(Bloomberg) — Best Buy Co. shares tumbled the most since the start of the pandemic after the electronics retailer said increased robberies by organized groups of thieves are adding to an array of profit pressures.

Burglaries range from dozens of people rushing into stores and grabbing merchandise to theft by smaller groups, some of them brandishing guns or crowbars, Chief Executive Officer Corie Barry told reporters Tuesday. Northern California has been a particular trouble spot, she said, but Best Buy has seen pockets of criminal activity all over the country.

“We are seeing more and more particularly organized retail crime,” Barry said on an earlier call with analysts. “You can see that pressure in our financials, and more importantly, frankly, you can see that pressure with our associates. It’s traumatizing.”

The criminal activity is worsening just as Best Buy is struggling to keep pace with Wall Street’s soaring expectations. And it’s far from the only retailer contending with theft. Police in Northern California are looking for suspects after a series of thefts in recent days targeted businesses from a Louis Vuitton store to cannabis dispensaries to a Walgreens. A Nordstrom store in Walnut Creek was hit in an organized effort that included dozens of people.

Organized crime costs retailers an average of $720,000 for every $1 billion in sales, the National Retail Federation found in a survey published in December.

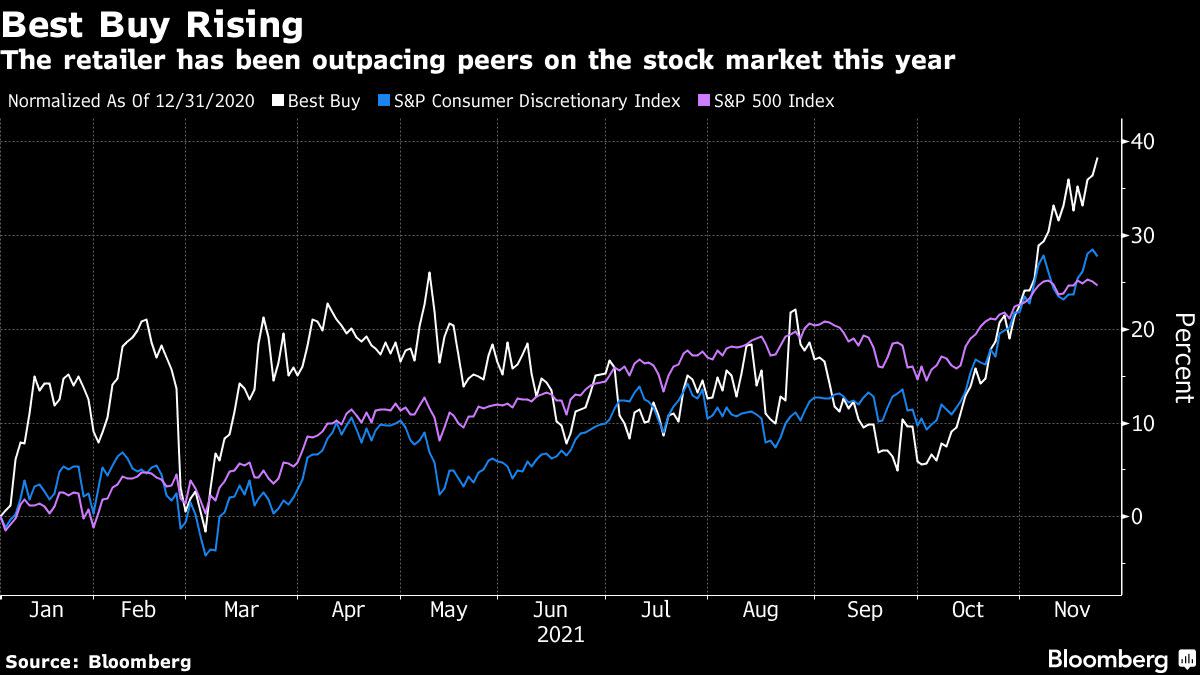

Best Buy shares plunged 15% at 10:14 a.m. in New York after sliding as much as 17% for the biggest intraday decline since March 2020. The shares had advanced 38% this year through Monday, outpacing the 28% gain of an S&P 500 index of consumer discretionary companies.

Best Buy credit default swaps widened Tuesday, with the cost to protect the company’s debt against default rising to the highest level since March.

Margin Pressure

Theft isn’t Best Buy’s only financial headache. While the company beat analyst estimates for third-quarter profit and sales, it said its gross margin — a closely watched measure of profitability — also got hit by stepped-up promotional activity and a drag from its new TotalTech membership program.

Gross margin fell 0.1 percentage point to 23.5%, Best Buy said in an earnings statement. That slightly trailed the 23.6% average of analyst estimates compiled by Bloomberg, and the decline in the core U.S. operation was steeper. The company also reported a 10% drop in domestic online revenue as more shoppers returned to stores.

The pullback in Best Buy’s shares follows a seven-week rally that contributed most of the stock’s year-to-date gain. Declines in gross margin at Walmart Inc. and Target Corp. spurred selloffs in each company’s shares last week.

Best Buy’s adjusted earnings rose to $2.08 a share, compared with the $1.96 average of analyst estimates compiled by Bloomberg. Sales climbed to $11.9 billion. Analysts had predicted $11.7 billion.

©2021 Bloomberg L.P.