Over the last couple of weeks, the market has been largely range-bound, with an increasing level of volatility that has been making stocks pretty choppy. I think the shift in the uncertainty of which that volatility is a reflection is interesting; the ongoing health crisis remains a part of it, but most of the commentary lately has moved into a focus on inflation as the economy continues to reopen, the availability of vaccines in the U.S. continues to expand to a larger set of the population and many traditional, social activities begin to resume in a way that suggests the long-awaited and anticipated “return to the old normal” is coming.

While I want to be hopeful, I think there is more than enough remaining risk that a cautious, conservative, and defensive approach continues to be practical. That’s why I believe the smart way to keep your money for you even as economic and social activity reopens and restrictions continue to be loosened is to be very selective about looking for growth opportunities and to focus on stocks that continue to offer good value. One area that has remained resilient throughout the past year and a half is the Food Products industry. Particularly over the last six months, stocks in this industry haven’t just kept pace with the market, but in many cases outperformed the sexier, growth-driven industries and names. Diving into the fundamentals of many of these companies show balance sheets that weathered the pandemic storm better than most other industries in 2020, and in a number of cases even managed to improve. That increasing fundamental strength has been a big driver in stock price performance, but even with significant moves higher, the fundamental strength has also grown enough to keep the value proposition attractive.

Tyson Foods Inc. (TSN), is a stock I’ve followed for some time. 2020 wasn’t good for the stock; from a January peak at around $94, the stock began a downward slide that only accelerated in March as the entire stock market moved into bear market territory. TSN did find a bottom at around $44 with the rest of the market, but managed to recover to an August 2020 peak at around $65 per share. After fading back to about $55 in early November, the stock started picking up bullish strength, moving into a new, intermediate upward trend that now has the stock a little above $80 and within shouting distance of its pre-pandemic highs in the $90 range.

The company has invested heavily over the past year and a half to address safety concerns, and that is something that in the early stage of the health crisis acted as a drag on the bottom line; but the company’s most recent earnings reports suggest not only that it continues to navigate those short-term, coronavirus-driven headwinds, but that it has benefited from increases in protein demand in the U.S. and overseas. An epidemic of African Swine Flu in 2018 ravaged the domestic hog population in China, the world’s largest pork producer and exporter, leaving a long-term protein shortage that is expected to continue for years to come, and puts U.S. protein producers like TSN in a position to benefit. Despite the stock’s impressive performance this year, there remains enough upside in its value proposition to make TSN a stock you should be paying attention to.

Fundamental and Value Profile

Tyson Foods, Inc. is a food company, which is engaged in offering chicken, beef and pork, as well as prepared foods. The Company offers food products under Tyson, Jimmy Dean, Hillshire Farm, Sara Lee, Ball Park, Wright, Aidells and State Fair brands. The Company operates through four segments: Chicken, Beef, Pork and Prepared Foods. It operates a vertically integrated chicken production process, which consists of breeding stock, contract growers, feed production, processing, further-processing, marketing and transportation of chicken and related allied products, including animal and pet food ingredients. Through its subsidiary, Cobb-Vantress, Inc. (Cobb), the Company is engaged in supplying poultry breeding stock across the world. It produces a range of fresh, frozen and refrigerated food products. Its products are marketed and sold by its sales staff to grocery retailers, grocery wholesalers, meat distributors, warehouse club stores and military commissaries, among others. TSN has a current market cap of $29.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 74%, while sales increased 3.78%. In the last quarter, earnings declined almost -31% while sales were a little more than 8% higher. TSN operates with a modest margin profile; in the last twelve months, Net Income was 4.94% of Revenues, and which weakened slightly to 4.21% in the last quarter.

Free Cash Flow: TSN’s Free Cash Flow is healthy, at a little more than $2.8 billion. That number has increased from about $1.6 billion at the beginning of 2020, but dipped from about $3.2 billion in the last quarter. Its current level translates to a useful Free Cash Flow yield of 9.62%.

Debt to Equity: TSN has a debt/equity ratio of .61, which is pretty conservative. Cash and liquid assets increased were about $437 million at the end of 2019 to $2.4 billion at the end of 2020, but dropped to $877 million in the most recent quarter. TSN carries about $9.7 billion in long-term debt. For now, there should be no problem servicing debt, however a decline in Net Income could erode liquidity fairly quickly given the high debt level.

Dividend: TSN increased its annual dividend from $1.68 per share to $1.78 per share in 2020, which at its current price translates to a dividend yield of 2.21%. TSN’s dividend has also increased from $1.20 per share in late 2018, and $1.52 at the end of 2019. The fact that management not only maintained the higher dividend, but increased it during the pandemic despite the early challenges it had to deal with in adjusting to pandemic-driven operating conditions is noteworthy since so many other companies have been reducing or suspending their dividends.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $93.26 per share. That means that even with the stock’s sizable increase this year, it still overs an interesting, if not quite compelling bargain proposition, with 16% upside from its current price.

Technical Profile

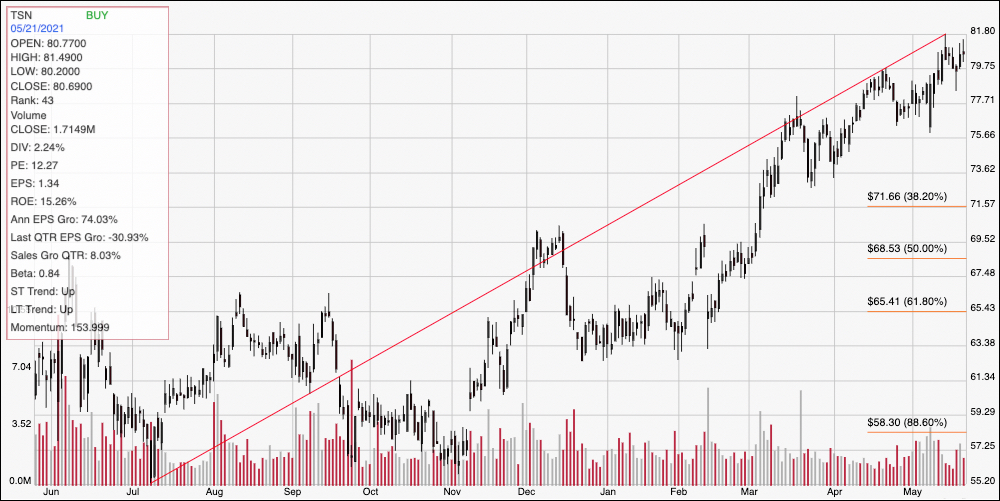

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line outlines the stock’s upward trend from July of last year beginning at around $55 and tracing to the current high at around $82. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The upward trend picked up bullish momentum beginning in February of this year, pushing above $65 and pushing to consistent new highs. Current resistance is at $82, with the stock looking set to push above that point, and current support at around $80. That means that a push above $82 should find next resistance at around $84, with additional upside to about $87 if bullish momentum persists. A drop below $80 should find next support at around $77, with $75 acting as secondary support.

Near-term Keys: TSN’s value proposition has remained attractive for the last few months, with improving fundamentals that I think make it hard to ignore as a good long-term investment. I also think that global conditions, not merely related to coronavirus, but also to protein shortages around the world from African Swine Flu will generally continue to work in TSN’s favor. If you prefer to work with short-term term trading strategies, you could also use a push above $82 as a signal to buy the stock or work with call options, with a useful profit target between $84 and $87. A drop below $80 could offer a signal to consider shorting the stock or buying put options, with $77 to $75 offering a useful profit target on a bearish trade.