As much as everybody is anxious to put the pandemic and COVID-19 concerns and commentary in the rear view, the practical reality is that the aftermath – which includes dealing with ongoing health concerns – will continue to extend through the rest of the year. In the United States, it’s tempting to say that the worst is over as economic activity is picking up again while social gathering restrictions ease and activities that consumers have not been able to enjoy for the past year and a half, the hard reality is that in many other parts of the world, managing the pandemic continues to be a struggle.

Along with increasing infection rates in areas like Japan, South Korea and Taiwan that last year were more successful at dealing with the initial outbreak than in the West, the rise of dangerous new variants in the coronavirus raise questions about the need for ongoing prevention measures. As long as a massive new infection wave from one or more of those variants isn’t seen, that isn’t likely to mean any kind of return to the kind of restricted activity we’ve seen over the past year or so; but it does mean that a single vaccination may not be sufficient to protect against the mutations of the virus.

I think the risk these variants continue to present means that research into the long-term efficacy of current vaccines will be an ongoing concern; it also means need for additional booster vaccines may be appropriate. For pharmaceutical companies like Pflizer Inc. (PFE), that means that their vaccines are likely to remain relevant not only in 2021 but also well into 2022 and possibly beyond. After accounting for an even split of those proceeds with its partner, PFE predicted their COVID vaccine – the first to be approved in the U.S. – would contribute $15 billion in sales for 2021 in their first quarter earnings report. In their most recent report, they raised that number to $26 billion, with some analysts predicting that it could be as high as $30 billion. Let’s also not forget that PFE has a robust pipeline of drugs in other important segments, including oncology that is expected to remain solid as growth in new, emerging drugs should offset declines in known names like Lyrica and Enbrel due to increasing generic competition for those older drugs.

As one of the leading pharmaceutical companies in the industry, PFE boasts a broad portfolio with eight separate drug brands that each account for more than $1 billion in annual sales, but none that contribute more than 11% of total revenue. They also have a large development pipeline, especially as previously observed in oncology drugs where most analysts see strong long-term growth that should offset the effect of increased competition in existing brands as patent protections expire and biosimilar and generic drugs start to take up market share.

After underperforming at the end of 2020 – the stock dropped from a 52-week high around $43 to a low in March of this year at around $33 – PFE has recovered nicely, peaking in May at around $40 to form a nice, new intermediate-term upward trend. In the last couple of weeks, the stock has faded back by about -10%, but appears to have found new support at which to consolidate around $36. Against the longer-term upward trend, that consolidation generally translates to a nice, new set up for short-term-oriented traders. What about the stock’s value?

Fundamental and Value Profile

Pfizer Inc. (Pfizer) is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). IH focuses on developing and commercializing medicines and vaccines, as well as products for consumer healthcare. IH therapeutic areas include internal medicine, vaccines, oncology, inflammation and immunology, rare diseases and consumer healthcare. EH includes legacy brands, branded generics, generic sterile injectable products, biosimilars and infusion systems. EH also includes a research and development (R&D) organization, as well as its contract manufacturing business. Its brands include Prevnar 13, Xeljanz, Eliquis, Lipitor, Celebrex, Pristiq and Viagra. PFE has a current market cap of $218.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 16.25%, while revenues rose a little over 21%. In the last quarter, earnings rose nearly 121.5% while sales were about 25% higher. The company’s margin profile isn’t just healthy, but robust and gaining strength; over the last twelve months, Net Income as a percentage of Revenues was 22.19%, and strengthened to nearly 33.5% in the last quarter.

Free Cash Flow: PFE’s free cash flow is healthy at $13.4 billion over the last twelve months. That also marks an improvement from $12.7 billion in mid-2020. The current number translates to a Free Cash Flow Yield of 6.22%.

