In market terms, one of the natural side effects of the COVID-19 health crisis has been an elevated focus on stocks in the Healthcare sector. That covers a wide range of industries, from health insurance to biopharmaceutical and healthcare equipment and supplies. All of these companies have spent the last year and a half not only coping with increased demand and emphasis on COVID-related diagnostics, treatments, and facilities, but also working to understand how to shift their individual and collective focus from non-COVID-related operations.

The shift was mandated by a pandemic that forced hospitals and health care providers to delay doctor visits, elective procedures and anything that didn’t involve the coronavirus in order to preserve capacity for nearly overpowering COVID case numbers. For some companies like Abbott Laboratories (ABT), that also meant overwhelming demand for COVID tests that has continued into this year; surging cases of the Delta variant that are once again straining capacity seem to threaten continued near-term, pandemic-driven headwinds. 2020 testing demand, in fact was so massive that while it forced the company to shift its focus away from its high-growth medical device and non-COVID diagnostic segments, it also benefitted from significantly elevated revenues from COVID testing sales. That is a predicted tailwind that is expected to materialize once pandemic-mandated shifts allow for a resumption of normal activities and procedures.

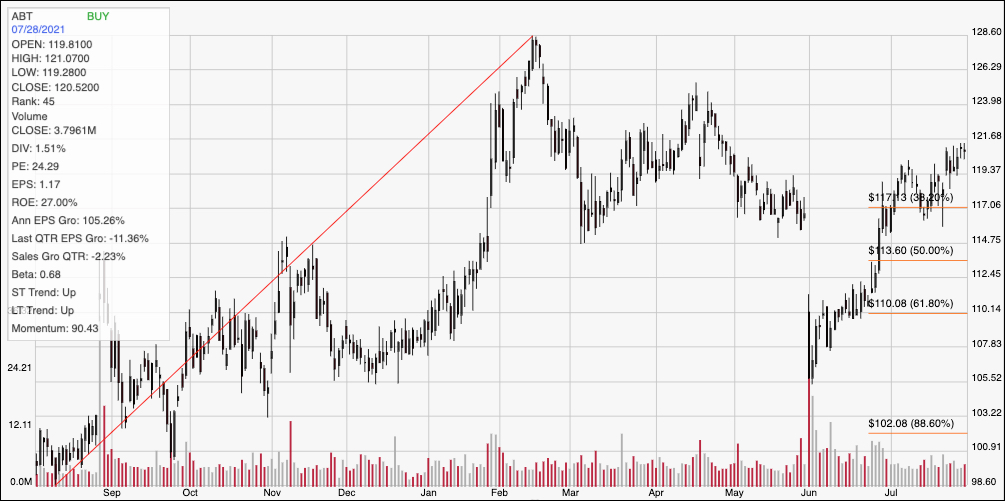

The stock enjoyed a big rally from its COVID-driven, bear market 2020 low at around $60, more than doubling in price to its February 2021 top above $128 per share. From that peak, the stock fell to a temporary low at around $105 at the beginning of June, but has picked up a lot of bullish momentum from that point, pushing up a little above $120 as of last week’s close. Speaking from the perspective of a value-driven investor, that run back up was great for those fortunate or smart enough to jump in around that $105 low; but what does it mean now? In a sector that has weathered unprecedented challenges over the last year and a half, should a company that is in a favorable fundamental position to be in position to return to normal growth operations once pandemic does finally begin to ebb begs the question: does ABT offer a useful long-term opportunity with attractive value built in, or has the stock’s price outpaced that fundamental strength?

Fundamental and Value Profile

Abbott Laboratories is engaged in the discovery, development, manufacture and sale of a range of healthcare products. The Company operates through four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products and Vascular Products. Its Established Pharmaceutical Products include a range of branded generic pharmaceuticals manufactured around the world and marketed and sold outside the United States. Its Diagnostic Products include a range of diagnostic systems and tests. Its Nutritional Products include a range of pediatric and adult nutritional products. Its Company’s Vascular Products include a range of coronary, endovascular, vessel closure and structural heart devices for the treatment of vascular disease. The Company, through St. Jude Medical, Inc., also offers products, such as rhythm management products, electrophysiology products, heart failure related products, vascular products, structural heart products and neuromodulation products. ABT’s current market cap is $215.03 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew a little more than 105% while revenues were 39.5% higher. In the last last quarter, earnings declined a little over -11.39%, while sales slipped -2.23% lower. The company’s margin profile is healthy, but is showing signs of short-term deterioration; in the last twelve months, Net Income was 15.85% of Revenues, while in the last quarter, it declined to 11.63%.

Free Cash Flow: ABT’s free cash flow is healthy and growing, at $7.6 billion over the last twelve months. This number has increased significantly from about $5.7 billion in the last quarter and $4.5 billion a year ago, and translates to a modest Free Cash Flow Yield of 3.97%.

Debt to Equity: ABT has a debt/equity ratio of .52, which is a low number that implies the company takes a conservative approach to the use of leverage. The company’s liquidity is healthy, with $8.3 billion in cash and liquid assets versus $17.4 billion in long-term debt.

Dividend: ABT pays an annual dividend of $1.80 per share, which translates to a yield of about 1.67% at the stock’s current price. The dividend was about $1.28 in 2019 and $1.44 a year ago, which is impressive; an increasing dividend is a strong indication of management’s forecast and confidence in its future.

Value Analysis: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $98 per share. That means that ABT is clearly overvalued right now, with about -19% downside from its current price to its fair value target. ABT’s useful discount price is around $78.50 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s upward trend from August of last year to its February peak above $128. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. After finding a bottom at around $105 in June, the stock rebounded strongly, as buying activity pushed the stock above all three of the major Fibonacci retracement lines that offered resistance at the time. The stock most recently broke above resistance at $119 in the last week or so, putting current support at that level, while immediate resistance looks to be at around $124 based on the stock’s temporary peak in April. The stock’s recent break above resistance means it should have about $3 of room to test immediate resistance at around $124, with additional upside to the 52-week high at around $128.50 if bullish momentum increases. A drop below $119, on the other hand appears to have about $2 of immediate downside to next support around the 38.2% retracement line, with next support expected at around $115.

Near-term Keys: There is a lot to like right now about ABT’s fundamentals; the company’s ability to work quickly to provide useful COVID-testing services has helped the medical community during the pandemic and been a net positive for its business. The anticipated return to non-COVID related activities is also something that bodes well for its operational model looking forward; even so, the stock remains overvalued, which means that it just doesn’t offer a compelling, value-oriented reason to buy the stock with a long-term forecast right now. There could be some interesting opportunities to place short-term trades, depending on what shifts in momentum occur for the stock in the days, weeks, and months ahead. You could use the stock’s recent push above resistance at $119 as an interesting signal to think about buying the stock or working with call options, using $124 to $128.50 as potential bullish target points, depending on the pace and strength of bullish momentum. A drop below $119 would act as a signal to consider shorting the stock or working with put options, with an eye on $117 to $115 as potential exit points on a bearish trade.