Uranium Energy Corp. (UEC) is a prominent player in the energy sector, primarily focused on the exploration, mining, and processing of uranium. With a well-established presence in key regions like the United States and Paraguay, UEC is strategically positioned to capitalize on the increasing demand for uranium, driven by the global shift towards clean and sustainable energy sources. The company’s core operations involve the production of uranium oxide, which is a crucial component for nuclear power generation. UEC’s expertise in in-situ recovery (ISR) mining, a method that is both cost-effective and environmentally friendly, sets it apart in the industry.

UEC’s key products and services include the sale of uranium concentrates, also known as yellowcake, which is sold to utility companies for use in nuclear reactors. The company also provides exploration and development services, leveraging its extensive database and cutting-edge technology to identify and develop new uranium resources. UEC’s diverse portfolio of assets includes fully permitted projects and significant mineral resources, ensuring a steady pipeline of production capacity.

One of the most exciting growth opportunities for UEC lies in its recent acquisitions and strategic partnerships. The company has been actively expanding its footprint through the acquisition of additional uranium projects, which are expected to significantly boost its production capabilities. Additionally, UEC’s focus on maintaining a strong balance sheet and operational efficiency positions it well to take advantage of the rising uranium prices and the increasing demand for clean energy.

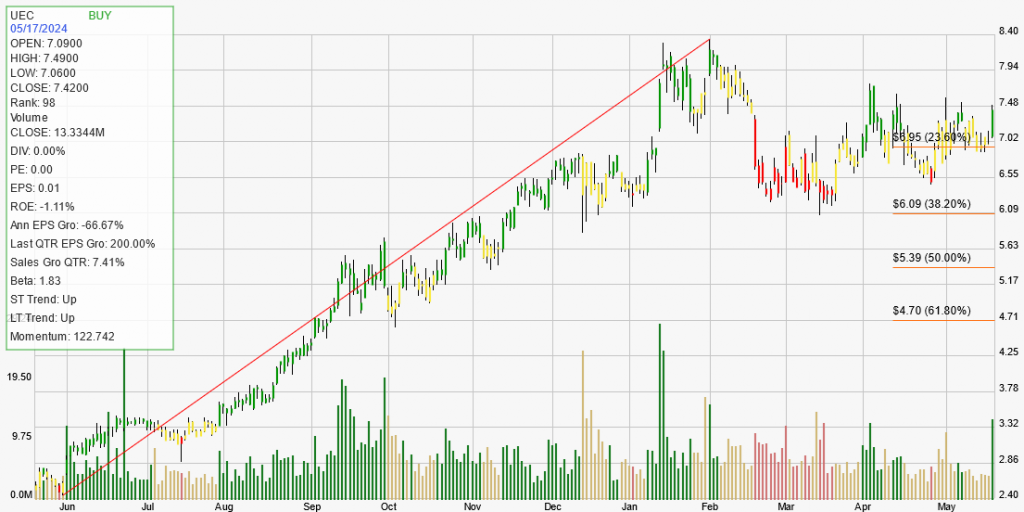

Currently, UEC’s stock is in a bullish momentum location, within the buy zone. This favorable position is further supported by a new buy signal, indicating a shift from hold to buy. This momentum suggests strong investor confidence and potential for future growth, making it an attractive investment option for those looking to capitalize on the expanding uranium market.