There are any number of dynamics that come to play in the markets at any given time – and not all of them come from company earnings announcements or national events.

The reality of our ever-more connected world means that the ebb and flow of economic health on either a national or global scale can be tied to a lot of different elements. They include political and geopolitical shifts, social perceptions and changes, and as we have seen since the start of this decade, most certainly to national and global health concerns. The latter is a more extreme case, as the kind of health issues that tend to creep into discussions of economic health are usually a once-in-a-century kind of occurrence. But then, prior to 2020, the last global pandemic came in the form of the Spanish Flu in 1918 – a little over a century ago.

A new year means an opportunity to write a new chapter in the history books. 2022 certainly went down marked with uncertainty on multiple fronts – inflation, rising interest rates, war in Ukraine, and renewed trade tensions between the U.S. and China are all just a few examples. The market’s uncertainty and increased volatility throughout last year forced the major market indices, and most stocks to hold in their own respective bear market levels until the end of last year. 2023 has started on more hopeful note, even as many of the economic pressures of the past year persist. That’s also meant that a lot of stocks have started to rally into new, intermediate-term upward trends. If you’ve been sitting on the sidelines, or even just taking a conservative, selective approach to taking on new positions, it might seem tempting to start thinking about jumping back in with both feet so you can ride the next wave upward.

The Auto industry has experienced quite a bit of bearish pressure for most of the past few years. Even before COVID-19 became a global health and economic crisis, sales were down globally, reflecting economic declines in various parts of the world as well as the effects of an extended trade war between the U.S. and China that held investor’s attention through most of 2018 and all of 2019. Just as the trade war seemed ready to fade away at the end of 2019, the global economy ground to a halt amid massive quarantine and shelter-in-place orders that closed down businesses and sent consumers home to limit the spread of coronavirus. For most of that year and 2021, the industry continued to struggle as sales remained tepid, with generally uninspiring sales results last year and moving into 2023. The exception to those unremarkable sales results has come from the emerging electric vehicle segment, which has been getting more and more market buzz over the past couple of years, and where demand continues to be high. Public shifts from most of the major automakers to shift combustion engine production to electric vehicles only validates the consumer trend even further.

BorgWarner Inc. (BWA) is an example of a U.S. company that provides parts and services to major auto manufacturers, and that made a big move at the beginning of 2020 when the company announced it had entered into an agreement to acquire Delphi Technologies, a 1999 spinoff of GM that specializes in combustion systems, electrification products, and software and controls. The “electrification” side of that description was the primary motivation for the deal, since it gave BWA a solid foothold in hybrid and electronic vehicles. New electric vehicles sound sexy, but the biggest long-term opportunity in the EV segment for BWA comes from the generally under-appreciated aftermarket, where auto components and parts are regularly needed for basic vehicle maintenance of all types. I think that puts the company at an interesting intersection of future growth with established presence and strength. In fact, BWA’s 2021 reports indicate that this new segment provided the biggest lift to the company’s sales and earnings through that year and have continued to be a source of financial strength.

The Delphi deal notwithstanding, another remarkable thing about BWA is that while the pandemic absolutely had an impact on the company, its earnings reports throughout the pandemic and the past year show that the company actually managed to absorb the various economic blows better than most of its industry brethren. While the stock showed a fair amount of volatility in 2021, in 2022 it experienced a significant downward trend, falling from a January peak at around $50 to find a low in October at around $31. From that low, the stock has moved into an impressive upward trend that peaked earlier this month at around $51. The upward trend is interesting, but of course it also begs the question of whether the stock’s current price still offers a useful value proposition to consider on a long-term basis. Let’s dive in.

