HubSpot Inc. is a leading provider of cloud-based customer relationship management (CRM) software. The company offers a comprehensive suite of software solutions designed to assist businesses in attracting visitors, converting leads, and closing customers. HubSpot’s offerings encompass various aspects of marketing, sales, customer service, and content management, aiming to provide an all-in-one platform that helps businesses grow by creating meaningful connections with their customers.

Company Overview

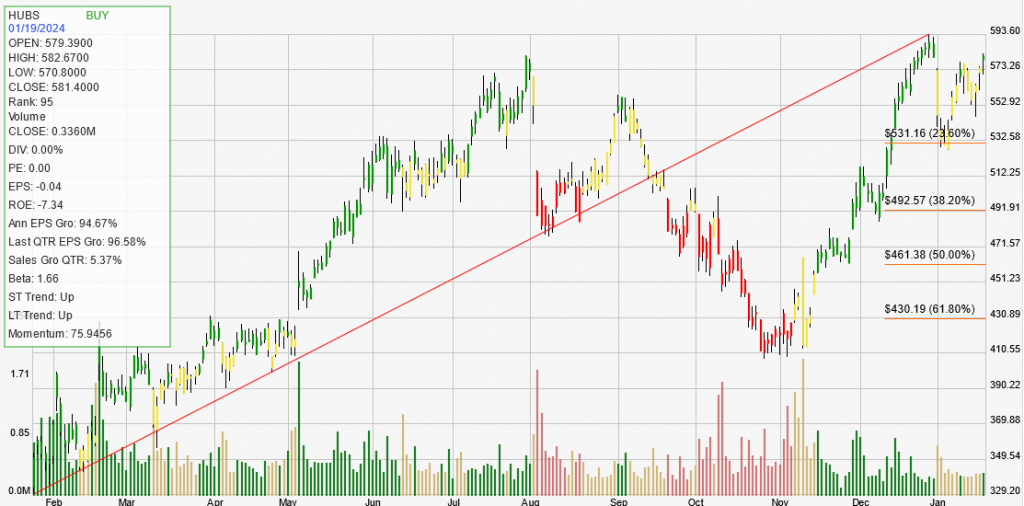

HubSpot Inc. has demonstrated strong performance trends, both in the short term and long term, with upward movements indicating a robust and growing business. Despite its negative return on equity (ROE) of -7.34%, which typically raises concerns about financial efficiency, HubSpot has shown impressive growth in earnings per share (EPS), with annual EPS growth at 94.67% and quarterly EPS growth at 96.58%. This level of earnings growth is significantly higher than the benchmark of 20% for companies likely to become leaders in uptrending markets, suggesting that HubSpot has a potent growth trajectory.

The company’s quarterly sales growth of 5.37% might seem modest compared to its explosive EPS growth. However, this sales growth indicates a healthy increase in revenue, which, when coupled with extraordinary EPS growth, suggests effective management and operational efficiency. Moreover, HubSpot’s market capitalization of $28 billion, along with its trading volume, underlines its significant presence and investor interest in the market.

Investment Highlights

Exceptional Earnings Growth: The standout feature of HubSpot is its earnings growth. The company’s annual EPS growth rate of 94.67% and quarterly EPS growth of 96.58% are indicators of its potential to outperform the market significantly. This level of growth, especially in earnings, is a key driver of stock price appreciation and investor returns.

Strong Market Position: With a strength rank of 95, HubSpot outperforms 95% of its peers, highlighting its competitive advantage and strong market position. This ranking reflects investor confidence and HubSpot’s ability to capitalize on market opportunities better than the vast majority of its competitors.

Positive Trading Signal and Trends: The BUY signal, coupled with upward short-term and long-term trends, suggests that HubSpot’s stock is advancing in its price trend and may continue to do so. This momentum is crucial for investors looking for growth stocks with the potential for significant price appreciation.

Backtesting Results: HubSpot’s backtesting data reveals a high winning percentage of 66.67% with an average profit on winners of 32.73% compared to an average loss on losers of 13.15%. This favorable reward-to-risk ratio and an annual trade expectancy of 52.31% further underscore the stock’s attractive investment profile.

Conclusion

Despite a negative ROE, which could be a point of concern for some investors, HubSpot Inc.’s significant annual and quarterly EPS growth, strong market ranking, and positive momentum indicators present a compelling case for its consideration as an investment. The company’s ability to generate substantial earnings growth, outperform a majority of its peers, and maintain positive market trends makes it an interesting opportunity for investors seeking growth in the technology sector. The data suggests that HubSpot is well-positioned for future growth, making it a potentially lucrative investment.