Given the way the market – and let’s face it, just about all of us – have been focusing all year long on pandemic-related news, including the prospects for practical vaccines, it’s safe to say that this week could see some uncertainty coming back into play. Positive news about clinical trials for a couple of the biggest pharmaceutical companies has given the market some reasons to be more optimistic in the last couple of weeks. The fact that this week the applications those companies have submitted to the U.S. government for emergency use authorization that could facilitate the distribution of these vaccines before the end of the year means that I won’t be surprised to see market volatility increasing a bit.

There is a saying that I find often comes back into relevance when it comes to market activity: “buy the rumor, sell the news.” The expectation that these vaccines will be approved, that they will be made available to first responders and highly at-risk individuals before the end of the year and on a more widespread basis in early 2021 is one of the big things that has given the market reason for optimism; that’s a great example of “buying the rumor” playing itself out. The realization of that expectation is a good thing from the standpoint of public health, to be sure – assuming it does, in fact happen – but it could very possibly mean that many of the investors and traders that “bought the news” will use that event as a signal to take profits off the table and move on to the next thing. That could increase selling pressure, at least on a short-term basis, with the additional reality factored in that infections are still on the rise in the U.S., and medical and health care facilities and personnel are being stretched to their limit right now.

The initial distribution of a vaccine will help relieve some of that pressure – but for the populations where reports are showing big percentages of current infection and hospitalization rates (and that don’t fit into the demographics for first wave vaccination), there is still plenty of risk that has be managed. I believe that means that any real economic boost that comes from vaccinations won’t be seen in practical ways until possibly the second quarter of next year, which is one of the biggest reasons that I think it is still smart to be cautious, conservative and defensive about taking on new positions.

A good way to start making your investments more conservative is by reducing large positions that you might have been holding for extended periods of time – especially if you have unrealized gains in stocks in normally cyclical industries like the Technology or Industrial sectors. Locking in some gains now can free up cash to start looking for new, more conservative positions in stocks with less sensitivity to economic cycles, and stable, established revenue streams. Food stocks have always been an area I gravitate to that fits this description, and that includes some of the biggest names in the Beverages industry.

Coca-Cola Co (KO) is one of the most recognized brand names in the entire world. They’re so ubiquitous, in fact that for many the word “Coke” doesn’t actually refer to Coca-Cola itself, but to soda in general. That is just one of the reasons that I think KO Is an example of a company that is less sensitive to economic risk, even on a global scale, than many other stocks in the marketplace. Another reason is that, even when the economy turns sour, consumers not only still have to buy food, but they have also proven that there are “indulgences” that they won’t do without. Soda is one of them, and that is why I think the largest stocks in the Beverages industry could be a smart place to think about putting your money to work even as the market remains uncertain and unpredictable.

Safety is one thing; value is another. The fact is that since hitting a bearish low with the rest of the market in March of this year at around $36, KO has rebounded strongly, increasing in value by a little over 46% since then. The stock is still about -12% its pre-pandemic high, however, with the company boasting a balance sheet that, not surprisingly has held up pretty well during the pandemic. Does that mean that KO could be a smart bet, both from a fundamental and value perspective? Let’s dive in.

Fundamental and Value Profile

The Coca-Cola Company is a beverage company. The Company owns or licenses and markets non-alcoholic beverage brands, primarily sparkling beverages and a range of still beverages, such as waters, flavored waters and enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, sports drinks, dairy and energy drinks. The Company’s segments include Europe, Middle East and Africa; Latin America; North America; Asia Pacific; Bottling Investments, and Corporate. The Company owns and markets a range of non-alcoholic sparkling beverage brands, including Coca-Cola, Diet Coke, Fanta and Sprite. The Company owns or licenses and markets over 500 non-alcoholic beverage brands. The Company markets, manufactures and sells beverage concentrates, which are referred to as beverage bases, and syrups, including fountain syrups, and finished sparkling and still beverages. KO has a current market cap of $227.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -1.79%, while sales decreased almost -9%. In the last quarter, earnings increased by about 31% while sales grew 21%. KO operates with a very healthy margin profile despite weakening in the last quarter; in the last twelve months, Net Income was 24.9% of Revenues and declined to 20% in the last quarter.

