When economists and market analysts look back at the last year and talk about the most impactful trends that emerged as a result of the COVID-19 pandemic, the conversation inevitably steers towards remote work. Corporations around the world were forced to adjust their operational models in rapid fashion, sending large numbers of their workers to work from home amid shelter-in-place orders and social distancing requirements and limitations on group gatherings, including business meetings and traditional office working settings.

The fact that this shift allowed many companies to keep things running successfully is a remarkable story in and of itself; but one of the questions now will be how much “stickiness” that trend will see as vaccinations increase, social restrictions ease and companies increasingly consider whether to bring remote workers back to the office. Many analysts are predicting that, while many companies are already beginning to bring workers back to the office, the remote work model will remain as a permanent part of corporate models – likely in some modified form from the past year, but permanent nonetheless. For businesses that enable this model via remote networking, web conferencing, and cloud-based computing, that is great news; for other companies that traditionally have relied on traditional office operations – like office equipment suppliers, for example – that stickiness represents an ongoing headwind.

Companies that provide equipment and services for in-office work, such as Canon Inc. (CAJ) have other operations in place alongside office and business services; however the extent that those other segments offset the challenges associated with this core segment have a lot to do with whether the company can withstand whatever the long-term effects of remote work on office demand may be.

CAJ is a company, based in Japan, that may best known to consumers for copiers, printers, and digital cameras, but that also has business operations tailored for medical systems and industrial equipment. In 2020, stable revenue in the Medical segment provided a backstop against declines in Office, Imaging and Industry, but analysts are predicting it will take until 2022 for product sales across all categories to recover to pre-pandemic levels.

The pandemic forced the stock from an early 2020 high around $28 to a low point in October at around $15. From that point, the stock rallied to a temporary, one-day peak last month at around $26 but has dropped back to a little above $22 as of this writing. Despite pandemic-drive effects, the company’s fundamental profile has remained healthy, and even gotten stronger, with increasing Free Cash Flow, excellent liquidity, and improving net margins in the last quarter. For a patient, long-term investor, does the stock’s current price, along with that fundamental strength, also translate to a useful value proposition? Let’s find out.

Fundamental and Value Profile

Canon Inc. is mainly engaged in the development, production, sale of office equipment, imaging systems, medical systems, industrial equipment and the provision of related services. The Company operates in four business segments. The Office segment provides office multifunction machines, laser multifunction machines, laser printers, digital continuous slip printers, digital cut sheet planters, wide format printers, and document solutions. The Imaging System segment’s products include lens-interchangeable digital cameras, compact digital cameras, digital video cameras, digital cinema cameras and others. The Industrial Equipment and Others segment provides semiconductor exposure devices, FPD exposure devices, vacuum thin film forming devices, organic EL display manufacturing devices, die bonders, micromotors, network cameras, handy terminals and others. The Medical System segment provides digital radiography, X-ray diagnostic equipment, ultrasound diagnostic equipment and others. CAJ’s market cap is $29.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by nearly 110.5%, while revenues rose by almost 11%. In the last quarter, earnings grew a little less than 227% while sales increased by more than 32.5%. The company’s margin profile is narrow, but still healthy and improving; over the last twelve months, Net Income was 2.65% of Revenues, and increased to 5.48% in the last quarter.

Free Cash Flow: CAJ’s free cash flow is a little more than $2.3 billion over the last twelve months. That number marks an improvement over the last year at $1.8 billion and translates to a Free Cash Flow Yield of 9.21%.

Debt to Equity: CAJ’s debt to equity is 0, reflecting the company’s very low level of long-term debt, which was less than $45 million in the last quarter. The company’s balance sheet also shows a little more than $4.5 billion in cash and liquid assets in the last quarter; this number is somewhat lower from its $4.6 billion level of a year ago, but also reflects the company’s excellent liquidity.

Dividend: CAJ’s annual divided is $.73 per share, which translates to a yield of about 3.12% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target for CAJ at around $26 per share. That suggests that at the stock’s current price, CAJ is undervalue by 11% from from its current price, with its actual bargain price at around $21.

Technical Profile

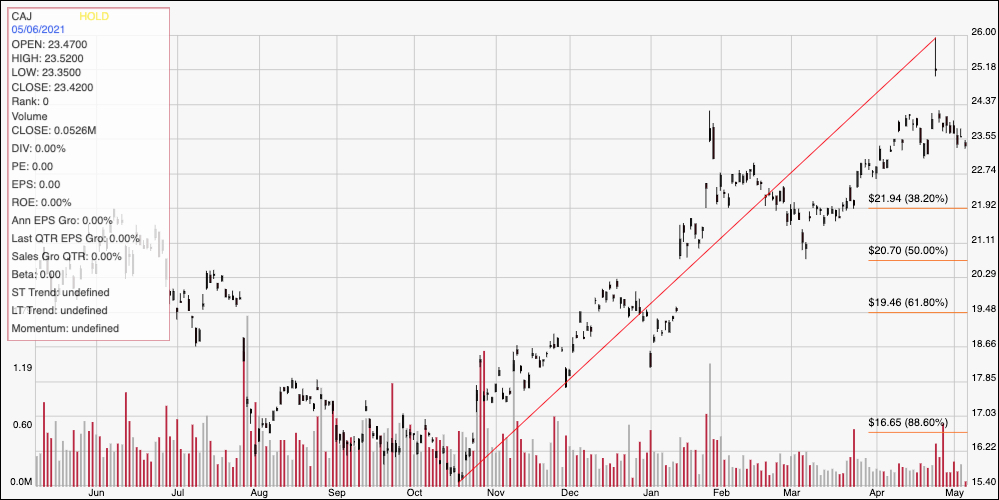

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend beginning in October at a low point around $15.50 to its peak in April at $26. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has faded back from that high point, but appears to be consolidating around support at about $23, with immediate resistance sitting at about $23. A push above $24 should have immediate upside to about $26. A drop below $23 has relatively limited downside, to about $22 to next support.

Near-term Keys: Looking only at the stock’s discount based on its valuation metrics means CAJ’s is undervalued, but not quite to compelling levels. The company’s fundamentals are solid, and getting stronger, but given expected pressure from the Office segment on operations, I would wait to see if the stock drops to a more useful valuation, perhaps at around $21 before taking it seriously as a long-term investing opportunity. That means the best probabilities with this stock come with short-term trades; you could use a break above $24 as a signal to buy the stock or work with call options, using a near-term price target at around $26 to take profits. The stock’s limited downside to next support actually means that a bearish trade, by shorting the stock or buying put options is an even lower-probability trade than normal.