When you filter through all the noise in news and market media, the one of the main questions so far this year has been whether the market will continue last year’s bear market action.

That, of course begs the question, at least to me, of whether 2022’s economic headwinds – inflation, supply constraints, war, and rising interest rates that they all translated into – will begin this year. That hasn’t been the case so far, as interest rates have continued to climb, with the aftereffects causing ripples in different areas of the economy, from rising consumer cost (including on items like food) to last month’s abbreviated banking crisis.

In the U.S., intense competition over the last few years in the retail pharmacy space has spurred major consolidation, leaving just Walgreens Boots Alliance (WBA) and CVS Corporation (CVS) standing among recognized national pharmacies and looking for ways to innovate to counter not only the competition from each other but also from other companies like Amazon, WalMart, and Costco, to name just a few. For both of these companies, evolution and transformation have become a primary theme. Along with its merger with health insurer Aetna, CVS is actively renovating and remodeling local retail locations into combined pharmacy and health care service centers in the form of MinuteClinic and HealthHUBs. WBA isn’t standing pat either, investing heavily to roll out full-service primary care clinics as part of a partnership with VillageMD, that became an outright acquisition of VillageMD into its corporate organization late last year.

If you look at the overall market for the pharmacy space, it becomes pretty easy to see that long-term demographic trends are generally favorable for companies like WBA and CVS. Continued aging of the Baby Boomer generation, with Generation X moving into retirement age in the next decade or two, means that demand for prescription drugs and related health care services is expected to only increase. When you add in other fundamental factors like WBA’s long-standing status as a dividend aristocrat (members of the S&P 500 Index that have paid a dividend for 25 consecutive years or more) and healthy Free Cash Flow, it is interesting to look at the stock’s price performance.

WBA has been following a downward trend since April 2021. That trend saw a temporary shift in the third quarter of 2022, as the stock rallied along with the rest of the market from a multiyear low at around $30 to peak in December at around $42 per share. The stock faded back from that point, dropping to a mid-March low at around $32, which is a bit higher than the $30, 52-week low, but still marks a low point for early 2023. Many of the pandemic-driven headwinds that had a positive impact on the company’s bottom line have faded, while management is also driving significant investment in accelerating the buildout of their VillageMD care clinics. Those are factors that I think have contributed to the stock’s underperformance so far, but also that could signal the stock’s useful long-term opportunity. Does that mean the stock’s value proposition is worth paying attention to?

Fundamental and Value Profile

Walgreens Boots Alliance, Inc. is a holding company. The Company is a pharmacy-led health and wellbeing company. The Company operates through three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The Retail Pharmacy USA segment consists of the Walgreen Co. (Walgreens) business, which includes the operation of retail drugstores, care clinics and providing specialty pharmacy services. The Retail Pharmacy International segment consists primarily of the Alliance Boots pharmacy-led health and beauty stores, optical practices and related contract manufacturing operations. The Pharmaceutical Wholesale segment consists of the Alliance Boots pharmaceutical wholesaling and distribution businesses. The Company’s portfolio of retail and business brands includes Walgreens, Duane Reade, Boots and Alliance Healthcare, as well as global health and beauty product brands, including No7, Botanics, Liz Earle and Soap & Glory. WBA has a current market cap of $30.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -27%, while sales were 3.28% higher. In the last quarter, earnings growth was flat, at exactly 9%, while sales grew by 4.33%. The company’s margin profile is normally razor-thin, and had dropped into negative territory late last year, but is showing signs of improvement; over the last twelve months Net Income was -2.36% of Revenues, and strengthened in the last quarter, to 2.02%. The turn from negative Net Income on a yearly basis to positive Net Income in the last quarter is an encouraging sign; additional improvement in the quarters ahead would validate the idea that this isn’t a temporary occurrence.

Free Cash Flow: WBA has free cash flow of $2.75 billion over the last twelve months. This number has declined from August of 2018, when it was about $6.9 billion as well as over the past year, when Free Cash Flow was about $4.44 billion. The current number also translates to a still-healthy healthy Free Cash Flow Yield of 8.93%.

