One of the things that I like about being a value-focused, long-term oriented investor is that I don’t spend a lot of time hunting for investing opportunities among stocks that I don’t know anything about. Over the years, I’ve been able to put together a good watchlist, filled with a pretty representative sampling of stocks from just about every part of the market. That means that in a lot of ways, I don’t have to spend a lot of time getting to know a company from scratch; most of the time running through a new analysis really just means refreshing the data for one of these old friends to see where things now stand.

ViacomCBS Inc. (VIAC) is one of those stocks; I’ve been following it now for a good portion of 2021 and been able to use it on multiple occasions in a practical sense for my income-generating system. From late March to the first part of April, VIAC was one of the attention-grabbing stories in the market due to its plunge from a peak at around $102 in less than one week to below $50. VIAC announced announced at the time that it would be selling new shares to the market, which diluted the value of existing shares, precipitating a 25% drop shortly afterward. The real story started from that point, as “family offices” – large investment funds set up exclusively to manage its own money rather than soliciting client funds – who were over-leveraged on this stock were forced to start selling other positions to cover margin calls on its borrowed assets. Increased selling – not just by this family office, but other investors as well – precipitated more declines in VIAC’s stock price, accelerating the decline even more.

The tendency for most investors is to shun stocks in free fall, which means that for the average growth investor or short-term trader, VIAC quickly became radioactive. That perception is countered, however by the fact that VIAC’s underlying fundamentals have continued to be very strong throughout the year. This is a company that was formed by the merger of two broadcast media giants – Viacom and CBS – to be more effective as a combined company in an ever more competitive landscape in in the broadcasting and entertainment industry. Traditional broadcast channels – cable, satellite TV, and so on – continue to be affected by “cord-cutters” that are shifting more and more to streaming channels. Cord-cutting doesn’t just apply to movies and TV series, but also for sports programming. Amazon, for example just paid a king’s ransom for exclusive rights to Thursday Night Football, and VIAC is moving to stay just as relevant, having overpaid for an extension of its NFL contract, and also adding Euroleague soccer to its streaming lineup as well.

This is a stock that rose from a March 2020, bear market low at $12 to about $35 by the start of 2020; but from that point the stock soared, rising to its March high at around $102 per share. From that peak and the initial collapse I just described, the stock has settled into a practical consolidation level, with consistent support just a little below the stock’s current price. The latest earnings report indicates that VIAC’s fundamental strength is still in place, which also means that its value proposition remains very, very attractive. Altogether, that suggests that VIAC continues to represent one of the best values in the market right now.

Fundamental and Value Profile

ViacomCBS Inc., formerly CBS Corp, is a global media and entertainment company. The Company is focused on creating premium content and experiences for audiences worldwide. It operates through various brands, including CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, CBS All Access, Pluto TV and Simon & Schuster, among others. It also offers production, distribution and advertising solutions for partners across five continents. BET is the primary channel of BET Networks, that provides entertainment, music, news and public affairs television programming for the African-American audience. CBS Sports brand is a broadcaster of television sports. Its Paramount Pictures brand is a producer and global distributor of filmed entertainment. Its CBS Television Studios is a supplier of programming with more than 70 series in production across broadcast and cable networks, streaming services and other platforms. Its brands also include Bellator MMA and COLORS. VIAC has a current market cap of about $26 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -21%, while revenue increased by 4.6%. In the last quarter, earnings were more than -36% lower, while revenues also shrank by about -11.44%. Despite those declines, VIAC operates with a healthy, strengthening operating profile; over the last twelve months, Net Income was 12.5% of Revenues, and that increased to 15.78% in the last quarter.

Free Cash Flow: VIAC’s free cash flow is very healthy, at $2.6 billion. This number increased from about $1.9 million at the end of 2020. The current number translates to a Free Cash Flow Yield of 9.71%.

Dividend: VIAC’s annual divided is $.96 per share, which translates to a yield of 2.31% at the stock’s current price.

Debt/Equity: VIAC carries a Debt/Equity ratio of .86, which is a significant drop from 1.23 a couple of quarters ago. Their balance sheet shows almost $5.4 billion in cash and liquid assets versus $17.7 billion in long-term debt. Their operating profile suggest that the company should have no problem servicing their debt, with good flexibility and liquidity to go along with it.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target a little above $102 per share. That suggests that the stock remains massively undervalued, with about 154% upside (not a typo) from its current price. It is also worth noting that just a couple of quarters ago, my analysis put the stock’s long-term target at around $89.50 per share – implying that the value proposition has gotten even more compelling.

Technical Profile

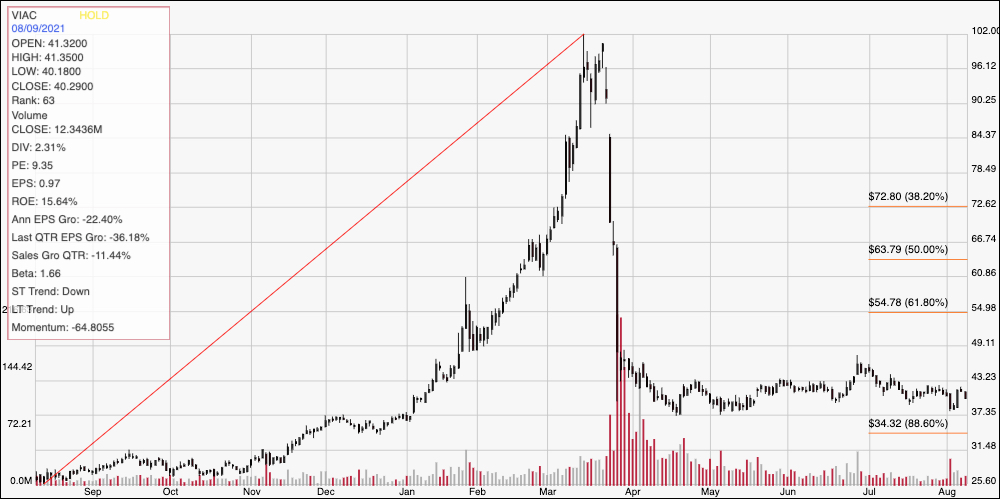

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart looks at the last year of price activity for VIAC. The red diagonal line measures the length of the stock’s upward trend from a low at around $25.50 to its peak in March at around $102; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock’s fall didn’t find a bottom until mid-April at around $37 per share, but from that point has started to define a consolidation range with very strong support at $37 and resistance at around $42 per share. The stock is sitting near the middle of the range right now. A push above $42 should have short-term upside to about $47 per share, while a drop below $37 could see downside to around $34 before finding next support.

Near-term Keys: VIAC’s consolidation range has extended for more than four months now, which strengthens the importance of the upper and lower bands of that range if you are a short-term trader. With the stock’s current level sitting near to resistance, a pivot high and move lower off of resistance could be a signal to think about shorting the stock or buying put options, using $37 as a useful initial profit target and $34 achievable if bearish momentum accelerates. A push above $42 would be a good signal to consider buying the stock outright or working with call options, with an eye on $47 as a very nice profit target on a bullish trade. From a value-oriented perspective, the stock’s consolidation range, along with its strong fundamental profile, only serve to improve the attractiveness of the value proposition right now.