(Bloomberg) — Strategists are looking beyond the key issue of inflation for other potential market metrics that may cause the Federal Reserve to slow its aggressive cycle of interest-rate hikes.

An ugly August reading for US consumer prices last week cemented bets on a third straight 75 basis-point move when the central bank hands down its next decision Wednesday. Setting aside a slowdown in inflation, other potential indicators that may cause policy makers to dial back their hawkishness include wider credit spreads, rising default risk, shrinking bond-market liquidity, and growing currency turmoil.

Here are a number of charts looking at these in more depth:

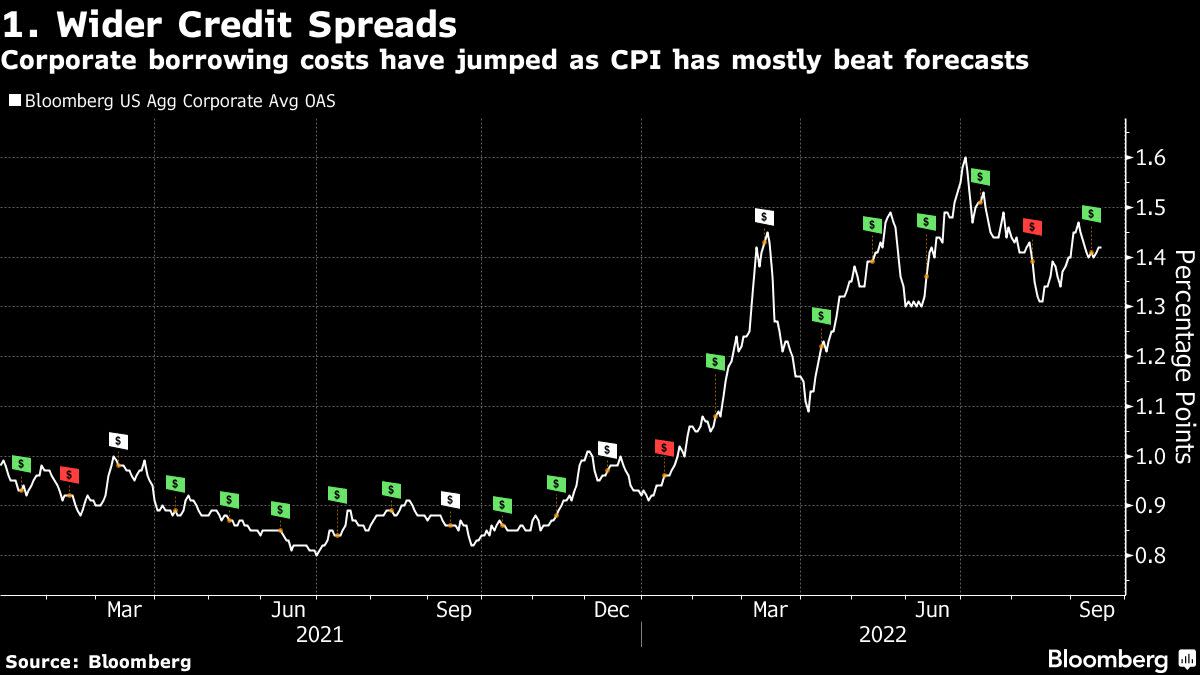

The difference between the average yield on investment-grade U.S. corporate bonds and their risk-free Treasury counterparts, known as the credit spread, has jumped about 70% over the past year, pushing up borrowing costs for businesses. Much of the increase has come as annual US inflation data have beaten forecasts, shown as green flags in the above chart.

Although spreads have dropped back from their July high, when they touched 160 basis points, the increase underscores the intensifying stress on credit markets from monetary tightening.

“Investment-grade credit spreads are by far the most important metric to watch given the large proportion of investment-grade bonds,” said Chang Wei Liang, a macro strategist at DBS Group Holdings Ltd. in Singapore. “Any excessive widening in investment-grade credit spreads to over 250 basis points, close to the pandemic peak, could induce a more nuanced policy guidance from the Fed.”

Higher borrowing costs and a decline in equity prices since the middle of August have tightened U.S. financial conditions to levels not seen since March 2020, according to a Goldman Sachs benchmark composed of credit spreads, stock prices, interest rates and foreign exchange rates. The Fed watches financial conditions closely to gauge the effectiveness of its policy, chair Jerome Powell said earlier this year.

Another metric that may spook the Fed is a surge in the cost of protection against the risk of default on corporate debt. The spread on the Markit CDX North America Investment Grade Index, a benchmark of credit-default swaps on a basket of investment grade bonds, has doubled this year to around 98 basis points, inching closer to its 2022 high of 102 basis points set in June.

The increasing risk of default has been closely correlated with the surging dollar, which is benefiting from the rapid pace of Fed interest-rate hikes.

Another threat that may prompt the Fed to slow the pace of tightening is shrinking Treasury liquidity. A Bloomberg index of liquidity for US sovereign is near its worst level since trading virtually seized up due to the onset of the pandemic in early 2020.

Market depth for US 10-year notes as measured by JPMorgan Chase & Co. has also declined to levels last seen in March 2020, when traders struggled to find prices for even the most liquid government debt securities.

Thin bond-market liquidity would add pressure to the Fed’s efforts to reduce its balance sheet, which ballooned to $9 trillion through the pandemic. The central bank is currently letting $95 billion in government and mortgage bonds roll off the balance sheet every month, removing liquidity from the system.

A fourth area that may cause the Fed to think twice is the growing turmoil in the currency markets. The dollar has powered ahead this year, setting multi-year highs against almost all its major counterparts and driving the euro below parity for the first time in almost two decades.

The US central bank typically ignores the dollar’s strength, but excessive declines in the euro may fuel concern about worsening global financial stability. The common currency extended losses earlier this month but its relative strength index or RSI did not. That suggests its downtrend may be slowing but bulls would need to push it back above its long-term falling trendline to put the bearish regime into doubt.

“If the euro fell out of bed, the Fed might not want that to get worse,” said John Vail, chief global strategist for Nikko Asset Management Co. in Tokyo. “It would be more a global financial stability concept rather than anything related to the dual mandate.”

©2022 Bloomberg L.P.