It’s always interesting to watch the way market sentiment and investor attention shifts over time. Over the last year and a half, COVID and the continuing pandemic has naturally dominated the news cycle. There are segments of the economy that demonstrated a remarkable ability to pivot and adjust to the “new normal” the pandemic imposed and that, even as economic activity begins to pick up, is likely to see some level of permanency. Corporate America’s ability to pivot quickly and adapt rapidly to keep business going is one of the reasons that the market rebounded strongly from its initial drop to bear market levels in March of last year to soar well past pre-pandemic highs.

Market commentary has been trying to shift away from the pandemic to recovery considerations for most of the year, using economic data that clearly shows positive trends in increased demand in pandemic-impacted industries, and continuing declines in the unemployment rate that many would point to as confirmation the recovery is underway. Even so, coronavirus has proven to be a horribly persistent concern, with new variants leading to spikes in infections and hospitalizations, and concerns that a health care system that has spent the past year and a half under extreme pressure can’t take much more. It adds an element of uncertainty to the market that really can’t be ignored, which is one of the reasons that I continue to argue for the wisdom of defensive positioning in the investments you choose to use.

One of the ways that a lot of people like to get defensive – to find useful “safe haven” assets – is to work with precious metals like gold and silver. Working with the commodities themselves can be a good way to directly hedge against broad market risk. The Fed’s continued accommodative stance towards interest rates, which they have continued to affirm they will keep in place for as long as necessary to shepherd the economic beyond the health crisis and into a clear pattern of growth, should be a net positive for metals like gold, which usually respond bullishly to low interest rates.

If you don’t want to work directly with the commodity itself, another alternative is to invest in the companies that mine, process, and produce it. Barrick Gold Corp (GOLD) is one of the largest gold miners in the world, with operations in Canada, the United States, Central and South America, and Australia. The initial surge in the pandemic in 2020 saw the stock make a big move, from a low around $12.50 to a 52-week high at around $31 in August. From that point the stock dropped back, apparently based on the expectation that economic activity would continue to improve, and that the health crisis may have seen its worst. The stock dropped all the way to a low point at around $18.50 in March of this year before starting a new upward trend that peaked in May above $25. From that point, the stock dropped back again, and has actually picked up bearish momentum since the beginning of August. Looking beyond the commodity and its value as a defensively-positioned asset, this is also a company with a very strong balance sheet, healthy Free Cash Flow, and a very attractive value proposition. I think that means that GOLD is a company that could act as a good, defensively positioned proxy for the precious metal – and is something that you might want to consider as a smart way to diversify your portfolio.

Fundamental and Value Profile

Barrick Gold Corp is a gold mining company. The Company is principally engaged in the production and sale of gold and copper, as well as related activities, such as exploration and mine development. The Company’s segments, include Barrick Nevada, Golden Sunlight, Hemlo, Jabal Sayid, Kalgoorlie, Lagunas Norte, Lumwana, Porgera, Pueblo Viejo, Turquoise Ridge, Veladero and Zaldvar. Pueblo Viejo, Lagunas Norte, Veladero and Turquoise Ridge are its individual gold mines. The Company, through its subsidiary Acacia, owns gold mines and exploration properties in Africa. Its Porgera and Kalgoorlie are gold mines. Zaldivar and Lumwana are copper mines. The Pascua-Lama project is located on the border between Chile and Argentina. The Company owns a number of producing gold mines, which are located in Canada, the United States, Peru, Argentina, Australia and the Dominican Republic. GOLD has a current market cap of about $34 billion.

Earnings and Sales Growth: Over the last twelve months, earnings have increased by 26.09%, while revenues declined by -5.3%. In the last quarter, earnings growth was exactly 0%, while revenues slipped by -2.13%. The company’s margin profile is a sign of strength, but it did show signs of weakness in the last quarter; over the last twelve months, Net Income was 19.86% of Revenues, but declined to 14.21% in the last quarter.

