One of the themes of most of 2021 has come as investors and economists have tried to look past the difficult conditions imposed by the COVID-19 pandemic and forecast the best places to look for new investing opportunities is the “reopening trade,” referring to the industries and stocks that may be best positioned to take advantage of the expected resumption of “normal” economic activity. That theme seemed to be taking hold just a few months ago, as infections and hospitalizations had started to decrease, and various economic indicators showed that economic activity was, in fact, beginning to show signs of recovery.

The summer months have brought the health crisis back into view, as COVID variants have found their way into previously unaffected segments of the population. With infection rates increasing again, and hospitalizations once again putting big pressure on the Healthcare sector’s capacity, the question starts to become whether the “reopening trade” was a little premature. I’m not so sure – basic economic indicators are still generally healthy, and while unemployment remains well above pre-pandemic levels, it is also true that trend continues to move in a positive direction for the time being. With extended unemployment benefits that have kept many workers home rather than returning to the workforce now expired, and plenty of open jobs available, I don’t think it is unreasonable to suggest this number could continue to move lower and further boost economic activity.

Yesterday, I highlighted VF Corp (VFC) in this space. Today, I want to turn the focus to a company KTB spun off in 2019 using recognizable apparel brands Wrangler, Lee and Rock & Republic. This is a stock that saw a big push higher from October of last year to a little above $69 before sliding into a downward trend that has the stock sitting now a little above $51. The stock could be settling into a consolidation range, which could also be an early indication that the downward trend might reverse and move back higher. The company has survived the past year and a half with healthy Free Cash Flow and a balance sheet that is generally healthy, helped by healthy increases in sales and earnings over the last twelve months that I think coincide with the “reopening trade” theme. Are those elements enough to a value proposition that you should be paying attention to? Let’s find out.

Fundamental and Value Profile

Kontoor Brands, Inc. is a global apparel company. The Company is focused on the design, manufacturing, sourcing, marketing, and distribution of its portfolio of brands, including Wrangler, Lee and and Rock & Republic. It sells its products primarily through its wholesale and digital channels. Its distribution channels include United States (U.S.) Wholesale, Non-U.S. Wholesale, Branded Direct-to-Consumer and Others. Wrangler offers denim, apparel, and accessories for men and women. Lee is a denim and apparel brand. Lee product collections include a range of jeans, pants, shirts, shorts, and jackets for men, women, boys and girls. Rock & Republic is a premium apparel brand. Rock & Republic products are sold in the United States exclusively through Kohl’s. It also owns and operates other various brands worldwide, which include Gitano and Chic. KTB has a current market cap of about $3.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased almost 282%, while revenues grew by 40.5%. In the last quarter, earnings were decreased by -72% while sales were also about -25% lower. KTB’s operating profile also reflects the downward pattern of the last quarter; over the last twelve months, Net Income was 8.04% of Revenues but decreased to 4.82% in the last quarter.

Free Cash Flow: KTB’s free cash flow is a sign of strength, at $312.5 million over the last twelve months. That marks a decline from $351 million in the quarter prior, but an increase from $256 million a year ago.

Debt to Equity: KTB’s debt/equity ratio is high, at 5.08. That sounds alarming, but it is a little bit misleading. As of the last quarter, the company reported $175.6 million in cash and liquid assets against about $782 million in long-term debt. The decline in Net Income is a concern, but for now, debt service isn’t a problem.

Dividend: KTB’s annual divided is $1.60 per share, which translates to a yield of 3.02% at the stock’s current price. This is a bit unusual when you consider that the company has only existed as a public entity for about two years; I take the dividend as a positively inherited characteristic from parent company VFC, which has a long history of returning value to shareholders via consistent dividend distributions.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $49 per share. That suggests that despite the company’s fundamental strengths and the stock’s current, mostly bearish momentum, the stock remains overvalued by about -8%, with a bargain price around $39 per share.

Technical Profile

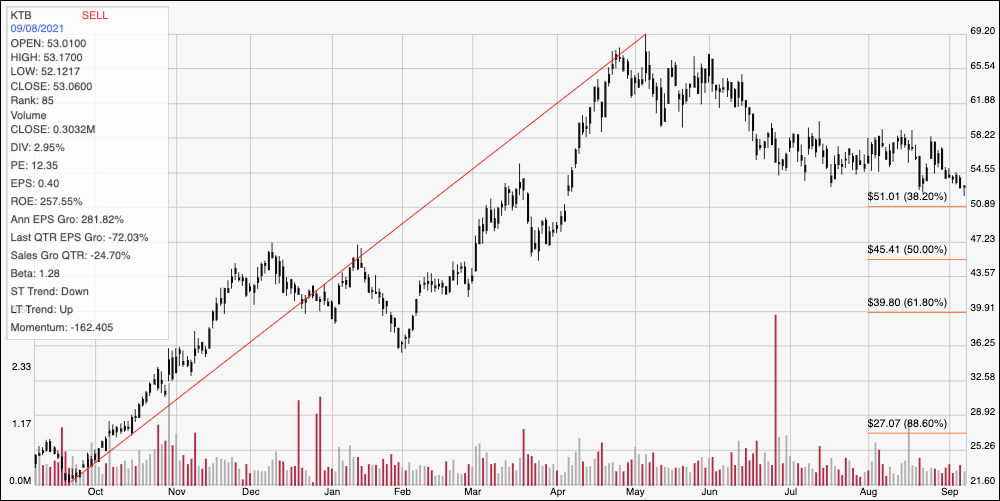

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend from a low at around $21.50 in October 2020 to its May peak at around $69. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s retracement from that May high now has the stock approaching the 38.2% retracement line at around $51, and which should now act as current support, and possibly give the stock an opportunity to begin stabilizing. Immediate resistance is around $54, based on the low end of an earlier consolidation range from late June to the end of August that the stock has more recently dropped below. A drop below $51 could have downside to somewhere between $47 and $45, inline with the 50% retracement line. A push above $54 should have about $4 of upside to the top of that previous consolidation range around $58, with $62 achievable beyond that point if bullish momentum picks up.

Near-term Keys: I think KTB’s fundamental profile, like its parent company in the face of the past year’s pandemic-induced economic conditions is a very interesting story – but unfortunately it doesn’t translate to a useful value as well. The stock’s current activity could offer some interesting signals to work with short-term trades. A drop below $51 would offer a useful signal to consider shorting the stock or buying put options, with useful bearish profit targets between $47 and $45 per share. A push above $54 would be a good signal to think about buying the stock or working with call options, with a practical bullish target at around $58, and $62 if buying momentum accelerates.