Markets are naturally cyclical – they swing from high to low and back again on a consistent, if unpredictable basis over a range of time frames. The different time periods associated with any given cycle, or sometimes even the depth of a certain cycle’s direction, can shade the casual investor’s perception about a stock’s opportunity. The most recent major bull market, which extended itself over a more than ten-year time period and was only briefly interrupted by the global pandemic, is a good example. Because of both the unprecedented time period that market’s bullish run covered, and even more particularly the abnormally-extended rallies that typified the market’s bullish momentum during its last couple of years, a lot of average investors made the mistake of assuming that the market would simply continue that run.

Technically speaking, that bull market ended in February 2020, as COVID-19 made its way to North American shores and prompted not just national, but global shutdowns that shuttered entire industries for an extended period of time. The irony of the story is that while the market reacted equally as violently – every major market index plunged by about -20% in less than a month – the recovery only took slightly longer, recovering pre-pandemic highs by late spring of last year. From that point the market has resumed the direction of that much longer-term upward trend, making the “COVID bear market” look like just another bump in the road and providing a reasonable argument that the bull market really hasn’t ended, but is now in the process of extending itself into a historic twelfth year.

While coronavirus is not yet a thing of the past, and rising infections and hospitalizations remains question marks and legitimate concerns that must be addressed, the fact is that just about every major economic indicator reflects increasing economic health in a broad-based sense. Even unemployment, which surged last year to historically high levels but lagged the rest of the general pattern of economic growth, has begun to approach healthier levels, with room still to improve to reach pre-pandemic levels. That, along with clear signs that cost increases that are the result of a number of forces, including labor shortages and restricted semiconductor supply that is hampering the implementation of new technology in just about every sector of the economy, has raised the question of whether the economy is heating up too fast, which of course raises the spectre of increasing interest rates.

For a somewhat contrarian-minded investor like me, the conditions I’ve just described mean that it’s one thing to be open to good buying opportunities right now – but it is still smart to think in very careful, selective terms about taking on new positions. For the stock market, that means not simply taking a stock’s price action – up or down – at face value without first diving into the company’s fundamentals to get a sense of what is driving current price activity. It is also a good idea to take a step back from typical metrics and think about other factors that may work in a company’s favor in the foreseeable future, or that may represent elements of risk.

Oshkosh Corporation (OSK) is a good example of what I mean. From November of last year to May of this year, the stock more than doubled in price, rising quickly from around $67 to a peak at nearly $138 per share. From that point, the stock tapered back into an intermediate-term downward trend that as of this writing finally found a bottom at around $98 per share in October, and has picked up a a lot of bullish momentum moving into the last two months of the year. The decline through the most of the year comes in the face of fundamental strengths that include increasing free cash flow and strengthening liquidity in its balance sheet, and which the market seems to be picking up on now.

Trying to take a look at the broader picture for OSK means factoring in not only where their business has been, but also where it’s going. Long established as a primary manufacturer of telehandlers, aerial work platforms, and specialty trucks for the defense, fire and emergency, concrete placements, and refuse hauling markets, OSK has signaled a strong commitment to EV product development. Their Pierce Volterra Pumper, for example, is the first electric fire truck in service in North America, with additional EV platforms in place in concrete placement, and scissor lifts. In February 2020, the company made headlines when the United States Postal Service (USPS) selected OSK to deliver 50,000 to 165,000 EV and hybrid vehicles over the next ten years in a nationwide, sustainable upgrade of the USPS fleet.

All of this information makes for an interesting mix for a growth-oriented investor; are these elements also enough to make the stock actually work as a legitimate value-driven, long-term opportunity? Let’s dive in to the details and see if we can decide.

Fundamental and Value Profile

Oshkosh Corporation (OSK) is a designer, manufacturer and marketer of a range of specialty vehicles and vehicle bodies, including access equipment, defense trucks and trailers, fire and emergency vehicles, concrete mixers and refuse collection vehicles. The Company’s segments include Access Equipment; Defense; Fire & Emergency, and Commercial. The Access Equipment segment consists of the operations of JLG Industries, Inc. (JLG) and JerrDan Corporation (JerrDan). The Defense segment consists of the operations of Oshkosh Defense, LLC (Oshkosh Defense). The Fire & Emergency segment consists of the operations of Pierce Manufacturing Inc. (Pierce), Oshkosh Airport Products, LLC (Airport Products) and Kewaunee Fabrications LLC (Kewaunee). The Commercial segment includes the operations of Concrete Equipment Company, Inc. (CON-E-CO), London Machinery Inc. (London), Iowa Mold Tooling Co., Inc. (IMT) and Oshkosh Commercial Products, LLC (Oshkosh Commercial). OSK has a current market cap of about $7.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -19.23%, while revenues rose 15.63%. In the last quarter, earnings decreased by almost -50%, while sales were -6.6% lower. The company’s operating margin has survived the difficulties of the past year better than most in the industry, but hasn’t been immune to the challenges that exist; over the last twelve months, Net Income as a percentage of Revenues was 6.11% and weakened in the last quarter to 4.35%.

