Over the course of my investing career, I have learned to rely on a lot of fundamental data to paint a picture about the underlying strength of any stock I might consider using for a value-based investment. While some fundamental investors prefer to work with easy-to-reference, quick-glance data like earnings per share and price-to-earnings ratios, I prefer to expand my view of a company’s profitability by also looking at the company’s pattern of Net Income and Free Cash Flow growth.

Earnings per share is a useful, standardized method of describing a company’s profit in a given period on a per-share basis; but it is also a number that can be calculated a number of different ways, which means that there is quite a bit of subjectivity a creative financial manager can inject into a company’s earnings numbers. On the other hand, Net Income (income remaining after expenses) and Free Cash Flow (the cash left after operating expenses and capital expenditures) are generally more straightforward measurements with less malleability, which is why I find them generally more reliable. That doesn’t mean earnings don’t have a place in my process – instead, I like to use all three measurements together. A pattern of growth in all three metrics is the ideal and best-case scenario, while divergences in one or more of these data points relative to the others can signal problems that need to be examined in more detail.

One of the stocks that has become like an old, familiar friend for me over the last couple of years is Bristol-Myers Squibb Company (BMY). This is a stock that I had already followed for about two years and used a few times to nice overall effect in 2020, but that hasn’t drawn a ton of attention from market analysts and talking heads lately as most of the focus since the beginning of 2020 has been on fractious political rhetoric, as well as the ongoing reality that COVID-19 questions continue to loom over just about every discussion, financial, political or otherwise.

The simple fact is that throughout the pandemic, COVID has pushed, and continues to push health care facilities and medical professionals to their limits. I think part of that is a reflection of the reality that, besides the pandemic, there is still a need for other, “normal” types of health care as well. I think that is where BMY has an important role to play not only in society but in a smart investor’s watchlist right now. This is a stock that has experienced some pretty wide swings between high and low points over the last year, with a big drop from an August 2021 high at almost $70 to a low in October at around $56. The stock has since rallied into a nice, new upward trend, and is now only a few dollars below that August 2021 peak.

My read on the stock’s wide trading ranges is that it reflects investor’s attempts to understand the challenges imposed by the integration of two large businesses (BMY acquired Celgene Corporation in November 2019), along with practical difficulties forced on the entire business world – and on the Healthcare sector in general and in particular – in the face of the COVID pandemic. BMY’s Net Income dropped into negative territory because of the challenges of 2020, but its recovery from that point can certainly be attributed, at least in part to one of the strongest, long-term development pipelines in the Pharmaceutical industry that became even less concentrated and more diversified with the completion of the Celgene acquisition. I think the new, combined company dovetails nicely with what I believe will inevitably be an increased level of scrutiny and attention – appropriately so, and in the long run, to our collective benefit – on proper health and care on an individual level. Following the latest earnings report, it seems safe to say that the reduction in Net Income was a temporary concern, and that the company’s other strengths, including robust, increasing Free Cash Flow, a strong balance sheet and attractive dividend make the company worth paying attention to. I also think that the stock’s recovery from its October low – it is sitting few dollars below its yearly high at $70 now – still offers a good opportunity to buy a stock at significantly discounted price compared to its long-term fair value. Let’s dive in to the numbers.

Fundamental and Value Profile

Bristol-Myers Squibb Company is engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products. The Company’s pharmaceutical products include chemically synthesized drugs, or small molecules, and products produced from biological processes called biologics. Small molecule drugs are administered orally in the form of a pill or tablet. Biologics are administered to patients through injections or by infusion. The Company’s products include Empliciti, Opdivo, Sprycel, Yervoy, Eliquis, Orencia, Baraclude, Hepatitis C Franchise, Reyataz Franchise and Sustiva Franchise. It offers products for a range of therapeutic classes, which include virology, including human immunodeficiency virus (HIV) infection; oncology; immunoscience, and cardiovascular. Its products are sold to wholesalers, retail pharmacies, hospitals, government entities and the medical profession across the world. BMY has a current market cap of $145.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 25.34%, while sales increased about 8.29%. In the last quarter, earnings were -8.5% lower while sales increased by 3.11%. BMY’s Net Income versus Revenue over the last twelve months was 15.08%, and strengthened to 19.79% in the last quarter. The turn to positive territory on both a yearly and quarterly basis is a continuation of a pattern established in mid-2021, and is something that I take as confirmation the company has returned to profitability as it continues to navigate the transitory period required to integrate two huge operations into a single company, along with the complications imposed by the global pandemic.

