Ever since coronavirus found its way to American shores, a large amount of media attention has been given to the Healthcare sector – and especially to the Biotechnology industry, where many of the biggest names across the world have been working hard to develop effective treatments for the disease. From the market’s bearish low in mid-March, the Biotech industry rebounded strongly, increasing in value by more than 50% by mid-July, as measured by the iShares NASDAQ Biotechnology ETF (IBB). The industry retraced from that point until late September – a drop that I think can be attributed both to simple profit-taking in many of the names that drove the increase, and to the frank reality that even with emergency use approvals and fast-tracked regulatory processes, COVID treatments – whether antiviral or straight vaccine – aren’t likely to be available for widespread distribution and use until sometime in 2021.

From that point, however, the industry has rebounded nicely and it now approaching the 52-week high it reached. I find it at least anecdotally interesting that the increase coincides with news that President Trump, the First Lady and a number of White House staffers had tested positive for coronavirus. Major market attention turned not only to the President’s physical health but also the specific treatments he was given.

Some of the names that showed early promise have gotten the most attention from analysts and media types. One of those companies is Gilead Sciences Inc. (GILD), a large-cap company with treatments for diseases such as HIV/AIDS, cancer, and other respiratory diseases. One of their antiviral drugs, remdesivir was originally created to combat the hepatitis C virus, but that demonstrated a benefit in clinical trials with hospitalized COVID patients – enough to gain emergency approval from the FDA. Analysts seem to expect sales of remdesivir to provide a tailwind to offset pandemic-driven weakness in some of their other products. The company has been investing heavily since 2019 to bolster its drug pipeline, with its pending acquisition of Immunomedics providing a newly approved treatment for metastatic triple-negative breast cancer that is expected to generate $3.5 billion in sales by 2025. The caveat associated with remdesivir as a growth driver is that its long-term benefit is less clear; in the absence of useful vaccines and antivirals specifically created for COVID, physicians have been forced to be creative, creating cocktails of existing drugs in an attempt to treat symptoms and to help patients get through the worst effects.

Some of the early news about remdesivir gave investors enough enthusiasm about GILD to push the stock from a February low around $62 to a May peak at around $86. From that point, however, the company’s latest earnings reports have shown that, while the company has a healthy balance sheet, their capital expenditures – which certainly, and appropriately include a big push to fast-track remdesivir as a COVID treatment – have the company operating on a net-negative basis. That is a big concern that pushed the stock back down to its pre-pandemic lows in late September. The stock has been picking up some bullish momentum from that point, which might tempt you to think the company could be a good bargain stock with improving prospects in 2021. Let’s take a look.

Fundamental and Value Profile

Gilead Sciences, Inc. is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational drugs includes treatments for Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS), liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions. Its products for HIV/AIDS patients include Descovy, Odefsey, Genvoya, Stribild, Complera/Eviplera, Truvada, Emtriva, Tybost and Vitekta. Its products for patients with liver diseases include Vemlidy, Epclusa, Harvoni, Sovaldi, Viread and Hepsera. It offers Zydelig to patients with hematology/oncology diseases. Its products for patients with various cardiovascular diseases include Letairis, Ranexa and Lexiscan. Its products for various inflammation/respiratory diseases include Cayston and Tamiflu. It had operations in more than 30 countries, as of December 31, 2016. GILD has a current market cap of $80.6 billion.

Earnings and Sales Growth: Over the past year, earnings declined -35.5%, while sales declined -9.5%. In the last quarter, earnings dropped by about -34%, while sales were -73.% lower. Adding to GILD’s unimpressive earnings pattern is an operating profile that is deteriorating rapidly; Net Income as a percentage of Revenues was -1.16% but deepened to an alarming -64.92% in the last quarter.

Free Cash Flow: GILD’s Free Cash Flow is generally healthy, at about $8.7 billion. On a Free Cash Flow Yield basis, that translates to 11.47%. It should be noted that this number has declined steadily since the beginning of 2016, when Free Cash Flow peaked at $19.5 billion, but has also improved from late 2019, when Free Cash Flow was about $6.6 billion. It is also a modest improvement from the beginning of 2020 at $8.3 billion. That improvement is an interesting counterpoint to GILD’s negative Net Income pattern – but I would prefer to see both of these measurements improving, with Net Income in positive territory.

