One of the most straightforward and useful ways for average investors like you and me to maintain an active investing approach without drowning in the massive volumes of news reports, analyst opinions and buzz around the thousands of publicly traded stocks is to work with our own watchlists. These are lists of stocks that you check out on a daily basis, sometimes only for a few seconds to see where the price is, and sometimes to dive into a little more detail.

A watchlist can get too big, or not be big enough, but there isn’t really a right or wrong answer about how big your watchlist should be. I usually just try to encourage people to create a list that they feel fits their investing style and system and that they can manage on a day-to-day basis without taking up a major portion of their daily lives. Investing has to fit into your lifestyle, not the other way around. That said, the nice thing about watchlists is that they often give you opportunities to work with a few stocks that you become really familiar with at different points in time; and then from time to time another one will come back into your view that you might now have been paying as much attention to for a while but that is now offering a good opportunity to use it again. It’s like saying hello to an old friend after a long time away from each other, which is kind of nice.

One of the stocks that has become like an old, familiar friend for me this year is Bristol-Myers Squibb Company (BMY). This is a stock that I’ve followed throughout the year and used a few times to nice overall effect, but that hasn’t drawn a ton of attention from market analysts and talking heads this year as most of the focus has been on the divisive political world we live in and the fact that COVID-19 news has dominated just about every discussion, financial, political or otherwise.

The reality is that even as we are getting closer and closer every day now to seeing multiple vaccines made available worldwide, infections are still on the rise, which means that there is going to continue to be a lot of pressure on the economy that I believe will persist through the winter months. Progress is being made in increasing employment, to be sure when you look at employment numbers since earlier this year when the pandemic pushed unemployment sharply above 10%; but a near 7% unemployment is still much higher than anybody would like to see, with 11.1 million total unemployed workers.

Even as COVID is pushing health care facilities and medical professionals to their limits, the reality is that there is still a need for other types of health care as well. I think that is where BMY has an important role to play not only in a society but in a smart investor’s watchlist right now. From its own bear market low, the stock has rebounded by more than 36%, and is only about -10% below its January high around $68. A big part of the stock’s surge, I think can be attributed to the pharmaceutical industry’s resilience this year as one of the market’s few bright spots during the initial part of the health crisis. In November of last year, the company completed the acquisition of Celgene, which helped to boost the stock’s intrinsic value in a BIG way. There is no denying that 2020 has had an operational impact on the company, but even so BMY still boasts an excellent balance sheet, one of the strongest, long-term development pipelines in the Pharmaceutical industry dovetailing with what I think will inevitably be an increased level scrutiny and attention – appropriately so, and in the long run, to our collective benefit – on proper health and care on an individual level. I think this could be one of the smarter areas to pay attention to if you want to keep your money working for you right now. Let’s run the numbers.

Fundamental and Value Profile

Bristol-Myers Squibb Company is engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products. The Company’s pharmaceutical products include chemically synthesized drugs, or small molecules, and products produced from biological processes called biologics. Small molecule drugs are administered orally in the form of a pill or tablet. Biologics are administered to patients through injections or by infusion. The Company’s products include Empliciti, Opdivo, Sprycel, Yervoy, Eliquis, Orencia, Baraclude, Hepatitis C Franchise, Reyataz Franchise and Sustiva Franchise. It offers products for a range of therapeutic classes, which include virology, including human immunodeficiency virus (HIV) infection; oncology; immunoscience, and cardiovascular. Its products are sold to wholesalers, retail pharmacies, hospitals, government entities and the medical profession across the world. BMY has a current market cap of $137.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -108%, while sales increased nearly 63%. In the last quarter, earnings dropped by -1.2% while sales were 4% higher. BMY’s Net Income versus Revenue pattern is a minor concern that appears to be turning the corner; over the last twelve months this number was -0.11%, which is not impressive, but improved significantly in the last quarter to an impressive 20.82%. I attribute the biggest portion of that shift to the transitory period required to integrate two huge operations, Bristol-Myers and Celgene, into a single company. Add to the mix the complication of the pandemic, and I think that while the negative numbers are important, the turn to an impressive margin percentage is important to note.