Free Cash Flow: KO’s Free Cash Flow is healthy, but has been pressured throughout the year by pandemic-related pressure, as well as the company’s wide international footprint, which exposes it to more foreign currency risk than most of its competitors and has been noted as a headwind recently by management. Over the last twelve months, the company generated cash flow of $7.5 billion. That marks decline from the beginning of the year at about $9.3 billion. The current Free Cash Flow translates to a Free Cash Flow Yield of 3.31% at the stock’s current price.

Debt to Equity: KO has a debt/equity ratio of 1.94, which is a bit high, but not unusual for stocks in the Beverages industry. It is worth noting that in late 2019, this number was 1.44, which is indicative of a measurable increase in long-term debt. Their balance sheet shows $21.8 billion in cash and liquid assets versus $39.5 billion in long-term debt. These total numbers have increased since the beginning of the year, from $17.6 billion for cash and $31 billion for long-term debt, implying that KO has borrowed at least in part to bolster their balance sheet this year as many companies have done. Even so, their operating profile and balance sheet indicate that KO should have no trouble servicing its debt.

Dividend: KO pays an annual dividend of $1.64 per share, which at its current price translates to a dividend yield of about 3.05%. KO is considered a “Dividend King;” they increased their dividend earlier this year from $1.60, marking 58 consecutive years of dividend increases. KO has paid a consistent dividend since 1920 and are a member of the S&P Dividend Aristocrats Index.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $43 per share. That suggest that KO is overvalued by about -18% at its current price.

Technical Profile

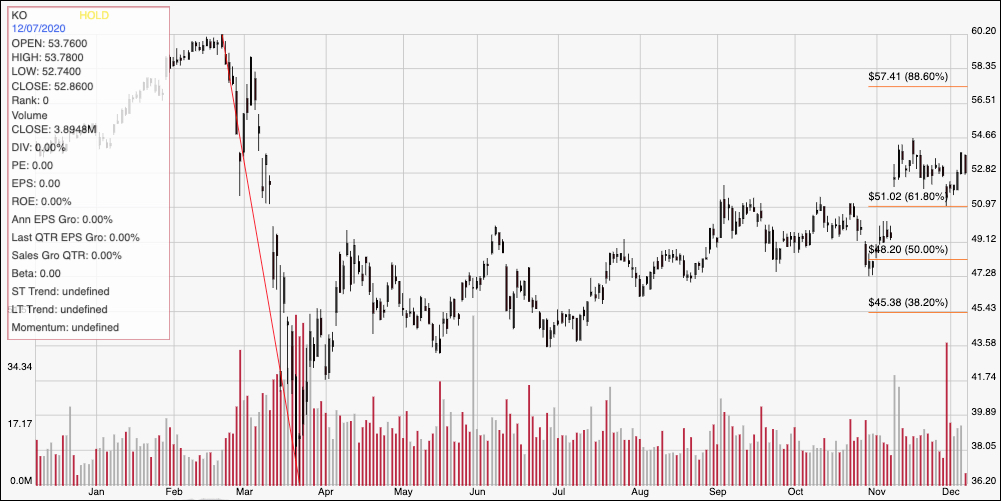

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the past year of price activity for KO. The red line traces the stock’s drop from February to March to a bear market low at around $36. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock’s upward trend from that March bottom is easy to see, and has driven the stock above the 61.8% retracement line, where current support sits at around $51 per share. Immediate resistance is at around $54.50 based on the most recent pivot high in November. A push above $54.50 should give the stock room to rally to anywhere from $57.50 (in line with the 88.6% retracement line) and the stock’s 52-week high around $60, last seen in February. A drop below $51 should find next support at around $48 based on the 50% retracement line along with significant pivot activity around that level over the last few months.

Near-term Keys: From a long-term perspective, there really isn’t any way to think of KO as a bargain at its current price. In fact, if you work exclusively from that perspective, the stock offers significantly more risk than upside right now, even with the underlying fundamental strength that has seen the company through the year. That said, I think there are some interesting opportunities to take advantage of changes in the stock’s current momentum and trading range. A break above $54.50 could be an interesting opportunity to take advantage of buying the stock or working with call options with a short-term eye on $57.50 as an exit point, while a drop below $51 could be a useful signal to think about shorting the stock or working with put options with an eye on the 50% Fibonacci line at around $48 to close that trade.