Every year, threads emerge that can be used to tell the story of the U.S. economy, and therefore the financial markets.

For me, one of the most interesting and consistent threads is the movement and pace of energy prices. West Texas Intermediate (WTI) crude, which acts as the benchmark for oil produced throughout North America started 2022 a little below $70 per barrel, and by early March hit a peak at around $130 per barrel. Prices dropped significantly below that peak, and have been hovering for most of the last four months between $75 and $80. Market and economic activity for most of the year has kept pressure on this commodity, with is currently a little above $71 per barrel.

In the Energy sector, there are a lot of different industries to think about, with a wide range of business types related to it. It’s easy to correlate Energy to crude oil, because that is the single commodity that most of the companies in the sector are tied to in one way or another; but there are a lot of other product types that make up a significant part of this sector. One of those is natural gas liquids (NGL), which like crude itself have uses in a number of other segments of the economy such as petrochemicals, home heating, cooking and refrigeration, synthetic rubber for tires, vehicle fuel blends and more.

Natural gas and NGL’s have their own place in the current economic and geopolitical climate. Russia is the world’s leading producer and exporter of natural gas and has used its dependence on that commodity as a justification for its aggression, since a major portion of the pipelines that facilitate export of its natural gas to the rest of Europe run through Ukraine, and therefore have historically made the two countries reluctant but necessary partners. No matter your view of events unfolding in that part of the world, there is no question that the longer the conflict continues, the greater the impact it will continue to have on worldwide energy supply and therefore is likely to keep energy prices elevated. That also means that for North America as well as every other part of the Western world, other sources for natural gas will come at a premium.

NGLs are an area that has experienced a growing level of exploration and production in the U.S., which means that companies that operate in this segment of the Energy sector, along with standard crude operations, have a useful second business leg to work from, and that I expect to provide a significant tailwind for the foreseeable future. Economic activity in the U.S. so far remains generally healthy, which along with the global pressures mentioned above means energy demand should is also expected to stay elevated for natural gas and NGLs. Many of the most interesting companies in this sector that have found a way to navigate difficult conditions of the last two years did so in part by figuring out how to operate successfully even amid depressed commodity prices, which means that healthy demand should boost these company’s profitability and long-term results even more.

Energy Transfer LP (ET) is a mid-cap company in the oil, gas & consumable fuels industry that focuses a primary portion of its business in natural gas assets, including storage facilities and transportation assets. This is a company whose balance sheet has been among the most healthy in its industry, even during the pandemic. From a low at around $9 in July of 2022, the stock pushed to a peak to start 2023 at around $14 per share. Over the last few months, the stock has settled into a narrow consolidation range between $12 and $13 per share. The question, of course is whether the company’s fundamental strengths also support the notion that the price should be higher. Is there a good value–driven opportunity to be had? Let’s find out.

Fundamental and Value Profile

Energy Transfer LP owns and operates a portfolio of energy assets. The Company’s operations include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (NGL) and refined product transportation and terminalling assets; NGL fractionation; and various acquisition and marketing assets. Its segments include intrastate transportation and storage, interstate transportation and storage, midstream, NGL and refined products transportation and services, crude oil transportation and services, investment in Sunoco LP, investment in USAC, and all other. Through its intrastate transportation and storage segment, the Company owns and operates natural gas transportation pipelines and three natural gas storage facilities located in the state of Texas. Its intrastate transportation and storage segment focus on the transportation of natural gas to markets from various prolific natural gas producing areas. ET has a current market cap of $40.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were -13.5% lower, while sales declined by -7.3%. In the last quarter, earnings decreased by about -5.6% while sales were -7.35% lower. The company’s margin profile over the last twelve months showed Net Income was 4.72% of Revenues, and strengthened to 5.28% in the last quarter.