Free Cash Flow: OSK’s free cash flow is healthy and growing, at about $1.12 billion over the past year. This number marks an improvement from the last quarter, which was $1.04 billion, and from $747.7 million a year ago. The current number also translates to a Free Cash Flow Yield of 14.19%, and provides a useful counterpoint to the negative earnings and Net Income pattern described above.

Dividend: OSK’s annual divided is $1.48 per share, which translates to a yield of about 1.28% at the stock’s current price. It also marks an increase from $.96 per share, per annum around the middle of 2018, $1.20 per share in 2020 and $1.32 per share in the last quarter. An increasing dividend is a strong sign of management’s confidence in its business plan and operating model. Even with the increase, it is also worth noting that OSK maintains a conservative payout ratio; the current annualized dividend is less than 25% of the company’s total earnings per share over the last twelve months.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $143.50 per share. That means the stock is trading at an interesting, and useful discount, with 24% upside from the stock’s current price.

Technical Profile

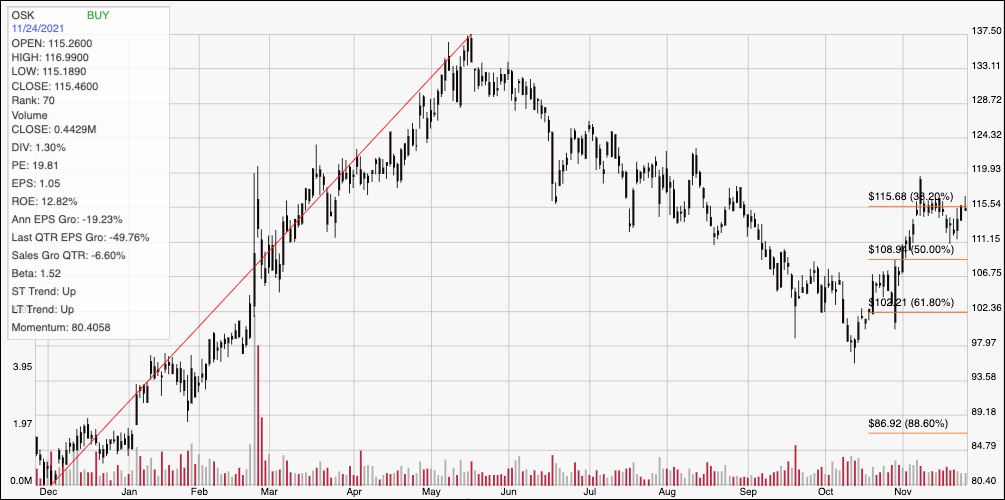

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend from its December 2020 low at around $80 to its all-time high in May at around $137.50; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock found a bottom for its downward trend in early October at around $98, and picked up a lot of bullish momentum into the early part of November, hitting a temporary peak at around $120 before dropping back to new, current support at around $111 just a few days ago. The stock is now sitting right around immediate resistance at $115.50, and which is also inline with the 38.2% retracement line. A push above $115.50 should have near-term upside to about $120 at that recent peak, with additional room to between $122 and $123 if buying activity increases. A pivot high at $115, and drop has about $4 of downside to $111, with additional room to fall to about $109, where the 50% retracement sits if bearish momentum accelerates.

Near-term Keys: OSK’s value proposition looks very attractive right now, and the company’s balance sheet remains healthy and in better shape than many other companies that have spent the past year and a half dealing with the reality of pandemic-driven difficulties. If you’re willing to accept the potential for continued near-term volatility, this is a stock that looks like a very good value. The stock also has some interesting possibilities if you prefer short-term trading strategies; watch for a break above $115.50 as a signal to consider buying the stock or working with call options, using $120 as a useful, short-term profit target. A drop off of current resistance at $115.50 could be taken as a signal to consider shorting the stock or buying put options, with downside to support at $111 providing a useful initial profit target on a bearish trade, and room to about $109 if selling activity increases.