It’s always interesting to watch the way market sentiment and investor attention shifts over time. Over the last year and a half, COVID and the continuing pandemic has naturally dominated the news cycle. There are segments of the economy that demonstrated a remarkable ability to pivot and adjust to the “new normal” the pandemic imposed and that, even as economic activity begins to pick up, is likely to see some level of permanency. Corporate America’s ability to pivot quickly and adapt rapidly to keep business going is one of the reasons that the market rebounded strongly from its initial drop to bear market levels in March of last year to sour well past pre-pandemic highs.

Increased vaccinations, declining infection and hospitalization rates have prompted state and local governments across the U.S. to begin lifting social restrictions, with the latest reports out of the Memorial Day holiday showing lots of pent-up demand for travel and leisure activities that had been looking for an inevitable outlet. Market commentary is beginning to shift to recovery considerations, which includes conversations about the pace of inflation, to what extent the Fed will continue to maintain an accommodative monetary policy. Unemployment numbers continue to drop, which offers additional hope that businesses are beginning to resume business in at least some form of the pre-pandemic “old normal”. It also shifts a lot of focus back to the political theater, and whether political agendas will continue to keep economic growth or potentially stifle it.

Normally, political concerns have relatively minimal effect on market movements, at least in the near-term. Political policy can certainly impact economic activity, but those impacts are generally seen over longer periods of time, which means that they are also usually manifest in the ebb and flow of economic growth or weakness that generally impacts long-term market trends. That said, the markets generally don’t like to be forced to deal with change; the initial surge of coronavirus, the immediate, sweeping restrictions it imposed, and the crushing blow those dealt to several industries and sectors at the beginning of 2020, with the resulting plunge in one month are good examples of the market’s reaction to sudden changes. Even more to the point as it relates to current events, the market abhors uncertainty even more than it does change, because that has the potential to impact the normal operation of business on a longer-term basis.

As an analyst, I make an effort to be politically agnostic – neither for one side or the other. Instead, I try to look at the potential economic impact of political programs. While the Biden administration’s hands-on approach to working through the pandemic appears to have helped the country finally begin to move into a social and economic recovery stage, the next chapter of his administration’s agenda begs questions about whether it will help or hinder continued economic progress. Congress is again gridlocked on the administration’s infrastructure proposal, which would add about $2 trillion more of federal spending to a balance sheet that ballooned throughout the pandemic through the passage of three separate spending packages. Pushes for increasing the hourly minimum wage, rollbacks of Trump-era tax cuts and freezes on oil production and pipeline infrastructure are just a few other items that the current administration is pushing hard for, and that are generally seen as the polar opposite of the mostly market-friendly policies of his predecessor.

My purpose in this space is not to argue for one side of the political debate over another, but to point out elements that I think could impact market activity in both the near tern and over time. The fact is that the divisiveness that market the last election hasn’t really tapered much, and can be seen in the way that Republicans are digging their heels in against Democratic proposals. That adds to economic uncertainty, which is something to which the markets tend to respond negatively. All of these elements present risks that I think beg the question of how much investors should be looking for conservative, defensive ways to put your money to work.

One of the ways that a lot of people like to get defensive – to find useful “safe haven” investments – is to work with precious metals like gold and silver. Working with the commodities themselves can be a good way to directly hedge against broad market risk. The Fed’s continued accommodative stance towards interest rates, which they have continued to affirm they will keep in place for as long as necessary to shepherd the economic beyond the health crisis and into a clear pattern of growth, should be a net positive for metals like gold, which usually respond bullishly to low interest rates.

If you don’t want to work directly with the commodity itself, another alternative is to invest in the companies that mine, process, and produce it. Barrick Gold Corp (GOLD) is one of the largest gold miners in the world, with operations in Canada, the United States, Central and South America, and Australia. The initial surge in the pandemic in 2020 saw the stock make a big move, from a low around $12.50 to a 52-week high at around $31 in August. From that point the stock dropped back, in my belief on the expectation that economic activity would continue to improve, and that the health crisis may have seen its worst. The stock dropped all the way to a low point at around $18.50 in March of this year before starting a new upward trend that peaked last month above $25 and has seen the stock fall back since to a little under $24. Does that mean that GOLD is a company that could act as a good, defensively positioned proxy? Let’s dig in and find out.

Fundamental and Value Profile

Barrick Gold Corp is a gold mining company. The Company is principally engaged in the production and sale of gold and copper, as well as related activities, such as exploration and mine development. The Company’s segments, include Barrick Nevada, Golden Sunlight, Hemlo, Jabal Sayid, Kalgoorlie, Lagunas Norte, Lumwana, Porgera, Pueblo Viejo, Turquoise Ridge, Veladero and Zaldvar. Pueblo Viejo, Lagunas Norte, Veladero and Turquoise Ridge are its individual gold mines. The Company, through its subsidiary Acacia, owns gold mines and exploration properties in Africa. Its Porgera and Kalgoorlie are gold mines. Zaldivar and Lumwana are copper mines. The Pascua-Lama project is located on the border between Chile and Argentina. The Company owns a number of producing gold mines, which are located in Canada, the United States, Peru, Argentina, Australia and the Dominican Republic. GOLD has a current market cap of about $43 billion.

