Over the last several months, one of the best sectors of the stock market’s rally back to, and even above pre-pandemic levels has been the Materials sector. Beginning in mid-May to a peak last week, the sector had increased in value by nearly 93% as measured by the S&P 500 Materials Sector SPDR (XLB).

This is a sector that I like to pay attention to as a barometer for the underlying relative health of the economy, because the companies that comprise it produce or mine many of the raw materials that make up the building blocks used to create most of the finished goods we use every day. The sector includes industries that cover chemicals and plastics, construction materials, paper, forest, and packaging products, as well as metals and minerals – which means that in some form, this sector touches practically every other segment of the economy in one more or another.

As a reflection of broad economic health, it isn’t that surprising that a lot of the momentum that helped to drive the sector higher came on the back of favorable economic indicators as state and global economics began to to reopen, facilitated by aggressive fiscal stimulus from the federal government earlier in the year and continued accommodative monetary policy from the Federal Reserve. COVID infections are increasing by alarming levels throughout the U.S., driving many states to reimpose restrictions on things like social gatherings and leisure activities. Once again, small businesses appear to be to be the most vulnerable, which is setting off a new wave of uncertainty about the stability of the economy heading into the coldest months of the year. Any possibility of new fiscal stimulus, which many experts are saying will be necessary sooner than later to blunt the worst effects of this new wave, looks to be something that may not materialize until after the beginning of 2021.

A heightened state of market volatility can drive you nuts if you’re trying to make rational, objective decisions about how to put your money to work for you. That’s because the signals and triggers you’ve learned to use to identify signs of breakouts, continuations, and reversals start to break down; a “breakout” signal may end up really being a “fake out” signal, putting you exactly where you don’t want to be at exactly the wrong time. That creates second-guessing and doubt, which increases stress and emotional decision making. It really makes things more difficult than they need to be!

Conditions like we are experiencing now, and that can make short-term trading strategies generally harder, are one of the reasons that I’ve come to use those technical indications of trends and short-term swings back and forth as just one piece of a broader puzzle to help me identify stocks that offer useful value. It isn’t that the volatility goes away; but when I can leaven the emotion that a stock’s current price action might encourage with a solid dose of reality about a company’s business based on current fundamental data along with whether the stock should still be worth more than its current trading price, it helps to make the process a little less emotional and more manageable.

Huntsman Corp (HUN) is a good example of the sector’s performance over the last few months – as well as the tipping point that I think it could be sitting at right now. From its bear market low in March at around $12, the stock more than doubled in price by last week, but after hitting a peak at around $26, has faded back a bit. Helping to drive the stock near to its pre-pandemic highs along with sector strength earlier in the year were strong indications the company had managed to improve their operating profile since the beginning of the year, which also helped them increase their financial liquidity and boost the stock’s intrinsic value. The last couple of quarters, however have revealed a pattern of declining Free Cash flow and narrowing overall profitability that has been severe enough to shift the value argument significantly against the stock’s current trend. With current fundamentals factored in, let’s take a look at where HUN’s “fair value” price should be.

Fundamental and Value Profile

Huntsman Corporation is a manufacturer of differentiated organic chemical products and of inorganic chemical products. The Company operates all of its businesses through its subsidiary, Huntsman International LLC (Huntsman International). The Company operates through five segments: Polyurethanes, Performance Products, Advanced Materials, Textile Effects, and Pigments and Additives. Its Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products and its Pigments and Additives segment produces inorganic chemical products. The Company’s products are used in a range of applications, including those in the adhesives, aerospace, automotive, construction products, personal care and hygiene, durable and non-durable consumer products, digital inks, electronics, medical, packaging, paints and coatings, power generation, refining, synthetic fiber, textile chemicals and dye industries. HUN’s current market cap is $5.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined more than -21.95%, while revenues dropped about -10.5%. In the last quarter, earnings were 328.5% higher while revenues increased by 21%. The reversal from negative earnings and revenues to positive in the last quarter looks encouraging, but unfortunately doesn’t carry over to the company’s margin profile; after indications showed margins were solidifying and improving in the first quarter of the year, the last couple of quarters have flipped the script. In the last year, Net Income was 16.55% of Revenues, but fell to 3.18% in the last quarter. It is worth noting that before the last earnings report was released, HUN’s quarterly Net Income/Revenue was -4.97%, which means that in a broader sense, this could be a temporary reflection of the broader economics that have come to play this year, but until HUN can demonstrate a couple of quarters of consecutive improvement in this area, I take it as a red flag that encourages caution.

