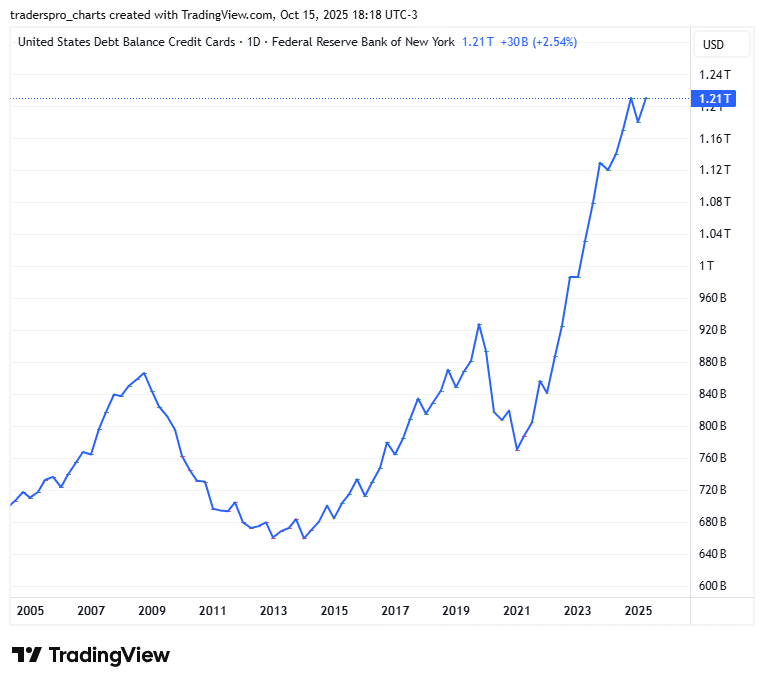

The chart tells a story most headlines miss. Total U.S. credit card debt, measured by the Federal Reserve Bank of New York, and it just hit a new all-time high: $1.21 trillion as of October 2025.

That’s more than at any point in history — higher than before the 2008 crisis, higher than the pre-COVID boom, and still rising fast. Credit card debt is one of the clearest measures of how everyday Americans are managing — or struggling — to balance their budgets. And right now, it shows households under pressure.

A brief history of the cycle

Pre-2008:

Credit card debt ballooned during the housing bubble, topping out near $930 billion before the financial crisis forced consumers to deleverage.

2009–2013:

The Great Recession brought a sharp pullback. Banks cut credit lines, consumers tightened spending, and balances dropped around 20%.

2014–2019:

Easy money returned. Low rates, steady wages, and confidence pushed balances steadily higher again.

2020 (COVID shock):

A rare reset. Lockdowns limited spending, stimulus checks flowed, and card debt plunged as households paid down balances.

2021–2025:

Then came the snapback. As inflation soared and living costs outpaced income growth, Americans leaned on plastic to fill the gap. The steep rise in the chart since 2021 reflects that financial strain.

Why debt is breaking records when everything “looks fine”

Inflation outpaced incomes.

Prices for food, housing, and essentials jumped roughly 20% since 2019. Wages rose too — just not enough. The gap between what people earn and what life costs has widened, and credit cards are the bridge.

Interest rates are punishing.

Average credit card APRs now exceed 22%, the highest in forty years. That means even if people aren’t spending more, their balances grow faster because of interest charges.

The savings cushion is gone.

Those pandemic-era savings and stimulus checks are long spent. Households that once had a buffer now rely on revolving credit to get through the month.

Lifestyle lag.

People are slow to cut back on the lifestyle they built during the cheap-money years. Rather than downshift overnight, they borrow to maintain “normal.”

Uneven prosperity.

Yes, the market’s strong and home values are high — but that wealth isn’t evenly distributed. The top 20% may be thriving, but the median family is still fighting rising bills and higher debt service.

Why it matters

Credit card debt is the most expensive form of borrowing — variable, unsecured, and directly tied to Federal Reserve policy. When it surges during what’s supposed to be a strong economy, it’s not a sign of confidence. It’s a warning.

Consumers are running hot just to stay even. Historically, that combination — record debt plus low consumer confidence — has often preceded slowdowns in discretionary spending and upticks in loan delinquencies.

The economy doesn’t break when people run out of cash. It does when they run out of credit.

Trade Of The Day

The stock trade of the day provides you a leading stock that is trending in the current market environment.

[Get The Trade]

Market Trends

Understanding the overall market trend is the foundation of smart trading. Why? Because 85% of all stocks tend to move in the same direction as the broader market.

[Get the Report]

GET OUR FREE DAILY STOCK PICK NEWSLETTER