Uncertain economic conditions have proven to be a good time to think about stocks that most people tend to overlook because they’re “boring.” These are stocks that also tend to operate in counter-cyclical fashion. It’s been interesting – but not surprising – to see a bit of a resurgence in stocks in the Food Products industry, for example show a lot more resilience, and in some cases even go up in price while stocks in industries usually considered “trendier” are getting thumped.

In the early stages of the pandemic, these stocks were the clear winners, as consumers clamored to stock up on basic home supplies and other packaged, non-perishable food products, like canned food, prepackaged meat, and so on. While most of the pandemic-induced fear drove that initial surged has faded, and even started to be replaced by optimism about being able to resume some kind of “normal” level of activity in 2021, even as stay-at-home working conditions are likely to remain in place for many working professionals on a long-term, and possible even permanent basis, while broad economic pressure from historically high unemployment isn’t going to go away soon; the government’s passage over the weekend of a second stimulus package, I believe is a frank acknowledgement of that reality. I think those are just two reasons that economists continue to forecast steady demand for household goods, including pantry, fridge and freezer foods – which offers a headwind that could make this industry a natural fit for anybody that wants to find places to invest that could represent “safe havens” within the market that aren’t as sensitive to economic downturns and prolonged periods of uncertainty.

Prepackaged food stocks like Hormel Foods Corp (HRL), CPB, and KHC have all been facing significant challenges over the last couple of years related to changing consumer preferences. HRL occupies a somewhat different niche than some of these other stocks, however because its products fit nicely into that shift towards healthier choices, with a specific emphasis on proteins. That also fits into related reports regarding China, which is increasing protein imports to make up for domestic supply shortages from the swine flu pandemic a year or so ago that ravaged its pork capacity. HRL specifically noted increasing orders for SPAM for China.

A lot of prepackaged food companies – especially those that deal with protein products – have business segments dedicated to foodservice – primarily referring to supply to restaurants – and grocery. One of the interesting ways a number of companies in this industry have been forced to adjust in 2020 because of the pandemic is to de-emphasize foodservice channels, where forced shutdowns across the globe have shuttered restaurants and social dining and focus more on grocery, where those same orders have prompted an increase in food storage and consumption at home. HRL may have more risk exposure than its competitors in this vein, as foodservice channels account for more than 30% of revenues. Another possible tailwind that could work in its favor in the second half of 2021, when “herd immunity” from vaccinations is hoped to be achieved, is a highly-anticipated increase in dine out demand; HRL has historically derived a major portion of its revenue from the foodservice channel that has been crushed by the pandemic throughout 2020. A broad recovery in restaurant dining should benefit suppliers like HRL in a meaningful way. Despite those pressures this year, the company carries a very strong fundamental profile mean that includes a very healthy balance sheet. The stock has also retraced from 52-week highs by a little over -10% since August, and has begun to consolidate in a narrow range over the last month that could be setting up an interesting technical opportunity. Does that also mean the stock offers a good value for defensive-minded investors? Let’s take a look.

Fundamental and Value Profile

Hormel Foods Corporation is engaged in the production of a range of meat and food products. The Company operates through four segments: Grocery Products, which is engaged in the processing, marketing and sale of shelf-stable food products sold for the retail market and health and also consists of nutrition products, including Muscle Milk protein products.; Refrigerated Foods, which consists of the processing, marketing and sale of branded and unbranded pork, beef, chicken and turkey products for retail, foodservice and fresh product customers; Jennie-O Turkey Store (JOTS), which consists of the processing, marketing and sale of branded and unbranded turkey products for retail, foodservice and fresh product customers; and International & Other, which includes Hormel Foods International Corporation, which manufactures, markets and sells the Company products internationally. HRL’s market cap is about $25.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -8.5%, while sales also declined -3.25%. In the last quarter, earnings increased 16.2%, while sales were 1.62% higher. The company’s margin profile is healthy; over the last twelve months, Net Income was 9.43%, and 9.68% in the most recent quarter.

