We’re in “a brutal recession,” and it may take a while for the market to recover amid the coronavirus pandemic. Here’s what one expert says to expect.

There’s been a lot of speculation that March 23 was the market’s bottom. But if investors are hoping for an epic run back to all-time highs and beyond, they may be waiting a while.

“The economic and corporate earnings news for the next month or two is going to be dreadful,” Federated Hermes chief equity market strategist Phil Orlando said this week. “You could see some 10% consolidation.”

Orlando says that it could take 18 to 24 months for the S&P 500 to return to all-time highs as the world sees recurring waves of the coronavirus pandemic with 2020 likely being a lost year.

“2020 to a significant degree is going to be destroyed in terms of economic growth and corporate earnings growth,” Orlando said.

Economic forecaster Lakshman Achuthan echoed that sentiment, warning that the pandemic will hit the U.S. economy harder than the financial crisis.

“This is a brutal recession” Achuthan, co-founder of the Economic Cycle Research Institute, said Wednesday. “This recession is extraordinarily deep. Already, you’ve got 22 million people filing for jobless claims compared to 8.7 million jobs lost during the Great Recession.”

That jobless figure grew to 26.5 million with Thursday’s jobs report which showed another 4 million Americans applied for unemployment benefits last week, marking the steepest downturn for the U.S, labor market since the Great Depression, and wiping out the 22.4 million jobs added to nonfarm payrolls since November 2009.

“Jobless claims are a warning that the worst isn’t over yet for the American economy with businesses and consumers alike being sucked down into the abyss of the pandemic recession” said Chris Rupkey, chief financial economist at MUFG. “The risks to the outlook are that the economy is digging itself such a big deep hole that it will become harder and harder to climb back out of it.”

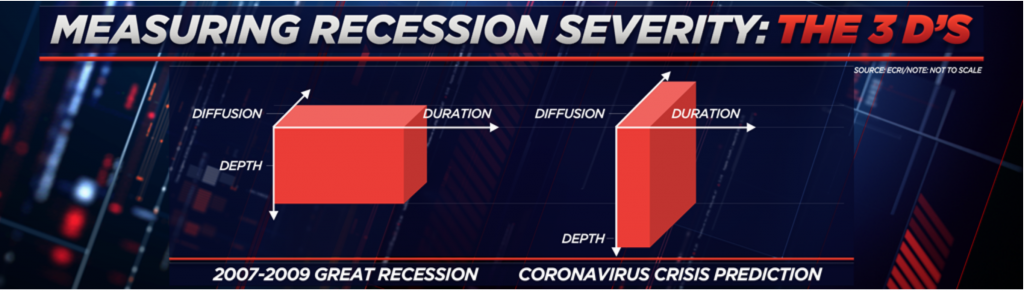

For Achuthan, his case is made by looking at three areas: depth, diffusion, and duration.

“The diffusion of weakness across the economy… spreads like wildfire,” Achuthan said. “This recession is certainly very severe. It’s affecting pretty much all industries.”

But on a positive note, Achuthan said, “This recession could end up being among the shortest on record. Just a partial re-opening of the economy would lift activity off the extreme lows.”

However, “It’ll be a long time. It won’t be anytime soon that we will be getting back to a more typical economic growth outlook,” Achuthan cautioned. “We really need to see where the leading indexes go. That’s the critical point.”

Despite the bleak outlook, Orlando hasn’t stopped buying stocks and says that there are opportunities with at least a two year timeline.

“Patience is a virtue,” Orlando said.

Orlando believes technology and health care stocks will continue to outperform the market, and longer-term, he likes financial services and small caps.

“If the economy starts to grow again in the second half [of 2020], banks are going to be part of that equation,” Orlando added. “Smaller cap stocks have gotten disproportionately hit relative to large cap stocks. The dollar remains strong, and we think the U.S. economy is performing a lot better than everybody else around the world.”