Free Cash Flow: HUN’s free cash flow is $17 million. This is marks a major, even alarming decline from the quarter prior, when Free Cash Flow was $375 million, and $588 million at the beginning of the year. The current number translates to a Free Cash Flow Yield of 0.33%. It is also noteworthy that HUN’s Free Cash Flow saw a peak at $1.2 billion in June 2018, and has declined steadily from that point; it helps to put the shorter-term decline into perspective and should add to the cautious outlook moving into the rest of 2020.

Debt to Equity: HUN has a debt/equity ratio of .46. This is a conservative number that has also decreased since the beginning of the year from .77. HUN’s balance sheet provides a strong counterbalance to the cautionary measurements just outlined. Total cash in the last quarter was about $1.16 billion, while long-term debt is $1.55 billion.

Dividend: HUN pays an annual dividend of $.65 per share, which translates to an annual yield that of about 2.79% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $8 per share. That means the stock is overvalued by -66%. Just a couple of months ago, my fair value price for HUN was $16.50, which means the last quarter’s numbers have eroded this measurement by more than -50%.

Technical Profile

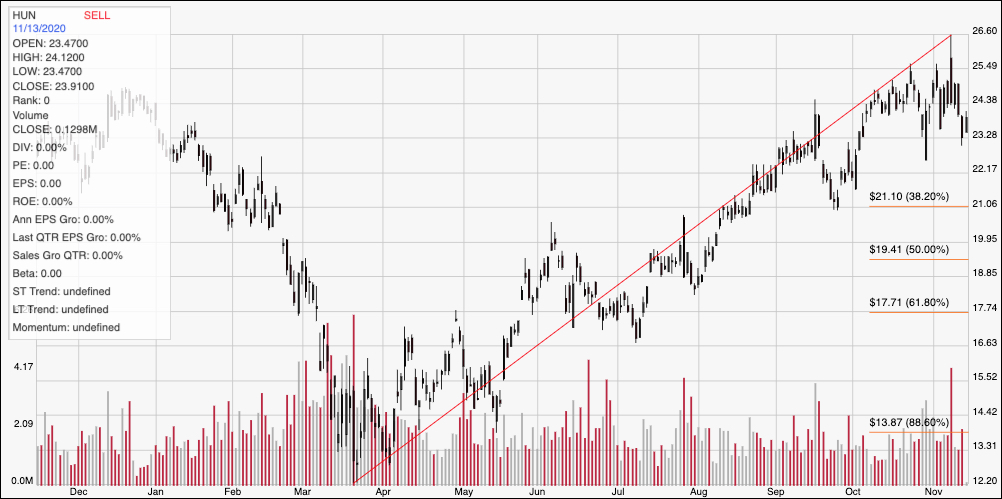

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line on the chart above traces the stock’s upward trend from a mid-March low at around $12 to its high point around $26.50just a few days ago. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s rally since March has been impressive, but the last month has seen the stock mostly hover in a sideways range between strong resistance at around $25.50 (the $26.50 peak is an outlier) and support around $23. The stock is currently testing that support low. A drop below $23 could see the stock drop to around $21 where the 38.2% retracement waits to offer new support. A bounce off of $23 has near-term upside to about $25.50, with $26.50 the next resistance target if bullish momentum in the stock picks up.

Near-term Keys: HUN’s current upward trend is intriguing, and might offer tempting fodder for a short-term trader right now. I think a bullish long-term forecast on HUN is not only over-optimistic right now, but also highly speculative given the fundamental concerns already outlined. That means the best trading opportunities lie in short term trades; you could use a bounce off of support at $23 as an opportunity to consider buying the stock or working with call options, using a target at around $25.50 as a useful exit point. A drop below $23 should be taken as a strong indication to consider shorting the stock or working with put options, with a near-term profits targets on the 38.2% retracement line at around $21, or $19.50 inline with the 50% retracement line if bearish momentum picks up. HUN is a company with a terrific balance sheet, which works in its long-term favor; but it is also very overvalued, and has some critical fundamental weaknesses including deteriorating Net Income and declining Free Cash Flow. Those are primary reasons that HUN shouldn’t be considered as a useful long-term opportunity unless and until those weaknesses show signs of material, stable improvement.