This semiconductor stock might be the most important chipmaker, and its recent correction could be a warning for the rest of the chip space.

The tech-heavy Nasdaq has had a good week.

The index closed at a new all-time high on Monday, and ended less than 0.1% below that record on Thursday, marking the second highest close ever.

Shares of Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Facebook (NASDAQ: FB), and Microsoft (NASDAQ: MSFT) all advanced between 1.3% and 2.2% today as investors bet that a steady economic rebound would boost demand for their products over the long run.

But while tech stocks in general have performed well this week, semiconductor stocks have largely sat out the rally with the exception of Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD.

And one strategist says there’s one chipmaker that could signal where the rest of the semiconductor group will be headed next.

“Right now, I’m worried about Taiwan Semiconductor (NYSE: TSM), because it’s one of the most—maybe the most—important semiconductor in the world,” said Miller Tabak’s Matt Maley.

Taiwan Semiconductor is one of the most important chipmakers in the world. It is a critical supplier to U.S. technology giants like Apple and Qualcomm (NASDAQ: QCOM), as well as Chinese companies including Huawei Technologies.

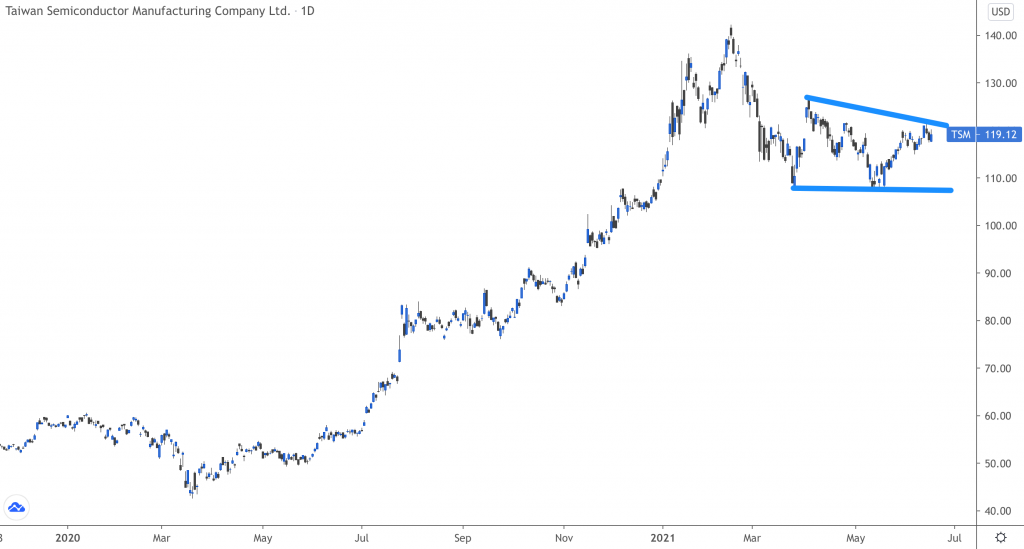

The stock is in a rare correction now, down around 16% since its mid-February high.

“Even though Nvidia and some of these other stocks have acted very well and the ETFs in the semiconductor space are within 2% or 3% of their all-time highs, one of the most important names [Taiwan Semiconductor] is down 15% to 17% from those highs,” Maley, the firm’s chief market strategist, added. “I’m concerned about it. Is it telling us something that we don’t see yet?”

While Maley notes the recent bounce in the stock is a positive, he said that the stock will need to make a move above $124 before he will get bullish and if it drops below its March low under $109, that would signal a bearish turn. Taiwan Semiconductor shares closed at $119.12 on Thursday.

“When a big stock like that has some problems, you should definitely take notice,” Maley said.

Still, over the long-term, Taiwan Semiconductor is a solid bet. Semiconductors will be the critical commodity of the future, and TSM is a leader in making the advanced chips needed for 5G, artificial intelligence, cloud computing, and electric vehicles.