Recessionary economic conditions tend to challenge a lot of different segments of the market. Others are usually seen as smart defensive places to put your money to work; I’ve spent a lot of time in this space focusing on some of those kinds of stocks throughout the course of the year. Consumer Staples stocks in the Food Products industry, Healthcare stocks of all types – these are terrific examples of the fact that no matter what the current market conditions or level of investor certainty might be, there are always good opportunities to be had in the market to keep making functional investments.

I also find it interesting that even when conditions are uncertain, there are companies that find new ways to succeed. Sometimes that is planned, and sometimes it happens to be the opportunistic intersection of being in just the right place at the right time. The most obvious examples of what I mean this year have come from the Tech sector, with companies that offer a variety of cloud-based, remote collaboration and networking tools and solutions proved to be the perfect way to keep much of corporate America running.

Another unexpected element of opportunity that has emerged from the difficult conditions mandated by the current pandemic comes from the Consumer Discretionary sector – an area of the market that usually suffers when basic economic indicators, like unemployment demonstrate clear weakness in the broad economy. Stay-at-home orders that have included shuttering or limiting access to gyms, and changed work life for white-collar workers to long-term remote arrangements have prompted an increase in demand for outdoor, active, and athletic apparel. It comes as remote workers have realized they can dress as comfortably as they wish to work from home and have also found creative ways to stay fit and healthy even though they might not have access to the gym they used before the pandemic started.

VF Corp (VFC) is a company that you might not recognize by its corporate name, but you almost certainly will by their brands. This is the company behind well-known apparel and footwear brands including The North Face, Vans, and Wrangler. It’s a better than even bet that you’ve bought their products before, and I’m even willing to go out on a limb and say that it’s a fair bet you have some of their products in your closet right now; I know I do. The company has, not surprisingly had to absorb the complications and difficulties that come from an uncertain marketplace and economy; but who have also seen traction from their ability to position themselves as a performance-driven, lifestyle sports company. They also have managed to maintain a strong balance sheet even in the midst of COVID-19 while dramatically reducing their reliance on department stores. This is also a company that enjoyed the distinction of being a ‘dividend aristocrat,’ having increased their dividend for 47 years in a row before the pandemic prompted management to reduce it. As of this writing, the stock is a little more than -25% below its pre-pandemic high at around $100. Does that mean VFC is also a good value that long-term focused investors should pay attention to?

Fundamental and Value Profile

V.F. Corporation is engaged in the design, production, procurement, marketing and distribution of branded lifestyle apparel, footwear and related products. The Company’s segments include Outdoor & Action Sports, Jeanswear, Imagewear and Sportswear. It owns a portfolio of brands in the outerwear, footwear, denim, backpack, luggage, accessory, sportswear, occupational and performance apparel categories. Its products are marketed to consumers shopping in specialty stores, department stores, national chains, mass merchants and its own direct-to-consumer operations. Its direct-to-consumer business includes VF-operated stores, concession retail stores and e-commerce sites. Its brands sell products in international markets through licensees, distributors and independently-operated partnership stores. Its brands primarily include The North Face, Vans, Timberland, Wrangler, Lee, and Kipling. VFC has a current market cap of about $28.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined almost -47%, while revenues dropped a little over -23%. The picture got much better in the last quarter, as earnings increased 217.5% and sales increased 142%. The company’s margin profile appears to have absorbed the damage inflicted by COVID-19 and could be turning the corner back to long-term profitability; Net Income as a percentage of Revenues over the last twelve months was -0.5%, but strengthened to nearly 10% in the last quarter.

Free Cash Flow: VFC’s free cash flow is a sign of strength, at a little over $1 billion over the last twelve months. This is a number that had persisted in negative territory since the first quarter of 2017, and was -$217.12 million at the beginning of 2019. I find it especially interesting that Free Cash Flow has improved steadily from that point, including over the last quarter, when Free Cash Flow was $626 million.

Debt to Equity: VFC’s debt/equity ratio is high, at 1.91. A big portion of that debt has come this year as the company borrowed heavily to bolster its cash reserves in order to manage its way through the health crisis. As of the last quarter, the company reported $2.6 billion in cash and liquid assets against about $5.6 billion in long-term debt. It should be noted that at the beginning of the year, cash was around $1.3 billion versus $2.6 billion in long-term debt.

Dividend: VFC’s annual divided is $1.96 per share, which translates to a yield of 2.69% at the stock’s current price. in 2019, the dividend was $2.04 per share; however considering the difficulties that have become clear this year, the fact that the dividend has been maintained relatively close to that 2019 level is an interesting sign of management’s commitment to shareholder value.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $46.50 per share. That suggests that despite the company’s fundamental strengths, the stock remains overvalued by about -37%, with a bargain price around $37 per share.

Technical Profile

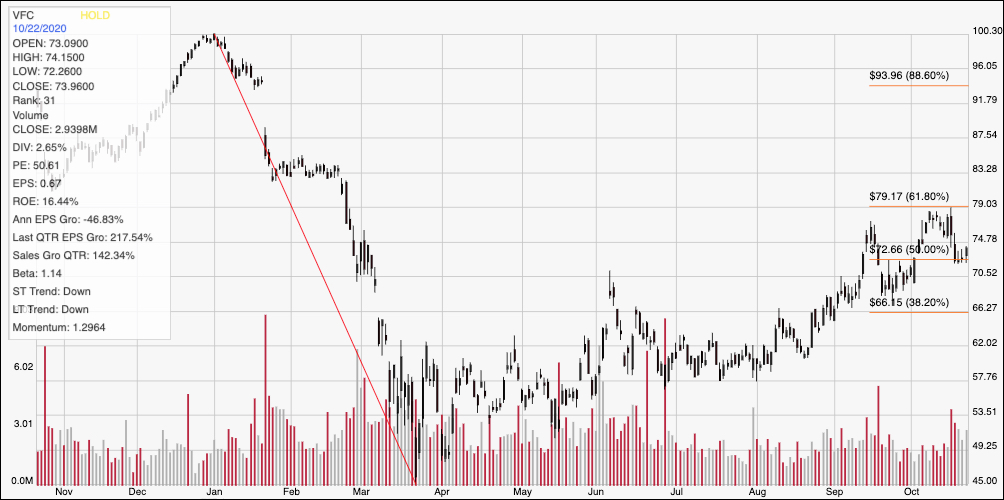

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from its December 2019 high at around $100 to its bear market low in March at around $45. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock has staged an upward trend that doesn’t look as impressive as it actually is, considering that the stock is now about 64% above its March low point. In the last few days, the stock has dropped back from a recent high at around $79, where the 61.8% retracement line sits, but also appears to be using the 50% retracement line at around $72.50 as new support. That means that if the stock can follow through on its current bullish momentum, it has about $5 of room right now to its most immediate resistance, with additional room to drive to around $83 from that point if bullish momentum accelerates. A drop below $72.50, on the other hand has about $4.50 of downside to next support, which is around $66, inline with the 38.2% Fibonacci retracement line.

Near-term Keys: I think VFC’s fundamental profile in the face of pandemic-induced economic conditions is a very interesting story – but unfortunately it doesn’t translate to a useful value as well. That means that the best opportunities to work with this stock lie in short-term trades. If the stock can keep following through on what looks like a good bounce off of support right now, you might consider buying the stock or working with call options, with about $5 of opportunity to the stock’s next resistance level at around $79 per share. A drop below support at $72.50, however could offer a good opportunity to think about shorting the stock or buying put options, using the 38.2% retracement line at around $66 as a very useful profit target point on a bearish trade.