just about a week ago. From that point, the stock has declined a little over -5% to its current level a little below $95. The stock’s most likely support level is around $90.54, based on previous pivot support in May, July, and the early part of August. If the stock drops below that level, it should test its recent low point at around $85 per share fairly quickly. In order to build any kind of sustainable bullish momentum, the stock would need to break above the $100 level; in that case, the next most likely level of resistance would probably be around $105.

Near-term Keys: If the stock can break its current resistance and stay above $100, there is probably a good opportunity to buy the stock or use call options to work a short-term bullish trade with a target around $105. Right now, the stock’s bearish momentum could offer an interesting signal to short the stock or buy put options, with a near-term target at the $90.54 level. Despite the company’s underlying fundamental strength, recent tough talk from President Trump before the United Nations about a deal with China seems to have only added to the stock’s mostly bearish momentum. That could be useful to improve the stock’s value proposition, but whether it will drop far enough to offer a compelling value opportunity remains an open, unanswerable question. That means that any trade you might consider for this stock should be limited in terms of duration as well as how much you expect to get out of it.