One of the hardest-hit sectors of the market this year is the Energy sector. While COVID-19 has dominated headlines throughout the year, and indeed has contributed to a massive decline in demand for petroleum products all over the globe as shelter-in-place orders have forced a massive shift for most corporations to remote work, the fact that people are driving less than they were last year isn’t even what started the problems for this sector.

Even before the pandemic had begun to spread on a global basis, the energy sector was rocked by a short, but intense price war between Saudi Arabia and Russia that forced benchmark oil prices to drop at the beginning of the year. The selloff just got worse once the health crisis began to accelerate, and even though the prices of both Brent and West Texas Intermediate crude oil have recovered off of the extreme lows they visited in April and May, they both remain significantly below their 2019 levels. That is an accurate reflection of the state of the sector at large, as even the biggest, most established names in the sector have all had to absorb major impacts on Net Income and Free Cash Flow that are putting pressure on their bottom lines.

Phillips 66 (PSX) is one of the largest refiners in the United States, and that came into 2020 in better position than most other companies in its industry. While oil refining is its primary business, it also had the foresight to position itself before the downturn, diversifying into crude storage and shale pipeline projects to alleviate congestion in the Permian Basin and Eagle Ford areas, where a large amount of U.S. shale has been held up by pipeline limitations. They have also seen an increase in consumer demand in its chemicals business, including packaging for cleaning products. Those are areas that helped to minimize, while not entirely offset the near-term effect of cratered refined crude demand earlier this year, and that could provide a useful tailwind to aid the company’s recovery as refined demand increases. The stock cratered from February to March as well, dropping from around $100 in January to an extreme low at around $40; from that low, the stock rebounded to about $75 before dropping back and revisiting its bear market lows last month. In the last few weeks, bullish momentum is picking up again, with the stock again starting to approach the $70 mark as of this writing. Is the move off of those bottoms an indication the worst is over? If it is, does that mean that PSX is a bargain that you should be paying attention to right now?

Fundamental and Value Profile

Phillips 66 is an energy manufacturing and logistics company with midstream, chemicals, refining, and marketing and specialties businesses. The Company operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream segment gathers, processes, transports and markets natural gas, and transports, stores, fractionates and markets natural gas liquids (NGLs) in the United States. The Chemicals segment consists of its equity investment in Chevron Phillips Chemical Company LLC (CPChem), which manufactures and markets petrochemicals and plastics. The Refining segment buys, sells and refines crude oil and other feedstocks at refineries in the United States and Europe. The M&S segment purchases for resale and markets refined petroleum products, such as gasolines, distillates and aviation fuels, primarily in the United States and Europe, as well as includes the manufacturing and marketing of specialty products, and power generation operations. PSX’s current market cap is $30.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined a little over -100%, while sales declined -41.3%. In the last quarter, earnings improved more than 98.5% while sales were 45.75% higher. Despite the positive earnings pattern in the last quarter, PSX’s margin profile, which is normally narrow has weakened throughout the year. Over the last twelve months, Net Income was -3.45% of Revenues, and deteriorated further to -5.02% in the last quarter.

Free Cash Flow: PSX’s free cash flow-$525 million for the trailing twelve month period. This measurement confirms the negative picture I just drew using Net Income, as Free Cash flow was around $935 million at the beginning of 2020, $1.8 billion at the end of the first quarter, and $330 million in the quarter prior.

Debt to Equity: PSX has a debt/equity ratio of .57, a low number that indicates the company operates with a conservative philosophy about leverage. Their balance sheet shows $1.46 billion in cash and liquid assets versus $12.6 billion in long-term debt.

Dividend: PSX pays an annual dividend of $3.60 per share, which translates to a yield of 5.54% at the stock’s current price. Given the declining state of Free Cash Flow and Net Income, the dividend bears watching.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $80 per share. That suggest that PSX is undervalued by about 16% at its current price.

Technical Profile

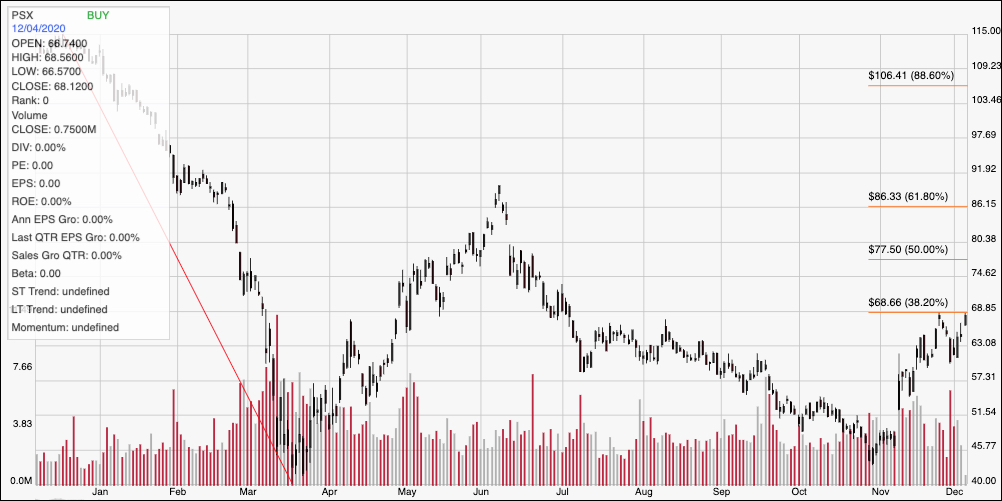

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the stock’s price action over the past year. The red diagonal line traces the stock’s downward trend from November 2019 to the bottom in March at around $40, followed by the rebound into June that peaked a little below $90 before dropping back again to revisit its bear market low in November. The trend line also provides the baseline for the Fibonacci retracement lines on the right side of the chart. From that November low, the stock has picked up quite a bit of bullish momentum and is now approaching resistance offered by the 38.2% retracement line at around $69. Immediate support should be found at around $60 based on recent pivot lows in that range. A push above $69 should see the stock rally to about $77.50 in the near term where next resistance should come from the 50% retracement line. A drop below $60, on the other hand could see the stock fall to around $54 before finding next support based on pivot activity seen in October and April.

Near-term Keys: The value proposition on PSX is interesting, but not quite compelling. I’ve painted a pretty grim fundamental picture that I think accurately reflects the challenges PSX has to cope with in 2020, but I also think it is reasonable to consider that as COVID vaccines are approved and distributed around the world in 2021, most of the downward pressure that the entire energy sector has been forced to absorb will taper, and in fact could rebound quickly back, if not to 2019 levels then certainly to healthier levels than they are seeing now. If you prefer to work with short-term trading strategies, a move above $69 could be useful signal to buy the stock or work with call options, with an eye on $77.50 or above offering some nice exit targets. A drop below $60, on the other hand could be strong signal to consider shorting the stock or working with put options, with $54 acting as a very attractive initial bearish profit target.