Free Cash Flow: ET’s Free Cash Flow is very healthy; over the last twelve months, this number was a little over $6.5 billion versus $5.6 billion in the quarter prior, and about $5.8 billion a year ago. The current number translates to a very healthy Free Cash Flow yield of 16.47%.

Debt to Equity: ET has a debt/equity ratio of 1.39, which is generally higher than I prefer to see, but which is also not unusual for stocks in this industry. As of the last quarter, cash and liquid assets were $330 million versus $47.2 billion in long-term debt. Liquidity from cash and liquid assets has decreased significantly, from about $1.1 billion a little over year ago. The company’s operating profile and free cash flow, however are good indicators that debt service isn’t a problem.

Dividend: ET pays an annual dividend of $1.23 per share, which at its current price translates to a dividend yield of about 9.59%. While that is incredibly attractive, it is also much higher (nearly 1:1 compared to the company’s trailing twelve-month earnings per share of $1.35) than I normally consider to be sustainable. I prefer to see dividend payout ratios of around 50% under typical circumstances.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $13.50 per share, which suggests that ET is only slightly undervalued, with 5.3% upside from its current price, and a useful discount a little below $11.

Technical Profile

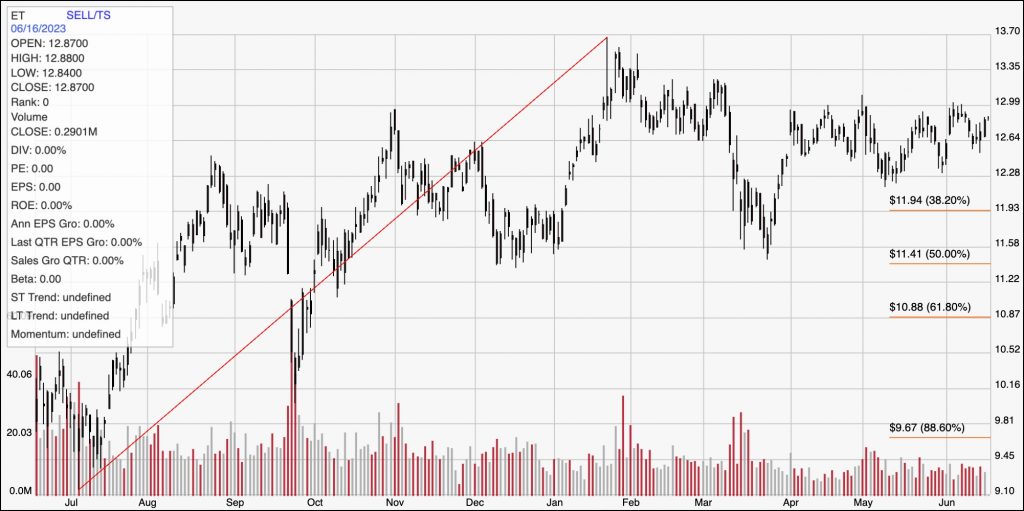

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for ET. The red diagonal line traces the stock’s upward trend from its July 2022 low at around $9 to its high reached in January at around $14; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Since April, the stock has been hovering in a narrow trading range, with current support sitting at around $12.30 per share, and immediate resistance at about $13. A push above $13 should give the stock room to test its 52-week high at around $14, while a drop below $12.30 should have limited downside, with next support sitting right around $12, about where the 38.2% retracement line sits.

Near-term Keys: ET’s healthy Free Cash Flow over the last year, along with a very attractive dividend payout is a strong sign of the company’s fundamental strength. That said, limited liquidity is a concern, as well as the sustainability of the stock’s very high dividend. All of those elements together add to the reality that the stock doesn’t offer a useful value at its current price levels. If you prefer to focus on short-term trading strategies, you could a push above $13 to consider buying the stock or working with call options, using $14 as a practical near-term bullish target price. There is limited downside on a bearish trade right now, with very limited downside to expected next support levels, which makes looking for a bearish trade involving shorting the stock or buying put options a very low probability prospect.