Debt to Equity: PFE’s debt to equity is .51, which is a conservative number. The company’s balance sheet indicates operating profits should be adequate to service their debt for the time being; cash and liquid assets were about $13.6 billion in the last quarter versus almost $22 billion six months ago, while long-term debt was $35.3 billion in the last quarter – down from $49.7 billion at the beginning of the year. I don’t see this is a major red flag, given that the company has been directing a major portion of its focus to COVID-19 and to debt reduction. It is worth noting that the real profit opportunity in the vaccine isn’t in the initial implementation and distribution. Profitability is expected to come from the ongoing need for a renewed vaccine, in similar fashion to the yearly flu or pneumonia booster that doctors generally recommend for just about everybody. The need for regular booster shots are even more likely given the emergence of new strains of the virus.

Dividend: PFE’s annual divided is $1.56 per share, which translates to a yield of about 4% at the stock’s current price. It is also noteworthy that the dividend increased at the beginning of 2020 from $1.52 per share, which is a useful indication of management’s confidence in their approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $34 per share. That means that PFE is overvalued right now by about -12%, with its bargain price actually down at around $27 per share.

Technical Profile

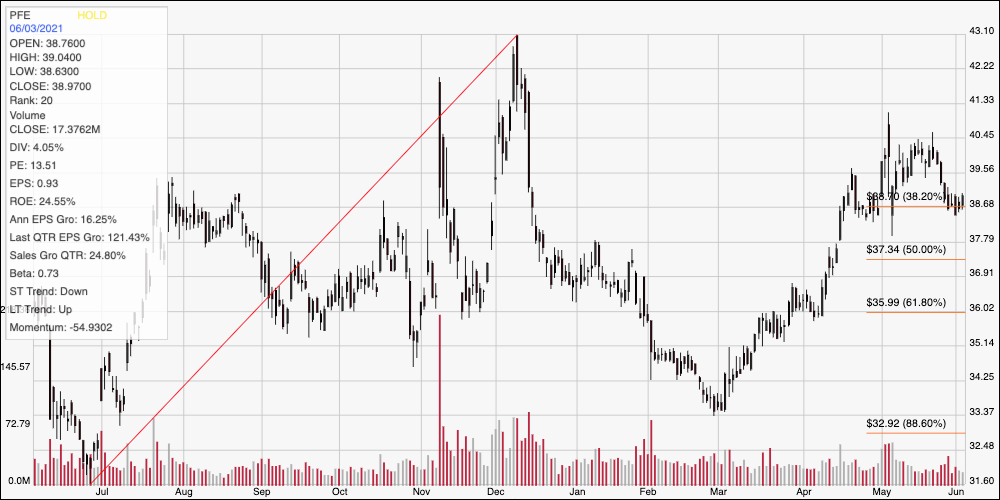

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend from a 52-week low at around $31.50 per share to its peak in December a little above $43. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After sliding back to about $33.50 in March, the stock started a strong, new upward trend that didn’t peak until late May at around $40.50 per share. The stock has since retraced off of that high point and now appears to be consolidating right around the 38.2% retracement line in the $38 price area, marking current support at that level, with immediate resistance back at the $40.50 peak. A drop below support should find next support at the 50% retracement line, around $37, with additional support at $36 offered by the 61.8% retracement line. A bounce off of current support should have at least $2.50 of immediate upside, with room to retest the stock’s December high at around $43 if bullish momentum picks up.

Near-term Keys: If you work off of the basis of the stock’s valuation metrics, it’s hard to make a case for the stock right now as a good bargain – even with the expectation of increased distribution for PFE’s COVID vaccine throughout 2021 and into next year. For now, the best bet if you want to work with this stock is to look for short-term trading opportunities dictated by the path and pace of price momentum. If the stock bounces off of support at $38, you could consider buying the stock or working with call options, using a bullish target price at around $40.50 to take profits. The narrow distance between the stock’s Fibonacci retracement lines and below the stock’s current price also suggests that near-term downside is extremely limited, which makes trying to look for a bearish trade – either by shorting the stock or buying put options – a very low-probability prospect right now.