In my search for value, I’ve found it useful to develop a watchlist of stocks that I can check on a regular basis. That means that I often recycle stocks that I’ve previously used to make useful investments in, but don’t currently have a position in. That’s useful, because the familiarity that comes with the company and its approach builds a shorthand that I think can help to make the analysis process more efficient. As changes happen over time, it also helps to provide a historical context that aids perspective about current events and changes.

One of the drawbacks, however is that familiarity can also make it easier to gloss over troubling information. The burden on any investor, no matter what your approach may be, is to make your investing decisions as objective and systematic as possible. If you’ve been following a company for a while, it’s natural to start forming an emotional connection with it, or with the management team in one form or another. I think it’s part of the reason that we gravitate to the same brands and products in our personal lives; after a while, the familiarity of that product makes it easier to stick with it. As an investor, I think that can be a risk, because just as the economy ebbs and flows from prosperity to austerity, all companies experience their own ebb and flow in their business models. That also means that as an investor, there are times where even the companies you like the best won’t represent smart investing opportunities.

Westlake Chemical Corporation (WLK) is an example of a stock I’ve followed for a while and have used for some very productive investing opportunities, and that I like quite a bit. Technically speaking, the stock has been one of the ore interesting stocks to watch in the Chemicals industry. From a bear market low in March that actually marked the bottom of a long-term, extended downward trend at around $28, the stock has rallied in the last couple of days to break above its pre-pandemic high price at around$75 per share. WLK’s niche in the Chemicals industry is driven primarily by the housing market. Recent reports suggest that new home purchases are starting to pick up from their own previous lows. Numbers reported in the last few months suggest that housing demand has been higher than analysts predicted, which means that stocks tied to housing have had a nice headwind to propel their businesses forward for the rest of the year. The news this week of better-than-expected results from late-stage vaccine trials is offering a further ray of hope that, despite current spikes in infections and hospitalizations across the United States, there is an end in sight for the health crisis that has dominated virtually all discussion and market attention this year.

While unemployment numbers remain high, their overall trend is also continuing to move lower, implying that as economic activity resumes throughout the country, improving employment numbers – even gradual ones – could provide another useful tailwind for homebuilders and the companies that support them. This is true both for new homes as well as existing homes, as existing homeowners will probably be more likely to invest in home improvement projects. WLK is one of the biggest producers of PVC products, which are driven primarily by new home starts, but also by improvement projects in existing homes. While the effect of COVID-19 is certainly going to persist through the rest of the year, and into 2021, the company’s most recent earnings reports suggest that so far WLK has weathered the storm better than most. Does the stock’s big increase (the stock has nearly tripled in value from its bear market bottom), mean the stock has passed the point of useful value, or are the fundamentals strong enough to offer an attractive bargain proposition that makes it worth paying attention to?

Fundamental and Value Profile

Westlake Chemical Corporation is a global manufacturer and marketer of basic chemicals, vinyls, polymers and building products. The Company’s products include a range of chemicals, which are fundamental to various consumer and industrial markets, including flexible and rigid packaging, automotive products, coatings, water treatment, refrigerants, residential and commercial construction, as well as other durable and non-durable goods. Its segments include Olefins and Vinyls. It manufactures ethylene (through Westlake Chemical OpCo LP (OpCo)), polyethylene, styrene and associated co-products at its manufacturing facility in Lake Charles and polyethylene at its Longview facility. The Company’s products in its Vinyls segment include polyvinyl chloride (PVC), vinyl chloride monomer (VCM), ethylene dichloride (EDC), chlor-alkali (chlorine and caustic soda) and chlorinated derivative products and, through OpCo, ethylene. It also manufactures and sells building products fabricated from PVC. WLK’s current market cap is $9.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -51%, while revenues dropped by -8.13%. In the last quarter, earnings improved by 445%, while sales were 11% higher. The company has followed a pattern throughout the year, with narrowing of its margin profile; in the last quarter, Net Income was 3.89% of Revenues for the last twelve months, and tapered further to 3% in the last quarter.

