The start of 2023, in many ways has been an extension of fears and uncertainty that plagued the market for most of 2022.

The last year or so has shifted the narrative away from COVID and onto the reality of inflation, rising interest rates, and all of its normal effects. Issues that existed prior to the pandemic, like labor shortages, supply chain problems and the war in Ukraine have all compounded to push inflation indicators even higher and prompted the Fed to maintain a hawkish approach throughout the period. While some experts expect that the time may finally have arrived for the Fed to pause their rate increases, others are predicting that, at best the size of rate increases will begin to flatten, even as monetary policy remains largely hawkish for the foreseeable future.

The economic questions I’ve just described could put Specialty Retail industry in a dangerous spot, which is why it isn’t too surprising that a lot of well-known names in the industry are still significantly below their 2021 highs. That includes Best Buy Co (BBY). BBY resides in an already, intensely competitive landscape, but that has become more and more fierce under the weight of pressure from inroads made by Amazon (AMZN) in its digital and technology-centric offerings while still facing intense competition from big-box retailers like Walmart (WMT) and Target (TGT). That is a symptom of what has become a clear, long-term, “sea change” kind of shift by consumers away from traditional brick and mortar stores to online shopping alternatives.

BBY has been working hard to stay relevant amidst that change, and many of those changes are what has enabled the company to succeed over the last three years. This is a company with some interesting fundamental strengths including a very solid balance sheet and free cash flow, manageable debt and an attractive dividend. The stock dropped more than -50% from its November 2021 peak to an October 2022 low, and then rallied to a high to start February of this year at around $90 per share. Since then, the stock has dropped sharply, and appears to be consolidating in the low-$70 range. Does that consolidation represent an opportunity to get in at a good value price for long-term investors, or would it smarter to wait? Let’s find out.

Fundamental and Value Profile

Best Buy Co., Inc. is a provider of technology products, services and solutions. The Company offers products and services to the customers visiting its stores, engaging with Geek Squad agents, or using its Websites or mobile applications. It has operations in the United States, Canada and Mexico. The Company operates through two segments: Domestic and International. The Domestic segment consists of the operations in all states, districts and territories of the United States, under various brand names, including Best Buy, bestbuy.com, Best Buy Mobile, Best Buy Direct, Best Buy Express, Geek Squad, Magnolia Home Theater, and Pacific Kitchen and Home. The International segment consists of all operations in Canada and Mexico under the brand names, Best Buy, bestbuy.com.ca, bestbuy.com.mx, Best Buy Express, Best Buy Mobile and Geek Squad. As of December 31, 2016, the Company operated 1,200 large-format and 400 small-format stores throughout its Domestic and International segments. BBY’s market cap is $16 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -4.4%, while revenues also dropped by nearly -10%. In the last quarter, earnings were 89% higher while sales increased by about 39.2%. BBY operates with a very narrow, but stable margin profile. Over the last twelve months, Net Income was about 3.06% of Revenues, and improved slightly last quarter to 3.36%.

Free Cash Flow: BBY’s Free Cash Flow over the last twelve months was about $894 million. That translates to a modest Free Cash Flow Yield of 5.51%. The current number marks a drop from $1.2 billion in the last quarter, and $2.5 billion a little over a year ago.

Debt to Equity: the company’s debt to equity ratio is .42, a very low number that reflects the company’s biggest strength, which can be seen in its balance sheet. In the last quarter, management reported $1.87 billion in cash and liquid assets against about $1.16 billion in long-term debt. Cash has increased over the past year, from $640 million a year ago.

Dividend: BBY pays an annual dividend of $3.68 per share, which translates to an annual yield of about 5% at the stock’s current price. It’s worth noting that BBY has increased their dividend from $2.00 at the end of 2019, $2.10 in 2020, $2.80 in 2021, and $3.52 prior to the latest earnings announcement. The ability to raise its dividend is a notable sign of strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $62 per share. That suggests that BBY is overvalued, with -15% downside from their current price, and a useful discount price at around $50.

Technical Profile

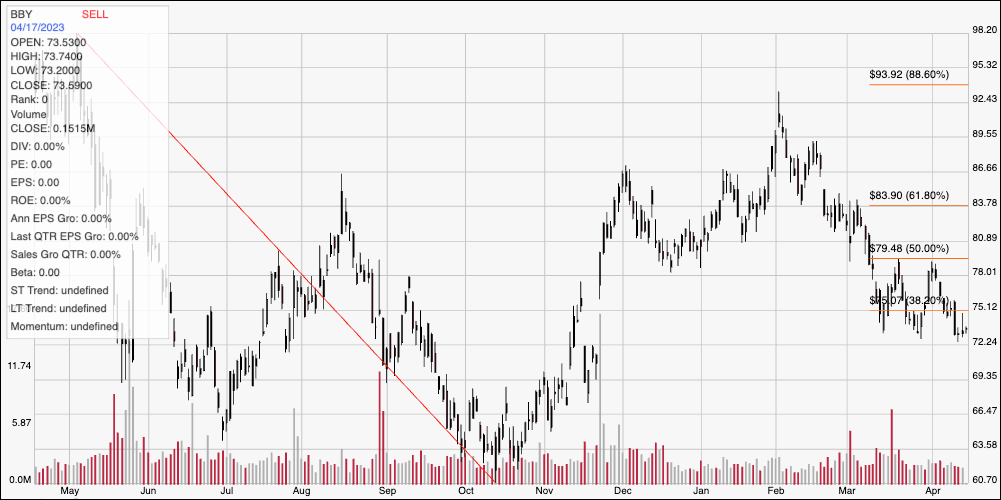

Here’s a look at the stock’s latest technical chart.

Current Price Action: This chart represents BBY’s price activity over the past year. The red diagonal line traces the stock’s fall from its $98 high a year ago to its October 2022 low at around $61. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock rallied to a February peak at around $90, but has dropped back again to find its latest, current support level at around $73 per share, which is also right around the stock’s current trading price. Immediate resistance is at around $75 where the 38.2% retracement line sits. A push above $75 should see short-term upside to about $79.50, where the 50% retracement acted as strong resistance in March and at the beginning of this month. A drop below $73 could see the stock drop to around $69 before finding next support, based on pivot activity in that range in November, October, September, and June of last year.

Near-term Keys: If you’re looking for a value-based, long-term investment, BBY has some useful fundamental strengths, but lacks the value proposition to make me want to take it seriously as a good bargain opportunity right now. The stock would need to drop to around $50 before a stronger value-based argument can be made. If you’re looking for a short-term opportunity, however, there are a couple of signal points that could be useful. A push above resistance at $75 could act as a good signal to consider buying the stock or working with call options, with a short-term, momentum-based target price at around $79.50 per share. If the stock drops below current support at $73, you could also think about shorting the stock or buying put options, with an eye on $69 as a useful profit target on a bearish trade.