Markets are naturally cyclical – they swing from high to low and back again on a consistent, if unpredictable basis over a range of time frames. The different time periods associated with any given cycle, or sometimes even the depth of a certain cycle’s direction, can shade the casual investor’s perception about a stock’s opportunity. The most recent major bull market, which extended itself over a more than ten-year time period is good example; because of both the unprecedented time period that market’s bullish run covered, and even more particularly the higher-than-average runs that run covered during its last couple of years, a lot of the average investors made the mistake of assuming that the market would simply continue that run.

We’re well into the final quarter of 2020, and it’s natural to start looking back at the year so far to take inventory of what happened. It’s unusual to be able to describe two major shifts in market momentum in a single year; this year, we saw the market plunge to bear-market lows in less than a month from February to March, with global economic activity grinding to a screeching halt as governments in almost every country imposed strict quarantine and shelter-in-place restrictions in an effort to contain the spread of COVID-19. That slide downward coincided with broad-based concerns not only about how long the pandemic would last, but also how long we would all be forced to follow those restrictive, self-isolation guidelines.

While concern about the pandemic hasn’t decreased – in fact, with new daily records throughout the U.S. infections seeming to happen every few days, it’s safe to say the winter months have started out with a fresh new wave that will only extend health concerns – economic activity began to resume in the early spring. It is more and more apparent that we are going to simply have to get used to living in a world where coronavirus remains a threat and a concern; even though some vaccine and antiviral candidates are expected to receive emergency use authorization before the end of the year, even the most optimistic medical and scientific professionals in the world aren’t expecting to see broad distribution and availability until sometime next year at the absolute earliest.

The next major shift in market momentum this year has come as the market has rebounded strongly from that late March, bear-market bottom; the NASDAQ 100 and S&P 500 both pushed strongly above pre-pandemic highs to establish their own new 52-week highs in September. The market’s recovery from bear market lows marked the quickest recovery from bear market conditions in history, just as the initial drop marked the most rapid drop to a bear market in recorded history. The market has become a bit more volatile in the last couple of weeks, driven mostly by political uncertainty as Election Day drew nearer; as of this writing it is still unclear who the winner will be, or how long it will actually take for the expected recount demands and legal challenges are resolved. Since the market always tries to anticipate what is coming, today it seems to be keying off of the prospect of a Biden win for the White House and a continued split in power between the House and the Senate that will keep Congress as divided as ever.

No matter what side of the political divide you sit on, one thing the eventual, inevitable declaration of a presidential winner should mean is that once the dust settles, most analysts seem to think that Washington will be able to get back to business, which means that stalled stimulus talks should get back underway. Hopefully that means that the path to a broader, more stabilized economy recover becomes clearer. A fresh set of stimulus could include programs geared around infrastructure spending, which history has proven is usually a smart way to apply fiscal policy to stimulate economic activity. That means that industries related to those programs should stand to benefit.

Oshkosh Corporation (OSK) is a good example of a stock in an industry – Industrial Machinery – that I would expect to benefit from a boost in infrastructure spending. After rebounding from a bear market low around $47 to a June high at around $84, the stock has faded, with the last couple of week’s worth of uncertainty pushing the stock to find latest support around $68. The company has undoubtedly had to absorb significant impacts from the health crisis; in their latest earnings report, for example, management disclosed that some closures in production facilities that were originally anticipated to be temporary will become permanent. Even so, the company’s balance sheet has remained mostly healthy, and while the commercial side of their business is expected to continue to be a headwind, the Defense segment – where the company manufactures light, medium, and heavy tactical wheeled vehicles – has continued to see increases in demand, not only in the U.S. but also internationally. Management also raised its quarterly dividend from $.27 to $.32 per share – which is a strong signal of management’s confidence in their long-term prospects. Does that make the stock a good value as well? Let’s find out.