Debt to Equity: the company’s debt to equity ratio is .30, which is a conservative number. Long-term debt has decreased, from about $10.7 billion a year ago to $8.8 billion in the last quarter. It is also noteworthy that the company’s long-term debt increased by about $900 million in the last quarter. The company reported $1.8 billion in cash and liquid assets versus roughly $4.45 billion a year ago. Debt management should not be a concern, however the decline in liquidity and Free Cash Flow are elements to keep an eye on and that could be a challenge if they persist in the quarters ahead.

Dividend: WBA pays an annual dividend of $1.92 per share, which translates to an annual yield of 5.37% at the stock’s current price. WBA also increased their dividend from $1.87 per share in 2021, and from $1.91 in 2022 – which is a sign of strength and a confirmation of the company’s status as a Dividend Aristocrat.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $40 per share. That means the stock is undervalued, with just about 12% upside from its current price, and a compelling discount sitting at around $32 per share. It should also be noted that at the beginning of the fourth quarter of 2022, this same metric yielded a fair value target of $52.50, and $38 on quarter ago.

Technical Profile

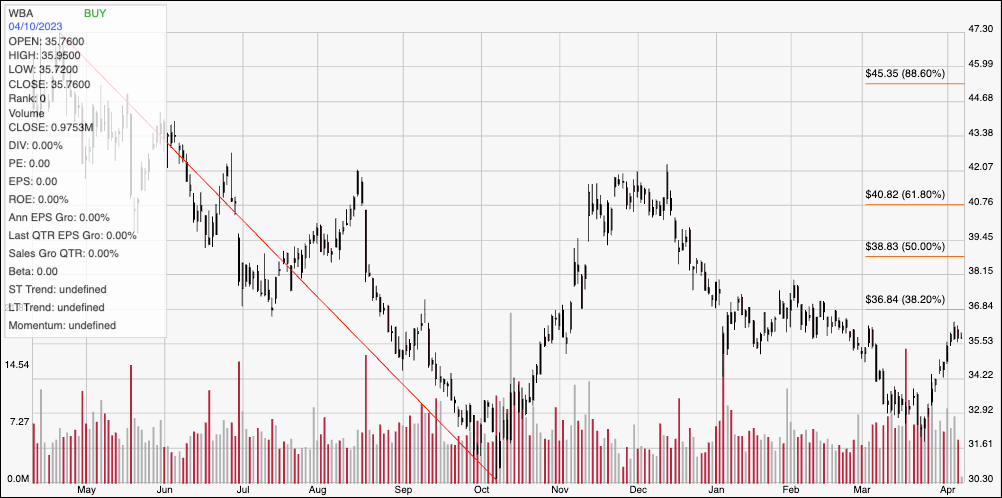

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The diagonal red line traces the stock’s downward trend from a high in April of last year at around $47 to its low, reached in October at around $30. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rallying to a December peak at around $42, the stock dropped back again, finding its last major low point at around $32 last month. Immediate resistance is around $37, where the 38.2% retracement should provide next resistance, with current support at around $35. A push above $37 should see near-term upside to about $41 where the 61.8% retracement line waits, while a drop below $35 could see the stock fall to about $32 before finding next support, with a retest of October’s $30, multi-year low possible if selling activity accelerates.

Near-term Keys: While WBA’s fundamentals are generally healthy, I do think that the current declines in liquidity and Free Cash Flow are red flags that should give even aggressive growth investors pause. The stock’s value proposition in interesting, but not quite tempting, which I think also validates the idea of waiting for the next quarter or two to see if these elements, as well as Net Income, see improvement. If you prefer to focus on short-term trades, you could use a drop below $35 as a signal to consider shorting the stock or working with put options, with an eye on an initial profit target at around $32. If the stock pushes above $37, there could be an interesting signal to buy the stock or work with call options, using next resistance at $41 as a useful bullish profit target.