Debt to Equity: GILD has a debt/equity ratio of 1.22, which is a bit higher than I prefer to see; but by itself this number doesn’t really tell the whole story. Their balance sheet shows $18.9 billion in cash in the last quarter (down from about $20.7 billion at the beginning of the year) against $22.1 billion in long-term debt. Despite their negative Net income, this is a good indication that the company can service their debt with cash on hand; however it should also be noted that if Net Income doesn’t begin to improve soon, the strength of their solid cash position may begin to see a proportional deterioration.

Dividend: GILD pays a dividend of $2.72 per share (up from $2.52 in 2019), which translates to an annual yield of about 4.21% at the stock’s current price. Going back to the company negative Net Income pattern, I am concerned about the stability of the company’s dividend, which is unsustainable in the long-term as things stand today.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $61 per share, which means that GILD is a bit overvalued, with about -6% downside from its current price, and also puts the stock’s bargain price at around $48.50.

Technical Profile

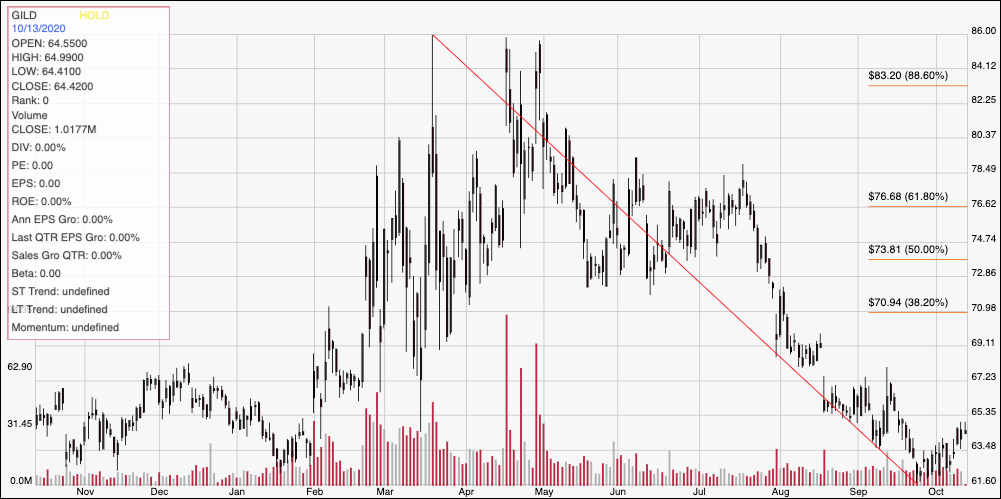

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: the chart above covers the last year of price activity for GILD. The diagonal red line traces the stock’s downward trend from its May high at around $86 to its recent, new 52-week low a little above $62 per share; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has rebounded nicely from that recent low point and appears to be building a nice, short-term upward trend. Immediate resistance is a little above $65, with support at $62. A push above resistance, to $65.50 should give the stock room to rally to around $68 or $69, with most likely next resistance at the 38.2% retracement line around $71 not far above that point. A drop below $62 would put the stock in territory it hasn’t seen since late 2013; on the basis of pivots seen around that time, next support is somewhere between $59 and $56.

Near-term Keys: Given GILD’s overvalued status in spite of the stock’s sharp decline since May, it’s hard to get too excited about seeing the stock trading at a steep discount relative to its highs earlier in the year. The company would need to post measurable improvements in earnings, sales and Net Income in the quarters ahead to begin to shift the fundamental view of this company in a more favorable light. That also means that the best probabilities lie with short-term trades. If the stock can break above $65.50, you could consider buying the stock or working with call options, using $68 to $69 as practical, bullish profit targets; a drop below $62 could provide an interesting signal to think about shorting the stock, using $59 to $58 as a useful target on a bearish short-term trade.