Fundamental and Value Profile

Oshkosh Corporation (OSK) is a designer, manufacturer and marketer of a range of specialty vehicles and vehicle bodies, including access equipment, defense trucks and trailers, fire and emergency vehicles, concrete mixers and refuse collection vehicles. The Company’s segments include Access Equipment; Defense; Fire & Emergency, and Commercial. The Access Equipment segment consists of the operations of JLG Industries, Inc. (JLG) and JerrDan Corporation (JerrDan). The Defense segment consists of the operations of Oshkosh Defense, LLC (Oshkosh Defense). The Fire & Emergency segment consists of the operations of Pierce Manufacturing Inc. (Pierce), Oshkosh Airport Products, LLC (Airport Products) and Kewaunee Fabrications LLC (Kewaunee). The Commercial segment includes the operations of Concrete Equipment Company, Inc. (CON-E-CO), London Machinery Inc. (London), Iowa Mold Tooling Co., Inc. (IMT) and Oshkosh Commercial Products, LLC (Oshkosh Commercial). OSK has a current market cap of about $4.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -40%, while revenues decreased almost -19%. In the last quarter, earnings were flat, but positive by 0.78% while sales increased nearly 13%. The company’s operating margin has managed to be pretty stable, notwithstanding broad conditions this year; over the last twelve months, Net Income was about 4.73% of Revenues, and improved slightly in the last quarter, to 5.6%. High demand in the company’s defense-related vehicles as previously noted has provided a useful cushion to declines in their commercial business. Both are expected to grow in 2021.

Free Cash Flow: OSK’s free cash flow is adequate, at about $238.3 million. This number has declined from the last quarter, which was $334.3 million, and is also below its level at the end of 2019, when it was around $400 million. This decline is a reflection of the challenging environment imposed by the pandemic, with continued uncertainty about whether it will change.

Dividend: OSK’s annual divided is $1.32 per share, which translates to a yield of about 1.81% at the stock’s current price. Besides the increase announced during the last earnings call, that also marks an increase from $.96 per share, per annum around the middle of 2018.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $87 per share. That means the stock is trading at an interesting discount, with 23% upside from the stock’s current price.

Technical Profile

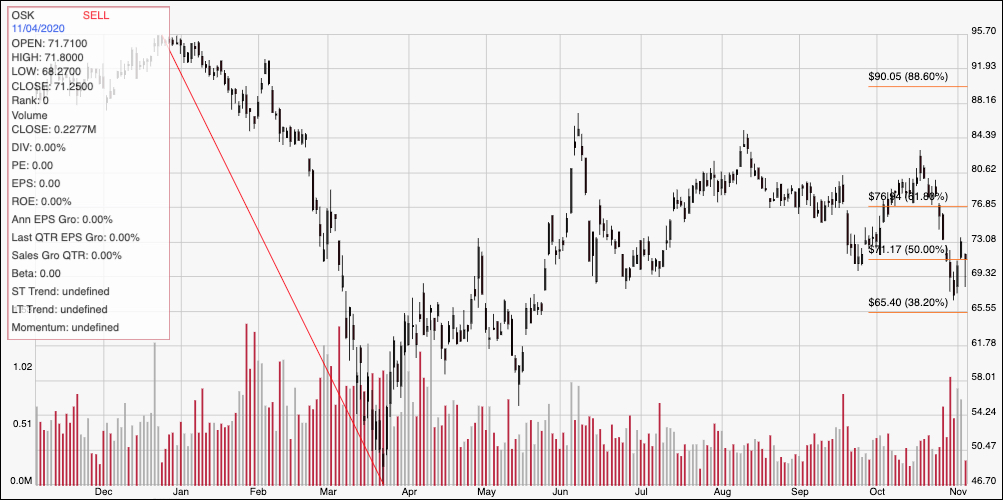

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from its peak at around $95 at the beginning of the year to its low in March at around $47; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock rallied strongly into June to peak at around $84 before dropping back below the 50% retracement line. The stock rallied again to revisit that June peak in August, but has fallen back from that point. Most recently, the stock found bearish support a little above the 38.2% retracement line, at around $68 and has rebounded from that point. Immediate resistance it at around $77 where the 61.8% retracement line rests. A drop below $68 should find further support around $65, but if bearish momentum picks up, it could be as low as $58 to $61. A push above $77 should give the stock room to retest its June and August peaks around $84.

Near-term Keys: OSK’s value proposition looks interesting right now, and for the most part the company’s balance sheet remains healthy and in better shape than many other companies dealing with the reality of pandemic-imposed shutdowns. Declining Free Cash Flow is a concern and bears watching; however, if you’re willing to accept the potential for continued near-term volatility, this is a stock that looks like a good value. The stock also has some interesting possibilities for short-term trades; continued bullish momentum from the stock’s current level could provide an interesting opportunity to consider buying the stock or working with call options, using $77 as an effective short-term profit target. A drop back below $68 could act as a good signal to consider shorting the stock or buying put options, using $65 as a quick-hit profit target and additional downside to around $61 from that point.