As a value-focused investor with more than a bit of a contrarian bent, I tend to get nervous when stocks keep making one new high after another, and I like it when I see stocks trading at or near historical lows. That’s pretty different than the mindset of most investors that focus on growth first, and I understand why – one of the most basic rules around trend analysis states that stocks tend to follow the direction of the next longer trend. That means, in part, that in the short term, a stock is more likely to go up if it has already been going up for at least a few months. If the stock has been going up for a year or more, then the rule should hold even more strongly.

The contrarian part of my investing system revolves around what a stock should be worth at any given time. I like to try to identify what I think represents a fair value for a stock. That mindset differs a bit from straight growth investing, because it uses a stock’s underlying fundamental strength, mixed with historical valuation metrics, to arrive at that “fair value” price. It is an attempt to smooth out the volatility that often exists in stocks as they swing from extreme high to extreme low and consider price movement in a more objective fashion than simply assuming that because a stock has been going up or down, it is going to keep moving that direction. If a stock is trading at a discount relative to historical valuations, with a strong book of business underneath, there is a strong argument to be made that the stock should trade higher than it is right now, and that is where the meat-and-potatoes of my investing strategy lies.

The major market averages lately have been pushing nearer and nearer to pre-pandemic highs – in fact, the NASDAQ broke above that high in July and continues to show a lot of bullish momentum right now. That has a lot of investors thinking in post-pandemic terms, despite the fact that the health crisis is far from over. One of the sectors that has unquestionably seen the biggest rise in price since the initial outbreak in the U.S. forced the entire market to bear market low is the Technology sector, which has rallied nearly 66% since mid-March based on the movement of the iShares U.S. Technology ETF (IYW). That kind of massive run-up in such a short period of time gets the contrarian side of me twitching – but it also helps me perk up when I find a stock in the same sector that isn’t only underperforming, but completely diverging from its brethren.

Seagate Technology (STX) is one of the biggest providers of storage technology solutions. Where many of its competitors, like Micron (MU) and Western Digital Corporation (WDC) have emphasized innovating in the emerging flash, NAND, and SSD memory space, STX has stayed fixed in traditional disk drives. While demand in traditional PC’s has dropped, the truth is that truly high-capacity storage – the kind required for network and cloud servers, where the tech sector has seen the most growth this year – is still only practical with traditional disk storage technology. That is where STX has put its greatest focus, and where analysts continue to expect to see growth. The work-at-home dynamic certainly played a role in helping STX’s stock drive nearly 41% higher to around $55 by early June after hitting a March low at around $39; but from that point the stock has dropped sharply back to around $45 as of this writing. Does that mean the stock is trading at a deep discount right now, and should be higher, or is its drop an indication of other problems? Let’s find out.

Fundamental and Value Profile

Seagate Technology public limited company is a provider of electronic data storage technology and solutions. The Company’s principal products are hard disk drives (HDDs). In addition to HDDs, it produces a range of electronic data storage products, including solid state hybrid drives, solid state drives, peripheral component interconnect express (PCIe) cards and serial advanced technology architecture (SATA) controllers. Its storage technology portfolio also includes storage subsystems and high performance computing solutions. Its products are designed for applications in enterprise servers and storage systems, client compute applications and client non-compute applications. It designs, fabricates and assembles various components found in its disk drives, including read/write heads and recording media. Its design and manufacturing operations are based on technology platforms that are used to produce various disk drive products that serve multiple data storage applications and markets. STX has a current market cap of $11.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 28% while sales grew 6.16%. In the last quarter, earnings dropped almost -15%, while revenues decreased by about -7.5%. The company’s margin profile is generally healthy, but like most companies right now has shown signs of deterioration; over the last twelve months, Net Income was 9.55% of revenues, but shrank to about 6.6% in the last quarter.

Free Cash Flow: STX has generally healthy free cash flow of a little over $1.13 billion over the last twelve months. This number decreased from a high point in September of 2018 at around $2.1 billion. At the stock’s current price, this also translates to a Free Cash Flow Yield of about 9.62%.

Debt to Equity: the company’s debt to equity ratio is 2.33, an elevated number that suggests STX is highly leveraged. The company’s balance sheet indicates their operating profits are more than sufficient to service their debt, with $1.72 billion in cash and liquid assets and a little over $4.1 billion in long-term debt.

Dividend: STX pays an annual dividend of $2.60 per share, which translates to an annual yield of 5.68% at the stock’s current price. Not only is that remarkable for a tech company, most of which don’t pay any dividend at all, but this is also well above the industry average. It is also worth noting that while competitors like WDC have suspended their dividend payout to preserve cash, STX has increased their dividend from $2.52 about a year ago.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $40.50 per share. That means that STX is moderately overvalued right now, with about -11% downside from its current price.

Technical Profile

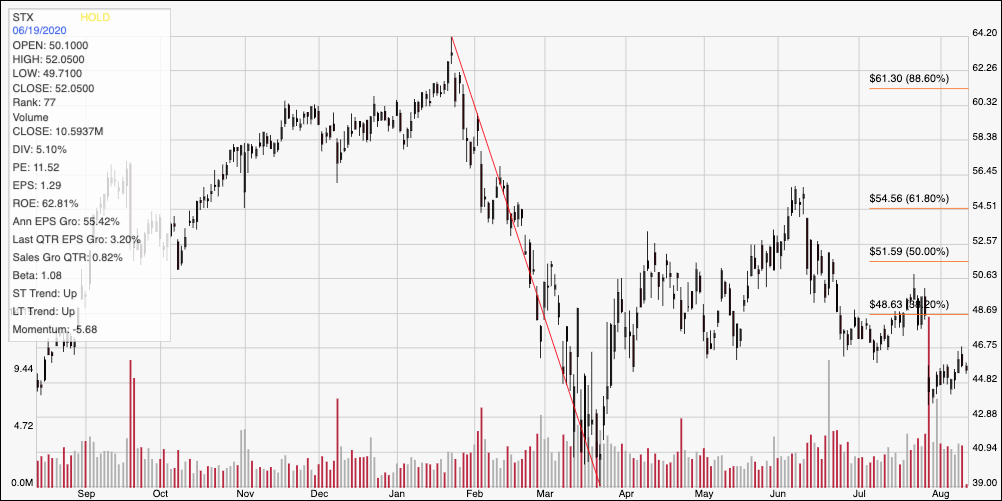

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward slid from a January peak at around $64 to its March low at close to $39 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock rebounded quickly, pushing to a high around $55 in early June before falling back in the last two months. In the last couple of week, the stock hit a low at around $43 before rebounding to a new short-term high a little below $47 before dropping back again to its current price. That puts immediate resistance at $47, with support around $43. A break above $47 should give the stock room to push to about $48.50 where the 38.2% retracement line sits, a good chance of testing its late July high around $50. A drop below $43 could see the stock test its March low levels between $39 and $40 per share.

Near-term Keys: STX has some interesting fundamental metrics working in its favor right now; despite those strengths, however, the stock is clearly overvalued. That means that if you want to work with the stock on a long-term basis, you’re doing it strictly on the basis of its growth prospects. The fact is that most analysts aren’t overly bullish on the storage segment’s long-term prospects right now, as declining consumer trends in the space provide a big counter and major headwind to the strength of enterprise demand, which is expected to narrow through the rest of the year and into 2021. I think that means that the best probabilities for a stock like STX lie in shorter-term trading strategies. If the stock can push above $47, you could think about buying the stock or working with call options, using a range between $48.50 and 50 as a good profit target. A drop below $43 would be a strong signal to consider shorting the stock or buying put options, with a profit target between $39 and $40 on a bearish trade.