Earnings and Sales Growth: Over the last twelve months, earnings have increased by 81.25%, while revenues improved a little over 8.64%. In the last quarter, earnings declined by a little over -17%, while revenues slipped by almost -10%. The company’s margin profile is a sign of strength; over the last twelve months, Net Income was 19.19% of Revenues, and declined slightly to 18.2% in the last quarter.

Free Cash Flow: GOLD’s free cash flow is healthy at $3.7 billion over the last year, which is an impressive improvement from about $401 million at the beginning of 2019, $1.17 billion at the end of 2019, and $1.9 billion in June of last year. The current number translates to a useful Free Cash Flow Yield of 8.71%. This is a good indication of broad underlying fundamental strength.

Debt/Equity: The company’s Debt/Equity ratio is .16, reflecting a conservative approach to leverage. Their balance sheet, in fact is a point of strength, since cash and liquid assets have improved since the beginning of 2019 from $3.3 billion in December 2019 to $5.67 billion in the last quarter. This number also improved from $4.74 billion in the last quarter of 2020. Long-term debt currently stands at $5.1 billion, versus more than $12.5 billion in January of 2015 and $5.4 billion in the last quarter of 2020.

Dividend: GOLD’s annual divided is $.36 per share and translates to a yield of about 1.5% at the stock’s current price. The dividend has increased steadily on a quarter by quarter basis since 2019; at the beginning of that year, the dividend was $.16 per share, and $.28 per share at the beginning of 2020. The increase is a good sign that the company is focused not only on managing their business but also about finding constructive ways to return value to its shareholders.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $31 per share. That means the stock is nicely undervalued right now, with 28% upside from its current price.

Technical Profile

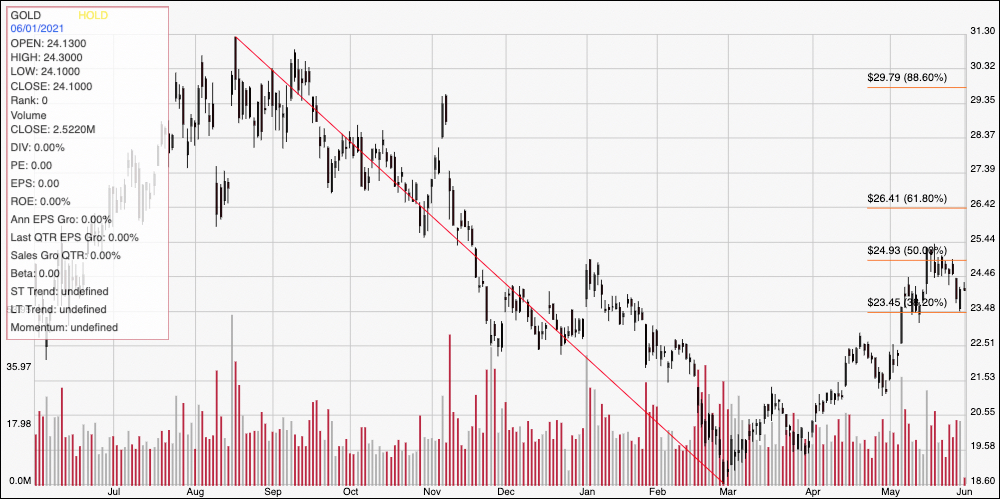

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last twelve months of price activity for GOLD. The red diagonal line traces the stock’s downward trend from its August 2020 peak at around $31 to its March low at around $18.50; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock has staged a useful upward trend from that low, pushing a bit above the 50% retracement at around $25 in May to mark immediate resistance, with support right around $23.50 where the 38.2% retracement line rests. A push above $25 should see the stock test next resistance around $26.50 where the 61.8% retracement line sits, while a drop below $23.50 should find next support between $22.50 and $22 based on pivot activity in January, February and April of this year.

Near-term Keys: GOLD’s fundamental strength and value proposition, along with current market conditions are elements that I think makes GOLD a hard stock to ignore. This could be especially useful as a hedge against broader market risk. If you prefer to work with short-term trades, a drop below $23.50 could offer an interesting opportunity to short the stock or to work with put options, with an eye on $22 as a useful, very short-term profit target. A push above $25 could be a very useful signal to think about buying the stock outright or to use call options to ride a short-term rally to about $26.50 per share as a bullish profit target.