Mr. Cooper Group Inc. (COOP) is a mortgage loan servicer and originator based in the United States. The company operates primarily through its flagship brand, Mr. Cooper, and is focused on delivering a variety of mortgage-related services. Its core activities include servicing existing mortgage loans, originating new mortgage loans, and offering refinancing options to homeowners. The company aims to provide exceptional customer service and support throughout the entire life cycle of a mortgage, from origination and financing to servicing and eventual payoff. https://www.mrcoopergroup.com/

Mr. Cooper Group Inc.’s services are designed to help homeowners manage their home loans more effectively, whether they’re looking to buy a home, refinance their existing mortgage, or need assistance with loan servicing and payment options. The company’s mission revolves around keeping the dream of homeownership alive for its customers by offering innovative solutions, personalized service, and a commitment to customer satisfaction.

The finance and consumer loans industry, where Mr. Cooper Group Inc. operates, is highly competitive and regulated. Companies in this sector must navigate a complex landscape of federal and state regulations while striving to meet the evolving needs of homeowners and borrowers. Mr. Cooper Group Inc. leverages technology and a customer-centric approach to differentiate itself in the market and provide value to its clients and stakeholders.

The summary for Mr.Cooper Group Inc (COOP) is as follows:

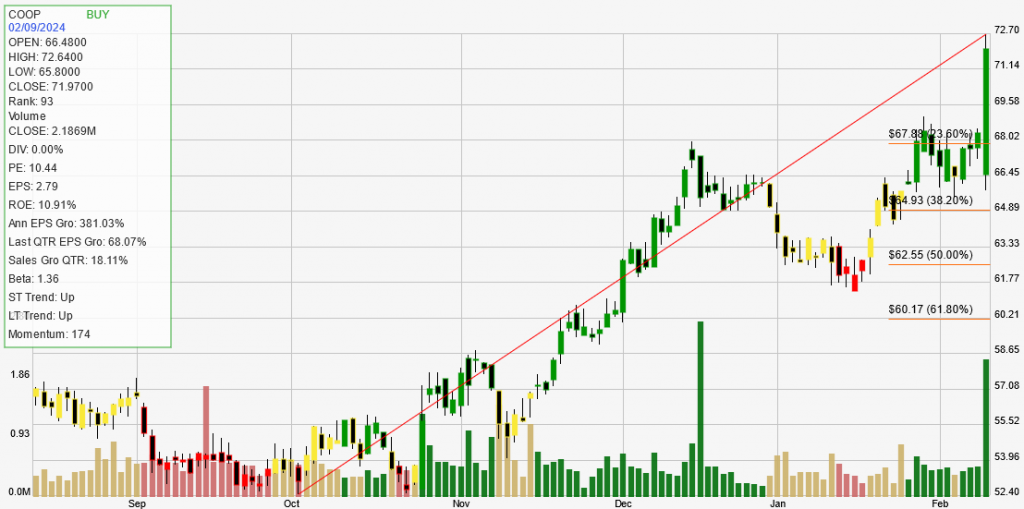

- Stock Performance: Mr.Cooper Group Inc has seen a significant uptrend with a current price of $71.97, marking a 5.42% increase in a day, a 6.48% increase over the week, a 14.88% increase over the month, a 57.17% increase over the year, and a 10.52% increase year-to-date.

- Market Analysis: The stock is currently rated as a BUY with both short-term and long-term trends being UP, indicating strong performance in recent times and a positive outlook.

- Strength Rank: With a strength rank of 93, COOP is outperforming 93% of its peers, suggesting strong momentum.

- Financial Metrics: The company boasts a PE ratio of 10.44, EPS of 2.79, a return on equity (ROE) of 10.91%, and a market cap of $4 billion. It has no dividend yield (DIV%: 0.00).

- Growth Indicators: Annual EPS growth is extraordinarily high at 381.03%, with the last quarter’s EPS growth at 68.07% and sales growth for the same period at 18.11%.

- Volatility and Trading Stats: COOP has a beta of 1.36, indicating higher volatility than the market. The stock’s historical trading data reveals an average profit on winning trades of 14.68%, an average loss on losing trades of 6.96%, with a winning percentage of 60%.

- Backtesting Results: Backtesting shows an average trade expectancy of 6.03%, with an annual trade expectancy of 24.11%. The average days in a trade were 64, with the average days between trades being 26.

In summary, Mr.Cooper Group Inc exhibits strong upward momentum in both short-term and long-term trends, significant outperformance compared to peers, robust financial efficiency, and notable growth in earnings. The backtesting results provide a positive outlook on the stock’s trading characteristics, although it’s important to note that past performance is not always indicative of future results.