Free Cash Flow: BMY’s Free Cash Flow is healthy, at a little over $15.2 billion. That marks an increase from about $14.8 billion in the last quarter. It also translates to a Free Cash Flow Yield of 10.34%. The strength in this number implies that the company’s ability to service its debt, maintain its dividend and keep its business growing remains intact.

Debt to Equity: BMY has a debt/equity ratio of 1.1 – a high number that is primarily attributed to the debt assumed during the completion of the Celgene deal. As of the last quarter, cash and liquid assets were $13.9 billion versus $39.6 billion in long-term debt. Pre-merger, BMY had just $5.3 billion in debt versus more than $8 billion in cash; however management as well as most analysts predicted the deal would be immediately accretive, even allowing for a temporary, negative impact on Net Income. So far that appears to be the case, which means the high debt level continues to be more than serviceable.

Dividend: BMY pays an annual dividend of $2.16 per share (increased after the last earnings statement from $1.96 per share), which at its current price translates to a dividend yield of about 3.25%. Management also increased the dividend from $1.80 per share, per annum in mid-2020. An increasing dividend is a strong signal of management’s confidence in its business strategy and overall financial strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $83.50 per share. That suggests that even with its current upward trend, BMY remains nicely undervalued, with 25% upside from its current price. This metric has also increased from its $82 fair value target in November of 2021.

Technical Profile

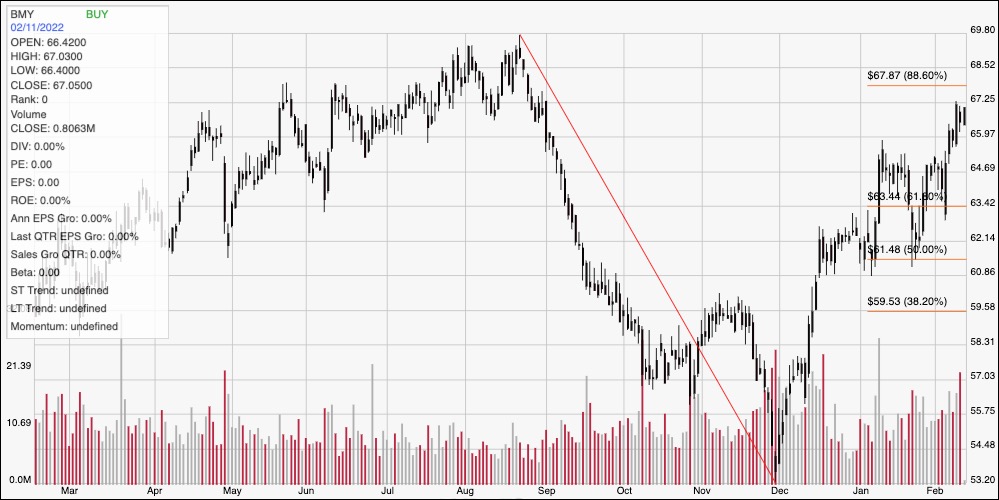

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for BMY. The red diagonal line traces the stock’s downward plunge from its August high at nearly $70 its December low at around $53; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s rally from that low has built a strong, short-term upward trend, with current support sitting at around $64.50 and immediate resistance expected between $67 and $68, where the 88.6% retracement line currently sits. A push above $68 will give the stock momentum to test the 52-week high at around $70, with additional upside to at least $72 if buying activity remains strong. A drop below $67 should find next support at around $63.50, where the 61.8% retracement line sits.

Near-term Keys: BMY’s fundamental profile has shown useful signs of improvement in the latest quarter, with a complete reversal of its earlier negative Net Income pattern, which can only be taken as a very positive sign. Their strong pattern of Free Cash Flow growth also offers a confirmation that I think underscores their overall fundamental strength and bargain proposition. If you prefer to work with short-term trading strategies, a push above $68 could offer an opportunity to buy the stock or work with call options, with about $2 of immediate upside to $70 as a good bullish profit target. A drop below $67 could be a good signal to think about shorting the stock or buying put options, using $63.50 as a useful profit target on a bearish trade.