Fundamental and Value Profile

BorgWarner Inc. is engaged in providing technology solutions for combustion, hybrid and electric vehicles. The Company’s segments include Engine and Drivetrain. The Engine segment’s products include turbochargers, timing devices and chains, emissions systems and thermal systems. The Engine segment develops and manufactures products for gasoline and diesel engines, and alternative powertrains. The Drivetrain segment’s products include transmission components and systems, all-wheel drive (AWD) torque transfer systems and rotating electrical devices. The Company’s products are manufactured and sold across the world, primarily to original equipment manufacturers (OEMs) of light vehicles (passenger cars, sport-utility vehicles (SUVs), vans and light trucks). The Company’s products are also sold to other OEMs of commercial vehicles (medium-duty trucks, heavy-duty trucks and buses) and off-highway vehicles (agricultural and construction machinery and marine applications. BWA has a current market cap of about $11.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by nearly 19%, while revenues grew by about 12.4%. In the last quarter, earnings were 1.6% higher while sales rose by 1.18%. The company’s generally narrow margin profile is healthy; over the last twelve months Net Income as a percentage of Revenues was 6.05%, and improved somewhat to 6.21% in the last quarter.

Free Cash Flow: BWA’s free cash flow is generally healthy, at $869 million over the last year. That marks an increase from $573 million in the last quarter and $458 million a year ago. The current number translates to a Free Cash Flow Yield of 7.46%.

Debt to Equity: BWA has a debt/equity ratio of .55. This is a very manageable number that suggests the company should have no trouble servicing their debt. Their balance sheet shows about $1.3 billion in cash and liquid assets (versus about $1.2 billion in the quarter prior) against a little over $4.1 billion in long-term debt. The long-term debt number is made up mostly of debt assumed at the beginning of 2020 ahead of finalization of its Delphi acquisition.

Dividend: BWA’s annual divided is $.68 per share and translates to a yield of 1.37% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $55 per share. That means that at its current price, BWA is undervalued by about 10.5%, with a practical discount price at around $44 per share.

Technical Profile

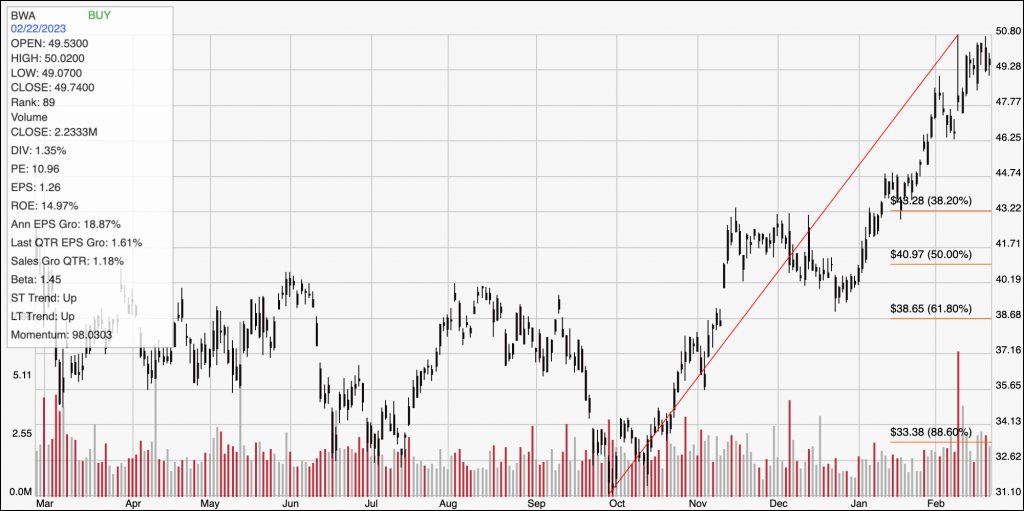

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend from its October low at around $31 to its peak earlier this month at around $51. It also informs the Fibonacci retracement lines shown on the right side of the chart. The stock has rallied strongly from that low, and is very close to immediate resistance at the stock’s recent high, which also marks immediate resistance at $51. Current support is around $48, based on a lower pivot high reached to start this month. A push above $51 could have upside to about $54, using the current distance between support and resistance as a reference, while a drop below $48 could find next support anywhere between $46 and $45.

Near-term Keys: BWA’s generally solid fundamental profile is something that I think lends credence to think about this stock as a practical, value-based opportunity, however the accelerated pace of the stock’s current upward trend is increasing the near-term chances it will retrace back to moderate that trend in the near term. If you prefer to work with short-term strategies, you could use a push above $51 as a signal to think about buying the stock or working with call options, with a useful profit target at around $54. A drop below $48 would be a useful sign to think about shorting the stock or buying put options, with $45 offering a practical profit target on a bearish trade.