The massive rally of the last week appears to have begun to taper in the last couple of days, which really shouldn’t be surprising at all. It’s pretty normal for the market movement moderate, or even move back in the opposite direction of quick, rapid moves to either the upside or downside. One of the big pushes the market got late last week was positive news about COVID vaccine candidates, where late-stage trial results are looking more favorable than expected. That’s great news, especially since it is apparent that by themselves Americans are not going to take the steps necessary to limit the virus’ spread; but I think another part of the market’s fade back to more rational levels of daily activity comes to the reality that, even if fast-track regulatory approval comes before the end of the year, deployment and distribution is still a sometime-next-year prospect.

I’ll admit, it’s tiring to keep talking about coronavirus – but it’s worse to pretend that it will simply go away on its own, and that seems to be what has happened as big infection spikes across the country have given way to new waves that are stressing hospitals and health care capacity, and have prompted some state governments to re-impose previously lifted restrictions, or to impose requirements previously dismissed as too restrictive. The fact is that while the health crisis continues – or worse, escalates – the pressure on the economy will only continue, particularly on small business, which has already absorbed a massive impact and could be even more seriously crippled than before.

Economic uncertainty is a big reason that defensive-oriented stocks have remained an important part of my investing focus, and that is why one of the sectors that I have been paying the most attention to lately has been Consumer Staples. I like a number of industries in this sector, like Food Products and Grocery stores, which represent businesses that consumers still have to engage with even when times are difficult. That includes the so-called “sin stocks” – companies like TAP that provide alcoholic beverages along with other products that have historically continued to generate strong revenues even as consumers are forced to start tightening their belts. I think of this industry in a similar light as snack foods, where these products offer a “comfort factor” that consumers make a point to include in their household budgets.

Molson Coors Brewing Company (TAP) is a stock in this industry that offers a good example of the kind of resilience these companies can see in these kinds of strange times. Even as the virus has raged throughout the year, TAP has managed to maintain steady liquidity, manageable debt, increase cash flow and improve their operating margin. That doesn’t mean they’ve been immune from the pandemic – the company suspended their dividend payout earlier this year to help maintain that balance sheet strength, and until the beginning of November, the stock had been hovering near, or even below its bear market lows for most of the past four months. In the last couple of weeks, however the stock has picked up a big boost in bullish momentum after its latest earnings report that highlighted the strengths I just mentioned. When you combine those elements with the stock’s steep discount to historical levels, you have a stock that I think could represent an impressive value and a terrific long-term opportunity.

Fundamental and Value Profile

Molson Coors Brewing Company (MCBC) is a holding company. The Company operates as a brewer. The Company’s segments include MillerCoors LLC (United States segment), operating in the United States; Molson Coors Canada (Canada segment), operating in Canada; Molson Coors Europe (Europe segment), operating in Bulgaria, Croatia, Czech Republic, Hungary, Montenegro, Republic of Ireland, Romania, Serbia, the United Kingdom and various other European countries; Molson Coors International (Molson Coors International segment), operating in various other countries, and Corporate. The Company brews, markets, sells and distributes a range of beer brands. The Company offers a portfolio of owned and partner brands, including Carling, Coors Light, Miller Lite, Molson Canadian and Staropramen, as well as craft and specialty beers, such as the Blue Moon Brewing Company brands, the Jacob Leinenkugel Brewing Company brands, Creemore Springs, Cobra and Doom Bar. TAP’s current market cap is $9.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased a little over 9.46%, while sales declined -3.42%. In the last quarter, earnings grew by 4.52% while sales increased 11.5%. TAP’s margin profile has historically been narrow, with Net Income over the last twelve months that was 4.86% of Revenues, but strengthened in the last quarter to 12.45% – a strong sign that the company is managing costs while also leveraging sales effectively.

Free Cash Flow: TAP’s free cash flow is healthy, at a little over $1.5 billion for the trailing twelve month period. That translates to a very attractive Free Cash Flow yield of 18.41%.

Debt to Equity: TAP has a debt/equity ratio of .52, a relatively low number that indicates the company operates with a generally conservative philosophy about leverage. Despite their impressive margin profile, the company doesn’t have great liquidity, with cash and liquid assets of about $731 million against $7.1 billion billion in long-term debt. It is worth noting at the beginning of 2020, cash was about $666 million while long-term debt was around $8 billion – meaning that management has increased liquidity while reducing debt, and which is another sign of strength. It is also true that since the end of 2018 the company has cleared more than $2.4 billion in long-term debt from their balance sheet.

Dividend: TAP suspended its dividend payout earlier this year in response to COVID-19 concerns, with no forecast about if or when the dividend will be resumed.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $72.50 per share. That means that TAP is extremely undervalued, offering 71% upside from its current price.

Technical Profile

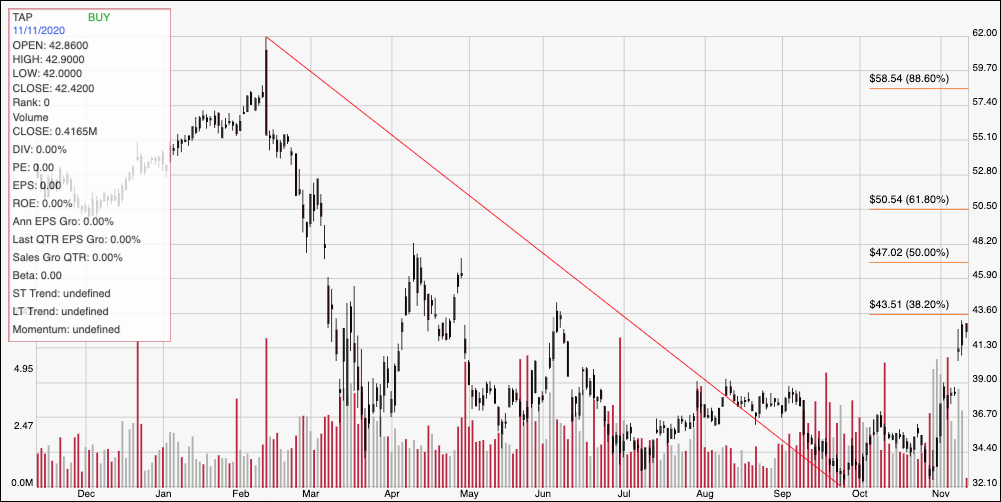

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The red diagonal line traces the downward trend from a February peak at around $62 to a low in October at around $32. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s rally since the beginning of the month is obvious, and has pushed the stock just a little below the 38.2% retracement line, which offers immediate resistance at around $43.50. Support is between $39 and $40 based on pivot activity in that range in May, June and July. A push above $43.50 should give the stock room to push to next resistance between $47 and $48 where the 50% retracement line sits, while a drop below $39 could see the stock drop to around $36 before finding next support.

Near-term Keys: The value proposition on TAP is compelling, with a strong balance sheet providing even more evidence that the market finally seems to be recognizing. I think that means that TAP’s long-term prospects are better than they have been in a couple of years. If you prefer to work with short-term trading strategies, you could use a push above $43.50 as a signal to buy the stock or to work with call options, using $47 to $48 as useful target prices for a bullish trade. A drop below $39 could offer a signal to think about shorting the stock or working with put options, using $36 as a useful target on a bearish trade.