Free Cash Flow: HRL’s free cash flow was a little over $762.44 million over the past twelve months and translates to a modest Free Cash Flow Yield of 2.99%. It should be noted that Free Cash Flow was about $761 million in the last quarter, and $619.5 million two quarters prior.

Dividend Yield: HRL’s dividend is $.98 per share, and translates to a yield of 2.08% at its current price. It is also noteworthy that HRL has increased their dividend this year; it was $.84 per share on an annualized basis as recently as October of last year. HRL is on a select list of S&P 500 “dividend aristocrats,” having increased its dividend every year for the last 54 years.

Debt to Equity: HRL has a debt/equity ratio of .16. This is a very low number that is clearly representative of the company’s conservative use of leverage and its approach to debt management. In the last quarter, HRL’s balance sheet showed about $1.73 billion in cash and liquid assets against $1 billion in long-term debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $39 per share. That means the stock is overvalued right now, with -17% downside from its current price, with a useful discount price at around $31.

Technical Profile

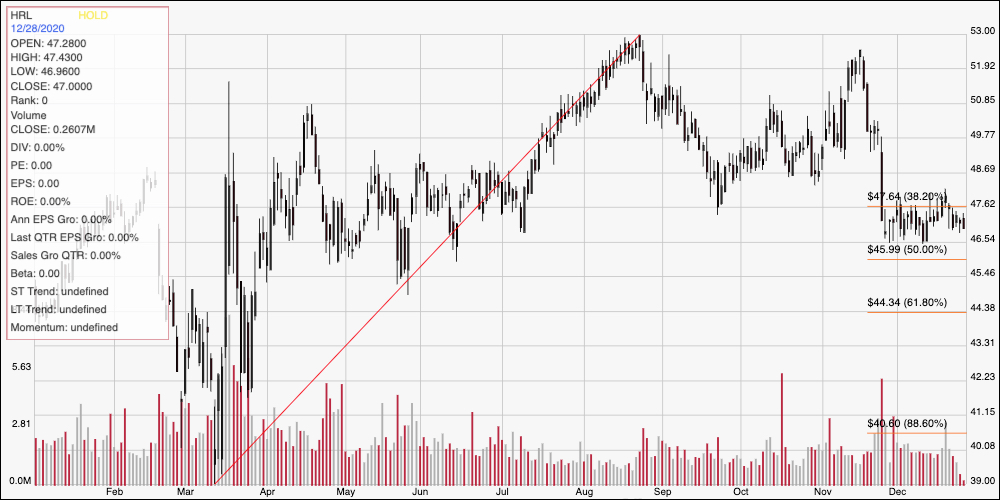

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last two years. The diagonal red line traces the stock’s upward trend from May 2018 to its peak, at around $53 in August. It also acts as the baseline for the Fibonacci retracement lines shown on the right side of the chart. After hitting that peak, the stock dropped back to support around $47, and near to the 38.2% retracement line before rallying again into the beginning of November, where it peaked near to the July peak. In mid-November, the stock dropped back sharply again, finding a new low at around $46, with immediate resistance at around $48, where the 38.2% retracement line rests. A push above $48 should see near-term upside to about $51 to next resistance, while a drop below $46 should find next support between $45.50 and $44.50, where the 61.8% retracement line sits.

Near-term Keys: HRL’s fundamentals are solid, especially considering the challenging conditions just about every sector in the market has had to deal with during the pandemic, but the stock’s big bullish move since March means that even with the latest drop in price, there really isn’t a good value-based case to make for HRL right now. HRL would actually have to drop to around $31 to offer a compelling value proposition. If you want to work with this stock, it may be more appropriate to focus on short-term strategies. If the stock breaks above current resistance at $48, you could consider buying the stock or working with call options, with a near-term profit target at around $51. A drop below $46 could act as a signal to consider shorting the stock or to work with put options with a target price at around $44.50.