Free Cash Flow: BMY’s Free Cash Flow is healthy, at $11.6 billion. That is below the $12 billion the company recorded prior to the last quarter of the year. the current number translates to a Free Cash Flow Yield of 8.42%. Even with the quarterly drop, the fact is that Free Cash Flow is significantly above levels earlier in the year when Free Cash Flow was about $9.75 billion, and $7.2 billion at the end of 2019.

Debt to Equity: BMY has a debt/equity ratio of .91, which is generally conservative and indicates the company has a disciplined approach to debt management. As of the last quarter, cash and liquid assets were an impressive $21.1 billion (a continued increase from $18.3 billion at mid-year and $3 billion from the end of 2019) versus $41.3 billion in long-term debt. Pre-merger, BMY had just $5.3 billion in debt versus more than $8 billion in cash; however management as well as most analysts predicted the deal would be immediately accretive; so far that appears to be the case, which means the high debt level continues to be more than serviceable.

Dividend: BMY pays an annual dividend of $1.80 per share, which at its current price translates to a dividend yield of about 2.92%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $113 per share, which means that BMY is massively undervalued, with more than 83% upside from its current price.

Technical Profile

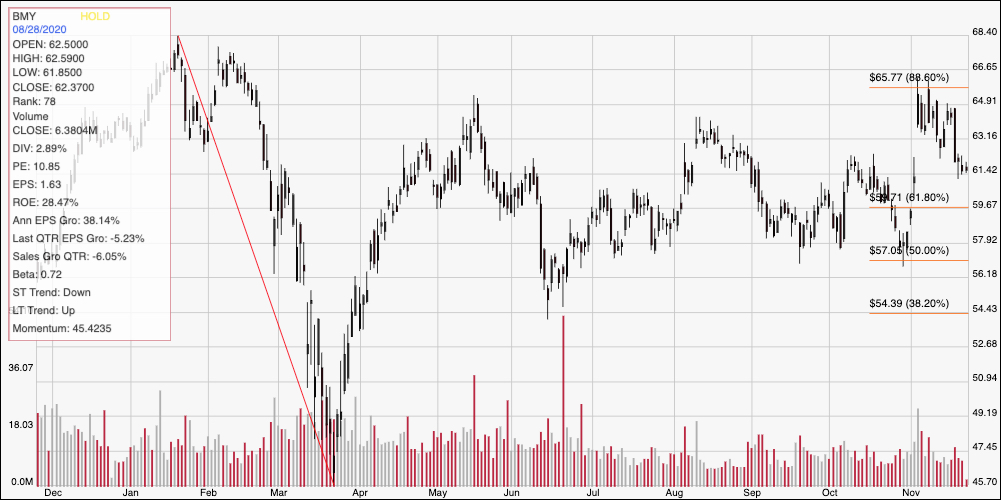

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for BMY. The stock’s rise off of its bear market low in March is clear; but more interesting is the stock’s pattern since June. BMY hit a mid-June low around $56 before picking up bullish momentum, driving to a high a a little above $63 early in August. After retracing a bit, the stock hovered through September and October below that high before pushing to a new near-term peak at around $66 earlier this month. From that point, the stock has dropped back again and appears to be looking for a new support level at around $61. If it can bounce off of that level, it should rally to somewhere between $64 and $65 before finding next resistance. If it drops below $61, next support should be at around $59.50 where the 61.8% Fibonacci retracement line rests, with additional downside to $57 if bearish momentum accelerates.

Near-term Keys: The only red flag in BMY’s fundamental profile is the negative Net Income pattern for the trailing twelve month period; but that looks to be a lingering remnant from the net, temporary effect of integrating Celgene into its organization. The massive improvement in this measure from the quarter prior is encouraging enough that I think it marks an important turning point for the company as it moves forward. The stock is only about 10% away from its 52-week high, but given the underlying fundamental strength, I still think the stock offers a fantastic value proposition far above that point. If you prefer to focus on short-term trading strategies, a pivot to the upside off of current support could offer a signal to consider buying the stock or working with call options, using $65 as a near-term profit target. A drop below $61, on the other hand could offer a good signal to think about shorting the stock or working with put options with an eye on $59.50 to $57 as a useful price target on a bearish trade.