If you’re like me, you’re probably more than a little bit tired of hearing all of the talk about coronavirus and its impact on daily life. That’s a big reason, I think that the market rebounded so quickly from pandemic-driven, bear market lows that took about a month to be seen from the market’s high point in early 2020. We all want to be able to look past the pandemic and to finally shift the narrative about COVID-19 into history rather than the present.

Health experts are predicting that the pandemic could be controlled by the middle of next year, and that is hopeful news, but in the meantime it is also impractical to look ahead and not be willing to contend with what is going on right now. In the stock market, a lot of industries have been forced to adapt and retool the way business is done in order to survive; for me, there is also inspiration to be found in the creative ways many businesses, large and small, have innovated their way to success.

The Specialty Retail industry is an interesting example of what I mean. The pandemic imposed a lot of restrictions on exactly the kind of activity most retailers depend on – foot traffic, and lots of it walking around a showroom and browsing through the items on its shelves. Most retailers were already being forced to begin developing “omnichannel” methods of selling their wares, which is another way of referring to sales generation by more than merely foot traffic. E-commerce is the first example, and retailers who already had reliable web-based platforms in place to offer goods and services and to process sales before the pandemic took effect were automatically ahead of the game over the laggards.

One of the examples of a company that found creative ways to adapt is Best Buy Co (BBY). While in-store operations were severely impacted, the company found creative methods not only to keep selling products, but also to stay in contact with its customers on a local level. Buying a product on their website gave customers the choice to have it delivered to their door or to pick it up at the store – which isn’t too different from what most retailers have been doing for some time. The wrinkle came during the pandemic when in-store activity was curtailed, as parking stalls were provided outside the store, with a number to call displayed for order pick up. This is a simple example of the kinds of things BBY was able to do to keep a number of its stores open during the worst of the pandemic.

BBY also resides in an intensely competitive landscape that was already fierce, but that has been under more and more pressure for a number of years from inroads made by Amazon (AMZN) in its digital and technology-centric offerings. That is a symptom of what has become a clear, long-term, “sea change” kind of shift by consumers away from traditional brick and mortar stores to online shopping alternatives. BBY has been working hard to stay relevant amidst that change, and many of those changes are what enabled the company to succeed during the last two years. This is a company with some compelling fundamental strengths including a very robust balance sheet and strengthening operating margins. The stock has dropped about -15% from its most recent peak. Does that drop represent an opportunity to get in at a good value price for long-term investors, or would it smarter to wait? Let’s find out.

Fundamental and Value Profile

Best Buy Co., Inc. is a provider of technology products, services and solutions. The Company offers products and services to the customers visiting its stores, engaging with Geek Squad agents, or using its Websites or mobile applications. It has operations in the United States, Canada and Mexico. The Company operates through two segments: Domestic and International. The Domestic segment consists of the operations in all states, districts and territories of the United States, under various brand names, including Best Buy, bestbuy.com, Best Buy Mobile, Best Buy Direct, Best Buy Express, Geek Squad, Magnolia Home Theater, and Pacific Kitchen and Home. The International segment consists of all operations in Canada and Mexico under the brand names, Best Buy, bestbuy.com.ca, bestbuy.com.mx, Best Buy Express, Best Buy Mobile and Geek Squad. As of December 31, 2016, the Company operated 1,200 large-format and 400 small-format stores throughout its Domestic and International segments. BBY’s market cap is $25.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 74.3%, while sales grew about 19.6%. In the last quarter, earnings grew by 33.6% while sales increased by a little under 2%. It’s generally difficult for a company to grow earnings faster than sales, and in the long term can’t be expected to continue, but it is also a positive sign of management’s ability to maximize their business operations. BBY operates with a very narrow margin profile that looks to be strengthening. Over the last twelve months, Net Income was about 4.85% of Revenues, but increased in the last quarter the number to 6.19%.

Free Cash Flow: BBY’s Free Cash Flow over the last twelve months was $1.3 billion. that translates to a Free Cash Flow Yield of 4.86%, but has also declined from $4.8 billion a year ago and $3.5 billion in the last quarter.

Debt to Equity: the company’s debt to equity ratio is .29, a very low number that reflects the company’s biggest strength, which can be seen in its balance sheet, which shows about $4.3 billion in cash and liquid assets against roughly $1.23 billion in long-term debt. Their healthy cash position, along with extremely manageable debt is a significant reversal from their position prior to the pandemic, when long-term debt was much higher than cash.

Dividend: BBY pays an annual dividend of $2.80 per share, which translates to an annual yield of about 2.65% at the stock’s current price. It’s worth noting that BBY has increased their dividend from $2.00 at the end of 2019, and $2.10 a year ago, with the boost to its current level coming in the first quarter of this year. The ability to raise its dividend during the pandemic is a notable sign of strength that shouldn’t be dismissed.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $51.50 per share. That suggests that BBY is significantly overvalued, by -51%, with a useful discount price at around $41.

Technical Profile

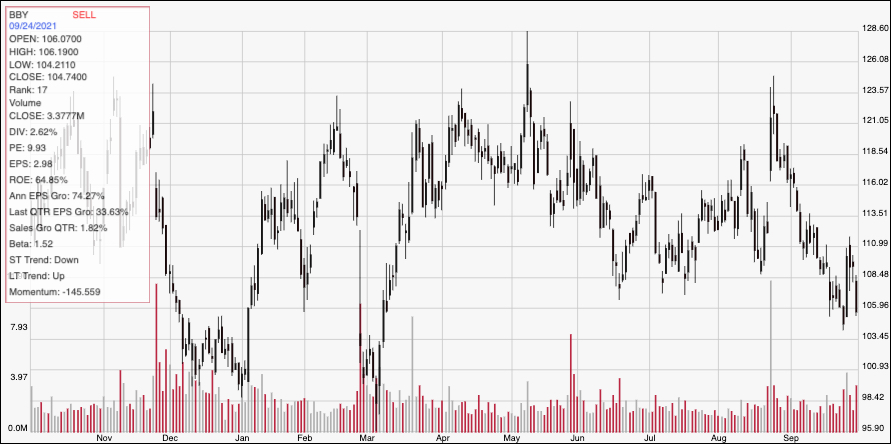

Here’s a look at the stock’s latest technical chart.

Current Price Action: This chart represents BBY’s price activity over the past year. The stock has seen some wide swings from high to low during that time, with its most recent high coming in late August at around $123.50. The stock has dropped sharply from that point and hit current support earlier this week at around $105. After briefly rebounding, the stock has dropped back towards that level again, marking immediate resistance at around $108.50. A push above $108.50 should find next resistance at around $111, with additional room to about $116 if bullish momentum picks up. A drop below $105, on the other hand should find next support at around $101, however if bearish momentum accelerates it could retest its 52-week low at around $96.

Near-term Keys: If you’re looking for a value-based, long-term investment, there is no way you should be considering BBY, even with its fundamental strength taken into consideration. The stock would need to drop to somewhere around $41 – more than -60% from its current price – before it can really be considered any kind of realistic bargain, based on current fundamentals and valuation metrics. If you’re looking for a short-term opportunity, however, there are a couple of signal points that could be useful. A bounce off of support at $105 could act as a good signal to consider buying the stock or working with call options, with a short-term, momentum-based target price at around $108.50 per share, and additional room to $111 if buying activity increases. If the stock drops below current support at $105, you could also think about shorting the stock or buying put options, with an eye on $101 as a quick profit-taking point, with $95 as an interesting secondary target point beyond that.