(Bloomberg) — The rapid selloff in Tesla Inc. shares has left most price targets from ever-bullish Wall Street analysts seemingly obsolete.

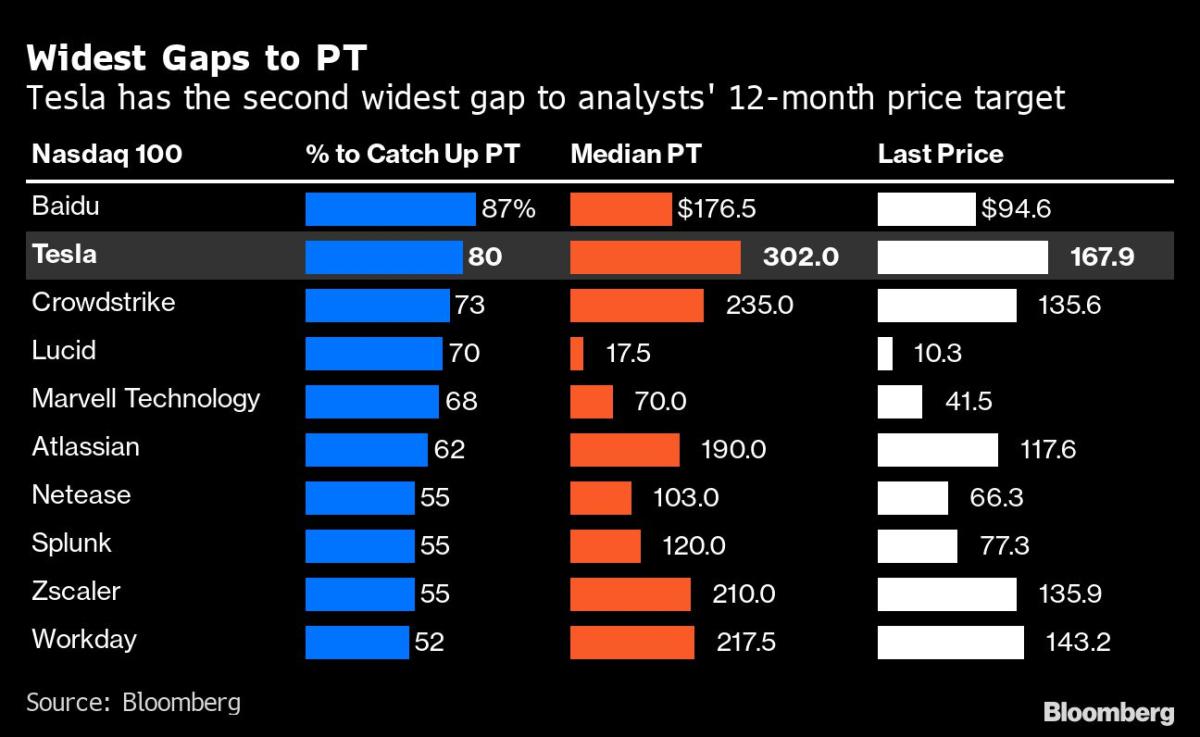

The yawning gap means Tesla shares need to rally a whopping 80% to hit the median analyst target price — the second widest on the Nasdaq 100 Index, just behind Baidu Inc. The Elon Musk-led firm’s stock has slumped 52% this year to $167.87, while analysts have a median 12-month target price of $302.

Tesla has been facing a host of issues including Musk’s shift-in-focus on turning around Twitter Inc. to China’s return to Covid Zero curbs. Adding to that are supply-chain snarls, rising raw-material costs and buyers feeling the squeeze of stubborn inflation and rising interest rates.

Still, many analysts are sticking to their bullish calls, with 27 of them rating the stock a buy, while 11 have a hold and seven have sell. The most bullish call has a price target of $530, according to data compiled by Bloomberg.

“It could be very hard for the stock to recover in the coming years,” said Valerie Gastaldy, a technical analyst at DaybyDay. “We recommend not looking back and waving bye-bye to this old darling.”

The slump this year has taken Tesla’s market capitalization to a touch above $530 billion, a far cry from a trillion dollars in April.

©2022 Bloomberg L.P.