This asset is hidden in plain sight and could make one of the world’s most valuable companies a whole lot more valuable once the market realizes what it’s sitting on.

With a market cap of over $800 billion, and with a PE ratio of 24.25, most wouldn’t consider Google-parent Alphabet (NASDAQ: GOOGL, GOOG) an under appreciated asset.

But The Daily Reckoning’s Jody Chudley might convince you otherwise.

According to Chudley, “The market is missing something huge about Alphabet. Investors are completely ignoring a hidden asset that Alphabet owns which alone is worth more than most publicly traded companies.”

“I believe that factoring in the value of this ‘hidden asset’ justifies a total valuation for Alphabet of at least $1 trillion,” he said.

So what is it?

It’s the Android operating system that’s used in thousands of models of non-Apple (NASDAQ: AAPL) phones, including brands like Samsung, LG, Sony, Huawei, and Google, among others, the world over.All told, there are currently 2 billion Android users worldwide.

And until very recently, Alphabet has made almost no effort to monetize the Android platform—and those 2 billion users—as the company has used the platform to drive users to Google search.

But late last year, that all changed.

Last summer, Google was slapped with a record $5 billion fine by the European Commission (EC) for alleged anti-competitive behavior in the European Union, where Android has 80% market share across the five biggest European markets. The EC took issue with Google’s practice of bundling and prioritizing its own apps so as to bolster its search business at the expense of its rivals.

At the time, Google’s CEO, Sundar Pichai, said that the EC’s decision “rejects the business model that supports Android,” which sparked some speculation that the search engine giant might begin charging fees of some sort for the platform.

Cut to mid-October, when the company announced that it would begin charging licensing fees to handset manufacturers for the ability to pre-install Google apps on Android devices, a major departure from how it had been operating.

According to European regulators, one of the anti-competitive practices that the company had been up to was that it had been paying some manufacturers and network operators to pre-install its apps, giving the company an advantage from the get-go. After that, Google would monetize Android through greater usage of Google Search, which helped to recoup those payments.

Switching to charging manufacturers instead of paying them is part of how Google is complying with the EC’s order. The company has not yet disclosed what it will charge as a licensing fee, but don’t expect that the change will be limited to the European market for long.

“Realistically, it will eventually go global because the dollars involved are enormous and because eventually monetizing Android has been the plan all along,” Chudley said.

Even as far back as 2010, monetizing Android was in the cards as evidenced by then-CEO Eric Schmidt saying, “If we have a billion people using Android, you think we can’t make money from that? All it would take is $10 per user per year…”

So just how enormous are those dollar figures?

“With the 2 billion users that Android currently has and Schmidt’s $10 per user estimate, that would result in a $20 billion revenue stream,” Chudley noted.

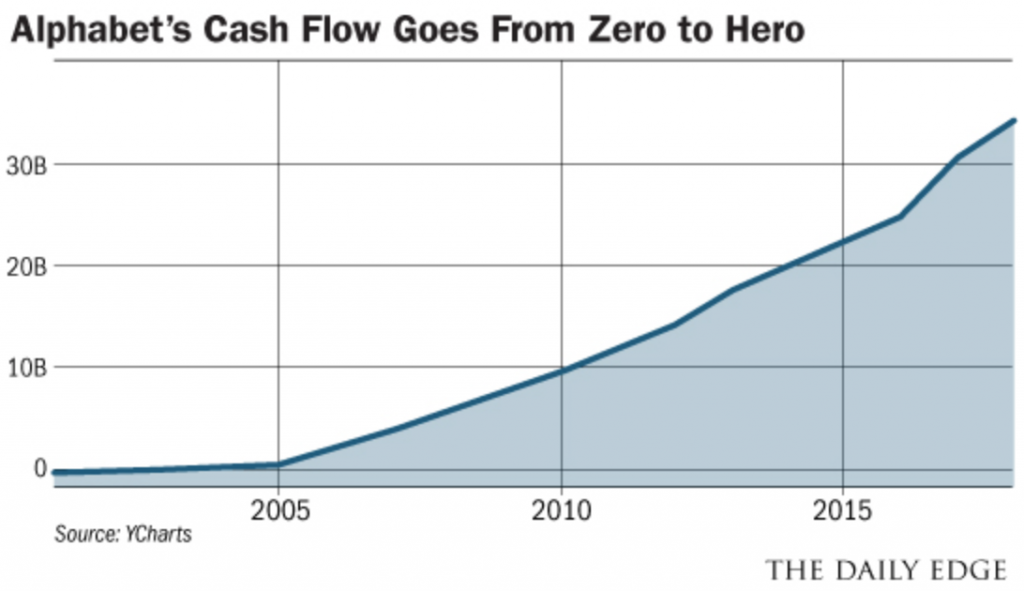

“Even for Alphabet, a $20 billion increase in cash flow is a very big deal,” he said, pointing to the chart below:

“I believe that makes Android the most valuable hidden asset on the planet,” Chudley said, “which is why this tech giant deserves a place in your portfolio.”

And Chudley isn’t the only one positive on Alphabet.

The stock currently has 28 Buy ratings and an average price target of $1,338.89 – 21% higher than the current price.