Any experienced investor, no matter what their investment philosophy is, will undoubtedly tell you that one of the most useful ways to find new opportunities is by maintaining a watchlist of stocks that they can check on a regular basis.

A good, diversified list of stocks in a variety of different industries can be an effective way to keep your investing functional, no matter what the ebb and flow of market sentiment is doing at any given time, since as one industry may be moving out of favor with investors, another will undoubtedly be moving into favor.

2022 kept a lot of people on edge as the health of the global economy prompted a broad drop to bear market conditions. Inflationary indicators have led to rising interest rates, which have also been compounded by the effect of Russia’s yearlong war with Ukraine. Add to that questions about whether the Fed will manage the proverbial “soft landing” everybody hopes for to avoid a push into actual recession, and it really isn’t surprising that the market’s natural tendency to forecast its fears is still having an impact as we move into 2023.

The market’s drop over the past year pulled most of the sectors and their respective industries of the economy into their own respective bear market levels. That includes stocks like Eastman Chemical Co. (EMN), one of the biggest companies in the Chemicals industry. The stock hit a high point in January at around $129.50 before following the market into its own bear market, hitting its most recent low in October of last year at around $70 per share. That’s a -46% drop that has the stock sitting at price levels throughout the past year that it hasn’t seen since 2020.

While most companies is just about every sector dealt with a COVID-driven, material impact, as a company, EMN has showed strength throughout the worst of the pandemic; however more recent reports show that the inflationary pressures I described earlier are having an impact on their bottom line, which is certainly a primary motivator for the stock’s extension of the downward to October. Since then, the stock has rallied to its current price at around $86. Are the company’s fundamentals improving as well? Also, what does that mean for the stock’s value proposition? Let’s find out.

Fundamental and Value Profile

Eastman Chemical Company (Eastman) is an advanced materials and specialty additives company. The Company’s segments include Additives & Functional Products (AFP), Advanced Materials (AM), Chemical Intermediates (CI), and Fibers. In the AFP segment, it manufactures chemicals for products in the coatings, tires, consumables, building and construction, industrial applications, including solar energy markets, animal nutrition, care chemicals, crop protection, and energy markets. In the AM segment, it produces and markets its polymers, films, and plastics with differentiated performance properties for end uses in transportation, consumables, building and construction, durable goods, and health and wellness products. The CI segment leverages large scale and vertical integration from the cellulose and acetyl, olefins, and alkylamines streams to support its specialty operating segments. Its product lines in Fibers segment include Acetate Tow, Acetate Yarn and Acetyl Chemical Products. EMN’s current market cap is $10.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about-17% while revenue growth was flat, but slightly negative, at -0.4%. In the last quarter, earnings declined by about -27.5% while sales were -2.7% lower. The company’s margin profile is showing signs of improvement that contradict the negative picture just described; Net Income for the last twelve months was 10.73% of Revenues, and improved to 1.11% in the most recent quarter.

Free Cash Flow: EMN’s free cash flow is modest, at $285 million. This is a number that declined over the past year, from about $1.04 billion, and $618 billion two quarters ago. It also translates to a Free Cash Flow yield of 2.69%.

Debt to Equity: EMN has a debt/equity ratio of .73, implying a generally conservative approach to debt management. The company’s balance sheet indicates their operating profits are more than adequate to service their debt for the time being, with increasing Net Income a good reflection of their improving financial flexibility. Their balance sheet shows $461 million in cash and liquid assets versus about $3.9 billion in long-term debt. I think it also noteworthy that EMN has decreased their debt from $5.4 billion in 2020 at the height of the pandemic, and $4.9 billion a year ago.

Dividend: EMN pays an annual dividend of $3.16 per share, which translates to a yield of about 3.58% at the stock’s current price. It should also be noted that management increased their dividend payout from $2.64 per share at the end of 2021 to $3.04 in 2022, and to its current level after the latest earnings announcement. An increasing dividend payout is an additional sign of management’s confidence in their business model moving forward.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $88.50 per share. That means that the stock is pretty fairly valued at its current price, with 2.35% upside from the stock’s current price, and a practical discount price at around $71 per share.

Technical Profile

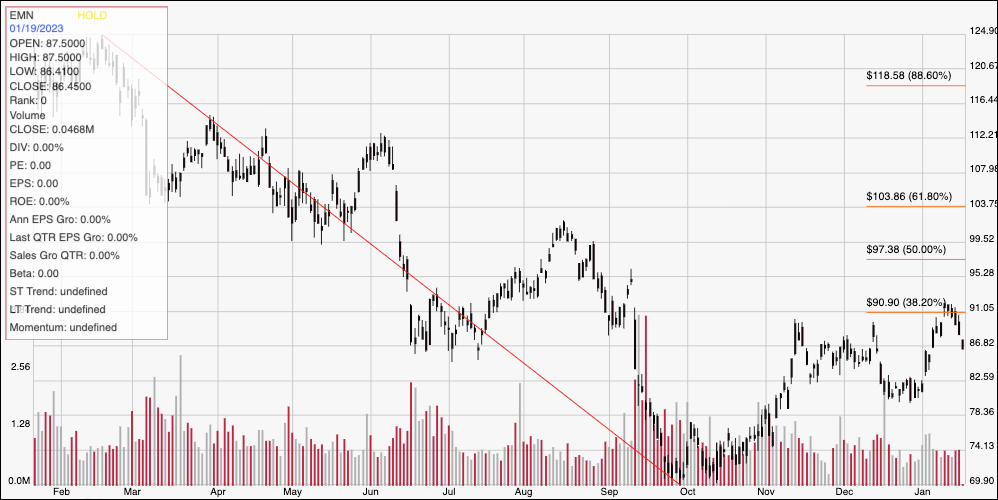

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward trend from $125 in February of 2022 to its low point, reached in October at around $70; it also provides the reference for calculating the Fibonacci retracement levels indicated by the horizontal red lines on the right side of the chart. The stock has rallied from that low, hitting its latest short-term peak at around $91, inline with the 38.2% retracement line to mark immediate resistance about a week ago. Current support should be near the stock’s current price, at around $86.50. A push above $91 should have immediate upside to about $95, with additional room to rally to about $100 where the stock peaked in August of last year. A drop below $86.50, on the other hand could see downside to about $80 before finding next support.

Near-term Keys: There really is no way right now to call the stock a useful value at its current price; the stock would need to fall to about $71 before a practical, useful discount would really be available. If you prefer to work with short-term strategies, I would pay close attention to the stock’s current support and resistance levels. A push above $91 could offer a good signal to consider buying the stock or working with call options, with $95 acting as a practical profit target on a bullish trade. A drop below $86.50 would be a good signal to think about shorting the stock or buying put options, with $80 acting as a good profit target on a bearish trade.