The cryptocurrency is back in the headlines after breaching its highest level in a year. The question now is, can it keep climbing higher?

Bitcoin surged to its highest level in the last year this week and, as of this writing, sits at $11,043.58.

The digital currency is up 54% year-to-date and is up more than 20% over the last month as investors hedge against the risk in the market amid the coronavirus pandemic, ensuing recession and concerns about the economic recovery, geopolitical turmoil, and an impending U.S. presidential election.

Bitcoin has been rising in lockstep with gold, which hit a new all-time high this week and is within striking distance of hitting $2,000 an ounce.

“We’ve been recommending gold as a way to play the expansion of the [Federal Reserve’s] balance sheet,” said Ari Wald, head of technical analysis at Oppenheimer. “It’s actually the high momentum commodity, it ranks highest above all commodities out there in terms of momentum.”

But when it comes to bitcoin, Wald says it may be a better bet now as it’s not as overbought.

“We do recommend sticking with [gold],” Wald added, “but I think it’s worthwhile to highlight bitcoin instead which isn’t as extended.”

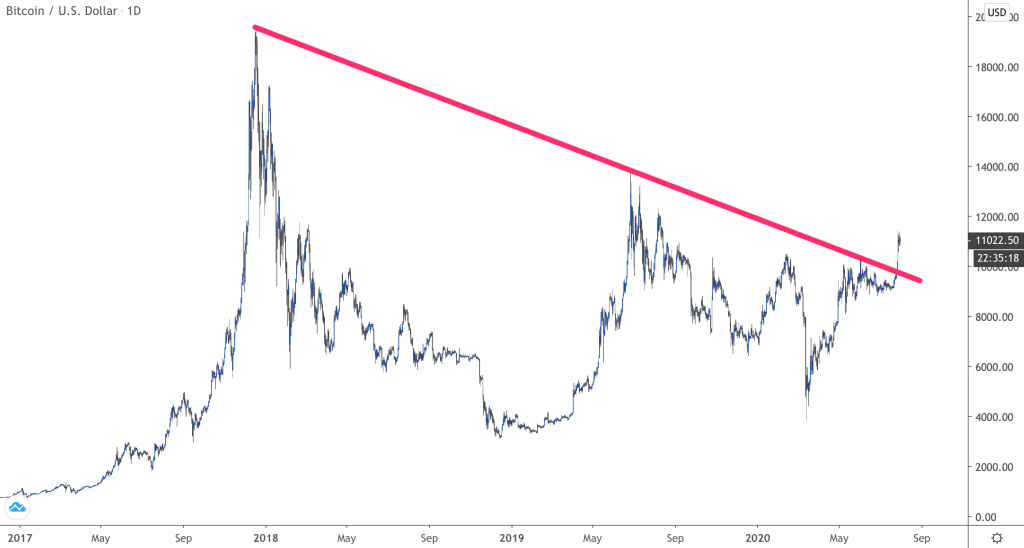

“Bitcoin is reversing its downtrend dating back to its 2017 peak,” Wald continued. “If you are a long-term holder, this is the type of action you’d like to see.”

“Bitcoin is currently realizing its reputation as a form of digital gold,” said Nigel Green, chief executive and founder of deVere Group. “Up to now, gold has been known as the ultimate safe-haven asset, but Bitcoin—which shares its key characteristics of being a store of value and scarcity—could potentially knock gold from its long-held position in the future as the world becomes evermore tech-driven.”

While the largest digital token is still around -45% below its December 2017 peak of nearly $20,000, some investors are now betting that the asset could surge to $15,000 and beyond.

“The Bitcoin price crossed above the 10K mark and the price action looks bullish now as the price has cleared a major psychological level that has been there for a long time,” said AvaTrade analyst Name Aslam in a note. “If the Bitcoin price does pick up the momentum, nothing else will be able to match it as Bitcoin is a different kind of beast. We believe the next resistance for the Bitcoin price is $15K now.”

And crypto fans have momentum with them to push bitcoin far higher.

Bitcoin’s recent rise is “attracting the momentum players,” said Matt Maley, chief market strategist at Miller Tabak. “And of course, the momentum players play such a big role nowadays that it’s giving Bitcoin the big move.”