One of the surprising areas of strength in the economy in 2020 are the Homebuilders and Construction industries. With historically high unemployment numbers since the outset of the pandemic, it’s natural to think that the economically sensitive industries like Homebuilders, Construction, and others would see decreases in demand; but it has been interesting to see a number of reports indicate high demand for both new and existing homes in areas across the country, with the average price of homes also seeing measurable increases.

These reports also coincide with the performance of these industries at large; the iShares Home Construction ETF (ITB), for example, is up about 30.5% on a year-to-date basis, and has nearly tripled in value from the bear market bottom it reached in March. As a value investor, seeing that kind of impressive performance in an industry benchmark generally makes me leery of looking for value in those stocks; but as is always the case, no matter what the industry or sector is doing, there are always exceptions to the rule.

Weyerhauser Company (WY) is an interesting example. If you’ve had to buy lumber for a home improvement project, you’ve probably acquired it from their Wood Products segment, which emphasizes the production and distribution of wood products. That, along with homebuilding in general, ties this company to the Construction and Homebuilders industries; however, this is a company whose primary focus is on the timberlands and forest acreage that makes all of its segments possible. That puts the company in the category of a Real Estate Investment Trust (REIT), a segment of the sector that tends to see more attention from the market, especially from income seekers when interest rates from more traditional instruments like Treasury bonds and regular stock dividends remain low.

REIT’s are interesting because stocks in this segment tend to pay higher annual dividends than stocks in other industries. WY suspended their dividend earlier this year due to COVID concerns, but reinstated it (at a lower than previous rate) after their last earnings report. Of course, dividend yield alone shouldn’t be the only basis for any investment decision, especially if your plan is to hold onto the stock for any extended length of time. That means that diving in to the stock’s fundamental profile becomes very important. Another element that makes WY interesting is the fact that while it has followed the trend of the Construction and Homebuilders industries to push to new recent highs, the company has also realized improving profitability and managed to maintain a healthy balance sheet while also still offering an interesting value proposition.

Fundamental and Value Profile

Weyerhaeuser Company is a timber, land and forest products company. As of December 31, 2016, the Company owned or controlled 13.1 million acres of timberlands, primarily in the United States, and manages additional timberlands under long-term licenses in Canada. The Company’s segments include Timberlands; Real Estate, Energy and Natural Resources (Real Estate & ENR), and Wood Products. The Timberlands segment’s offerings include logs, timber and recreational access via leases. The Real Estate & ENR segment includes sales of timberlands; rights to explore for and extract hard minerals, oil and gas production, and coal, and equity interests in its Real Estate Development Ventures. The Wood Products segment includes the manufacturing and distribution of wood products. The Wood Products segment is engaged in softwood lumber, engineered wood products, structural panels, medium density fiberboard and building materials distribution. WY’s current market cap is $25.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased almost 550%, while sales improved a little more than 26%. In the last quarter, earnings increased 372.7%, while sales grew by about 29.4%. WY’s margin profile has gotten stronger as the year has progressed; over the last twelve months, Net Income was 7% of Revenues, but improved to 13.41% in the last quarter.

Free Cash Flow: WY’s free cash flow is healthy and growing, at a little over $1.3 billion for the trailing twelve month period; that translates to a Free Cash Flow yield of about 5.35%. It is also noteworthy that this metric has increased in each quarter of this year from a starting point in the first quarter at about $970 million, and from around $550 million in mid-2019.

Debt to Equity: WY has a debt/equity ratio of .70, a relatively low number that implies a conservative approach to leverage. WY’s balance sheet shows $787 million in cash and liquid assets against $5.9 billion in long-term debt. While the proportion between the two is a bit high, their margin profile and improving free cash flow suggest that servicing their debt won’t be a problem.

Dividend: WY pays an annual dividend of $.68 per share, which translates to a yield of 2.04% at the stock’s current price. As mentioned earlier, the dividend was suspended after the first quarter of the year but recently reinstated at 1/2 its pre-pandemic levels.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $40 per share. That suggests that even with the stock’s increase this year, the stock remains undervalued, with about 17% upside from its current price.

Technical Profile

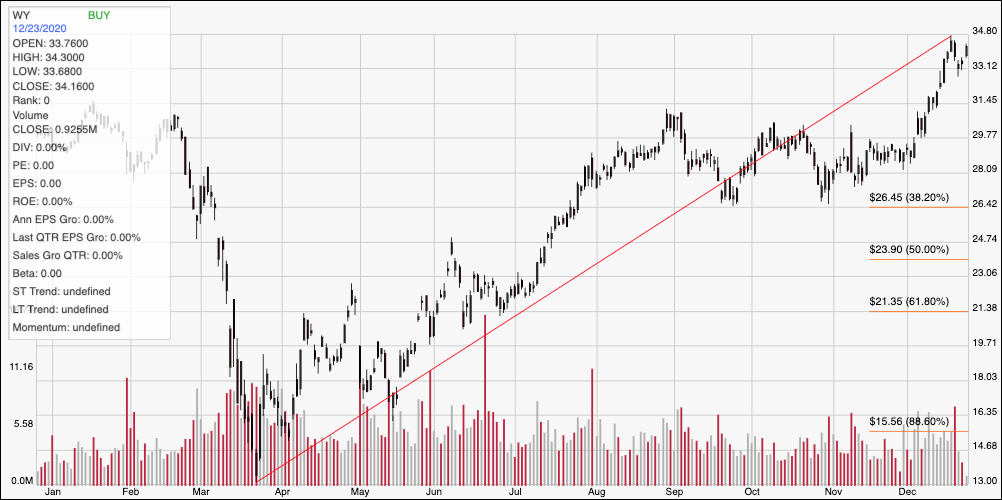

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of market activity for WY. The red diagonal line traces the stock’s upward trend from a March low at around $13 to its recent peak at nearly $35 per share; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock dropped off of that peak into the end of last week before finding support at around $33 per share. Immediate resistance is at $35. Since the last significant resistance level below $35 is at $31, it is reasonable to suggest that a push above $35 offers near-term upside to about $39 per share. A drop below support at $33, on the other hand, should find next support at that prior resistance level, between $31 and $30 per share.

Near-term Keys: With the stock’s strengthening Net Income, improving Free Cash Flow, generally solid balance sheet, and reinstated dividend, I think WY is a very interesting example of a company whose price increases isn’t only driven by broad market sentiment but also by the recognition of investors in its improving fundamental profile. It is also interesting that despite the increase so far, the stock still offers a useful value proposition. If you prefer to work with short-term trading strategies, you could use a break above $35 as a signal to buy the stock or to work with call options, using $39 as a useful target price on a bullish trade. Given the strength of the upward trend, a bearish trade right now is very speculative; but if you’re willing to work with short profit targets, a drop below $33 could be an opportunity to short the stock or buy put options, using $31 as a quick-hit exit point.