Free Cash Flow: WLK’s free cash flow is generally healthy, at$613 million. This measurement has deteriorated since a peak above $1 billion in the third quarter of 2018, but is significantly higher than the beginning of the year, when Free Cash Flow was $467 million. This also acts as an interesting counter to the company’s Net Income pattern. Its current level translates to a Free Cash Flow Yield of 6.68%.

Debt to Equity: WLK’s debt/equity ratio is .57, which is conservative and implies the company takes a careful approach to debt management, and decreased from .58 in the quarter prior. WLK’s cash and liquid assets in the last quarter were about $1.2 billion while long-term debt was about $3.6 billion. While WLK’s operating profile indicates they should have no problem servicing their debt, a continued deterioration of Net Income could present challenges in the quarters ahead.

Dividend: WLK pays an annual dividend of $1.08 per share, which translates to a dividend yield of about 1.45% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $83 per share. That means that WLK is somewhat undervalued, offering about 12% upside from its current price.

Technical Profile

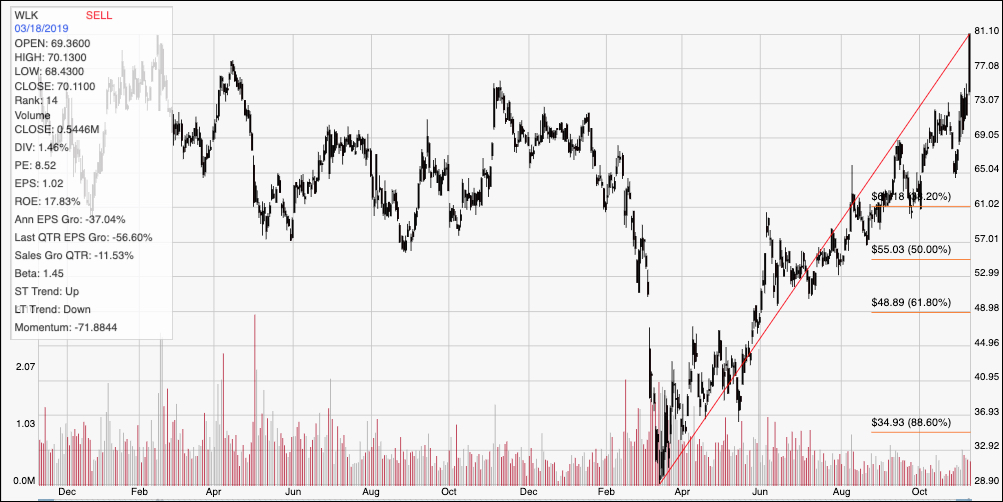

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend from March of this year at its bear market low around $29 to its current high at nearly $81; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s recovery and upward trend this year has been remarkable, pushing the stock near to highs not seen in nearly two years. Current support for the stock should be at around $72 based on the stock’s October pivot highs, with immediate resistance at the stock’s opening price at around $77. The peak shown on the chart is around $81, which marked an intraday high the stock wasn’t able to sustain into the close of yesterday’s trading session. That peak provides the short-term target if the stock is able to break current resistance at $77, while a drop below support at $72 could see the stock find next support anywhere between $68 and $65.

Near-term Keys: WLK’s fundamentals, which are showing useful signs of improvement, lend credence to the stock’s value proposition, which is interesting but not high enough to be compelling. If you’re willing to accept some volatility associated with the reality that we still aren’t out of the woods when it comes to COVID-19 – either from the standpoint of health risk or continued potential negative economic impact – this is a stock with a lot of market momentum behind it and that continues to be worth paying attention to. If you’re looking for a short-term trade, I think there could be a good signal to think about buying the stock or working with call options if the stock can push above $77, with a quick-hit, useful exit target at around $81. If the stock drops below $72, consider shorting the stock or buying put options, with $68 acting as the first profit target on a bearish trade.