Free Cash Flow: GOLD’s free cash flow is healthy at about $3.2 billion over the last year, which is an impressive improvement from about $401 million at the beginning of 2019, $1.17 billion at the end of 2019, and $2.7 billion a year ago. The current number translates to a useful Free Cash Flow Yield of 9.19%. This is a good indication of broad underlying fundamental strength.

Debt/Equity: The company’s Debt/Equity ratio is .16, reflecting a conservative approach to leverage. Their balance sheet, in fact is a point of strength, since cash and liquid assets have improved from $3.3 billion in December 2019 to $5.1 billion in the last quarter. This number also improved from $4.74 billion in the last quarter of 2020. Long-term debt currently stands at $5.1 billion, versus more than $12.5 billion in January of 2015 and $5.4 billion in the last quarter of 2020.

Dividend: GOLD’s annual divided is $.36 per share and translates to a yield of about 1.85% at the stock’s current price. The dividend has increased steadily since 2019; at the beginning of that year, the dividend was $.16 per share, and $.28 per share at the beginning of 2020. The increase is a good sign that the company is focused not only on managing their business but also about finding constructive ways to return value to its shareholders.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $27 per share. That means the stock is very nicely undervalued right now, with 42% upside from its current price.

Technical Profile

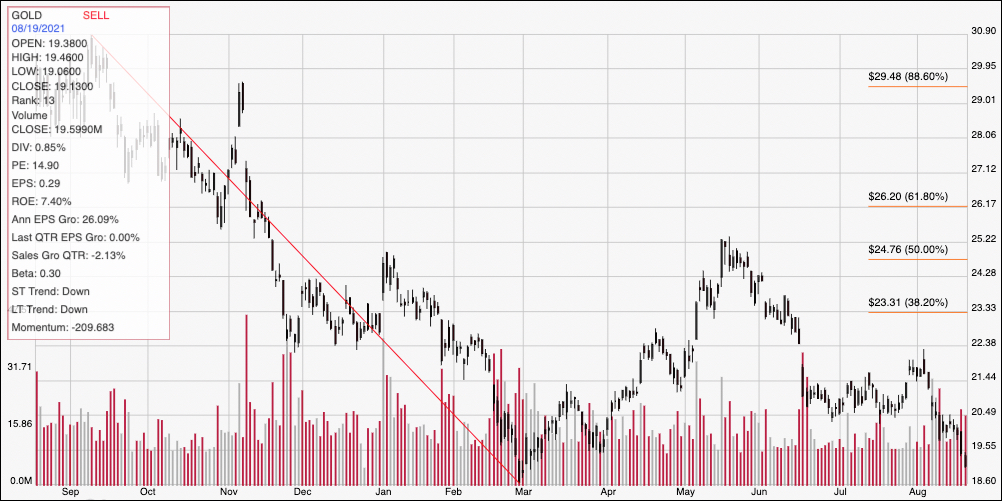

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last twelve months of price activity for GOLD. The red diagonal line traces the stock’s downward trend from its August 2020 peak at around $31 to its March low at around $18.50; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. From mid-June to late July, the stock hovered in a narrow range between $20.50 and $21.50, but fell below that low range in the first week of this month. It is now near to its 52-week low around $18.50, and which should provide current support. Immediate resistance is at $20.50. A bounce off of support should at least test immediate resistance; if bullish momentum picks up, the stock could push to somewhere between $21.50 to $22 in the near term. A drop below $18.50, on the other hand could see approximately $2 of downside to next support based on the current distance between expected support and immediate resistance.

Near-term Keys: GOLD’s fundamental strength and value proposition, are elements that I think makes GOLD a hard stock to ignore. The stock’s drop back is indicative, I think of continued investor desire to keep betting on economic growth. Any signs of economic weakness could make GOLD even more useful as a hedge against broader market risk. If you prefer to work with short-term trades, a drop below $18.50 could offer an interesting opportunity to short the stock or to work with put options, with an eye on $16.50 as a useful, very short-term profit target. A bounce off of support at $18.50 could act as a signal to think about buying the stock outright or to use call options, with an eye on $20.50 to $21 as near-term bullish profit targets.