Through a big portion of 2020, one of the areas that I was able to find some interesting valuations to work with was in the Telecommunications industry. Some of the largest players in the industry do much more than just telecommunications. For example, AT&T Inc. (T) has, of course long been one of the largest telecommunications companies in the United States, which has also given them the ability to branch out and diversify their business into the entertainment world. To say that 2020 was a challenging year for many of this “diversified telecomm services” company’s businesses is an understatement that helped to keep the stock price relatively low throughout 2020.

In 2015, the company acquired DirecTV, a segment that has struggled for the last couple of years, following a longer-term theme as consumers are increasingly “cutting the cord” on traditional cable or satellite TV services. T has been looking to sell DirecTV, along with other underperforming segments to private equity investors, but would be unlikely to recoup the $49 billion it paid (latest estimates put final expected bids from unnamed, interested parties in the $15 billion range). In 2018, T’s acquisition of Time Warner gave it a foothold in the same space occupied by media companies like Viacom and Disney. The onset of the global pandemic meant shutting down the entire WarnerMedia unit and heavy capital spending to protect employees, plus the launch of its own streaming service, HBO Max to compete with Netlflix, Disney+, and Amazon Prime; its results have mostly been mixed even as WarnerMedia made waves at the end of 2020 by announcing its plan to release new movie titles on HBO Max at the same time it makes them available in theaters.

Even with those headwinds, however, there are also some interesting strengths to consider, including a balance sheet that has remained relatively strong throughout the year even in the midst of an almost complete shutdown of the WarnerMedia unit during the initial outbreak. Late in 2020, rumors emerged that T was considering a sale of its Warner Bros. Interactive Entertainment gaming division, a transaction that could bring in $4 billion to help the company pay off new debt the company took on in the wake of COVID-19 to cover the WarnerMedia shutdown and protect its employees. In the last quarter, the segment even started to show some signs of recovery, helped in big measure by the return of college basketball and the NCAA tournament last month.

T is an interesting mix of opportunity and risk right now; as consumer activity begins to resume some semblance of “normal” as the pandemic is expected to continue to fade in the U.S., T should be well-positioned, with a healthy stable of new movie and television releases that can drive interest from the WarnerMedia segment, a strong focus on its telecommunications roots through its heavy investments in 5G infrastructure and connectivity, still healthy Free Cash Flow and a dividend that is well above the S&P 500 average. Are those strengths enough to offset concerns from deteriorating Net Income, narrowing liquidity and increasingly heavy debt, and just as importantly, what does the stock’s current price say about the long-term opportunity for investors?

Fundamental and Value Profile

AT&T Inc. is a holding company. The Company is a provider of telecommunications, media and technology services globally. The Company operates through four segments: Communication segment, WarnerMedia segment, Latin America segment and Xandr segment. The Communications segment provides wireless and wireline telecom, video and broadband services to consumers.The business units of the Communication segment includes Mobility, Entertainment Group and Business Wireline. The WarnerMedia segment develops, produces and distributes feature films, television, gaming and other content over various physical and digital formats. The business units of the WarnerMedia segment includes Turner, Home Box Office and Warner Bros. Latin America segment provides entertainment services in Latin America and wireless services in Mexico. Viro and Mexico are the business units of the Latin America segment. The Xandr segment provides advertising services. T has a current market cap of about $225.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 2.4%, while revenue declined about 2.7%. In the last quarter, earnings were 14.67% higher, while revenues were -3.83% lower. T operates with an operating profile that had been narrowing through most of 2020, but has dropped into negative territory in the last two quarters. Over the last twelve months, Net Income was -1.3% of Revenues, but improved to a little over 17% in the last quarter.

Free Cash Flow: T’s free cash flow is healthy, at more than $29.4 billion and translates to a useful Free Cash Flow Yield of 13.13%.

Dividend: T’s annual divided is $2.08 per share, which translates to a much larger-than-average yield of 6.62% at the stock’s current price.

Debt/Equity: T carries a Debt/Equity ratio of .88; that is generally considered a pretty conservative number, but it doesn’t really paint a complete picture. Their balance sheet shows a little over $9.7 billion in cash and liquid assets versus $160.7 billion in long-term debt. Much of that debt is associated with the Time Warner acquisition, and which is expected to be paid down in the long run; but being forced to shut down the WarnerMedia segment due to COVID-19-imposed restrictions in 2020 also forced the company to realize additional short-term costs of nearly $500 million.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little below $34 per share. That suggests that, the stock is only modestly undervalued right now, with about 7% upside from its current price. It is also worth noting that at the end of the second quarter of last year, my Fair Value target for T was closer to $40, but this number also increased from the quarter prior, when it was a little under $33.

Technical Profile

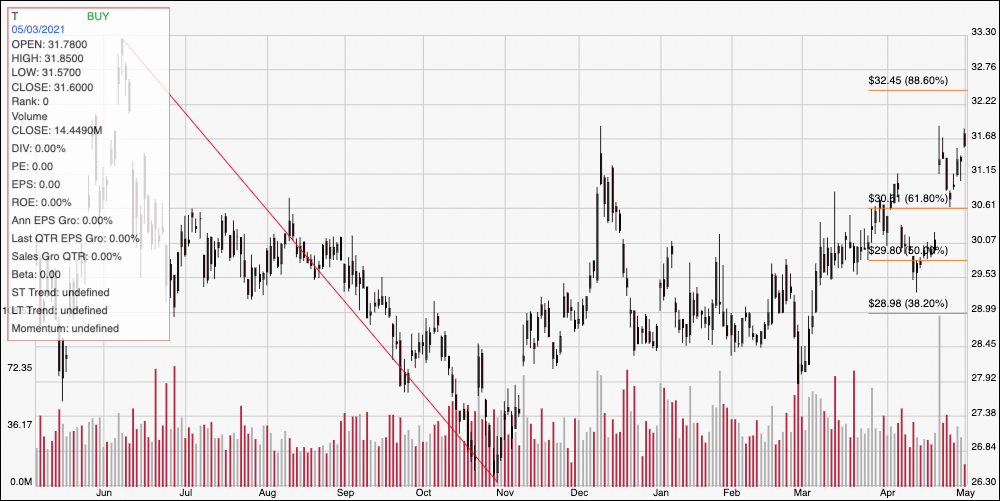

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward plunge from $33 in June to $26 in late October of last year; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock has moved into an intermediate-term upward trend from that point, picking up particular upward strength since March as it pushed from about $28 to its current price at around $31.50. The stock also seems to be pushing above resistance at around $31, with next expected resistance at around $33. Since previous resistance should become new support, that means the recent break puts current support between $31 and $30.50, where the 38.2% retracement line rests. A drop below that range should find next support between $29 and $28 per share.

Near-term Keys: T offers a high dividend that makes for tempting bait for income-seeking investors; the deterioration in Net Income over the last year is a concern, as is the company’s limited liquidity relative to its debt service. That said, the company’s improvement in Net Income in the last quarter looks like the company could be turning an important corner. The stock’s bargain price is at around $27 given its current fundamental data, which means that thinking about T as a good long-term bet seems risky right now. If you prefer to work with short-term trading strategies, you could use the current resistance break to think about buying the stock or working with call options, using the stock’s June peak at $33 as a useful bullish profit target. A drop back below $30.50 could provide a signal to think about shorting the stock or buying put options, using $28 as the profit target on a bearish trade.