When it comes to identifying stocks that might make useful investments, there are as many strategies as there are people. You can break these strategies into any different number of categories. I like to differentiate between strategies by thinking first about the amount of time I might actually plan to hold the stock in question, for example, long term versus short term. When I think about long term investments, I think it makes sense to focus on the business underlying a stock. There are a ton of different fundamental measurements people like to focus on, but one of the measurements that I think makes the most sense is whether or not a stock pays a dividend.

Dividend-paying stocks, in my book, should be a no-brainer for anybody thinking about long term investments, no matter whether you are trying to generate income, or if your focus is on building wealth. Why? Because dividends are the low-hanging fruit of investment returns that require the last work or analysis on your part. All you have to do to qualify for a dividend is to own the stock before the scheduled ex-dividend date. Another great thing about dividends in our current market environment is that with a lot of stocks down 20% or more in price over the last four or five months, in many cases you can find dividends offering annualized yields in access of 3% or more – which makes them very competitive with standard interest-bearing instruments like bonds and CD’s.

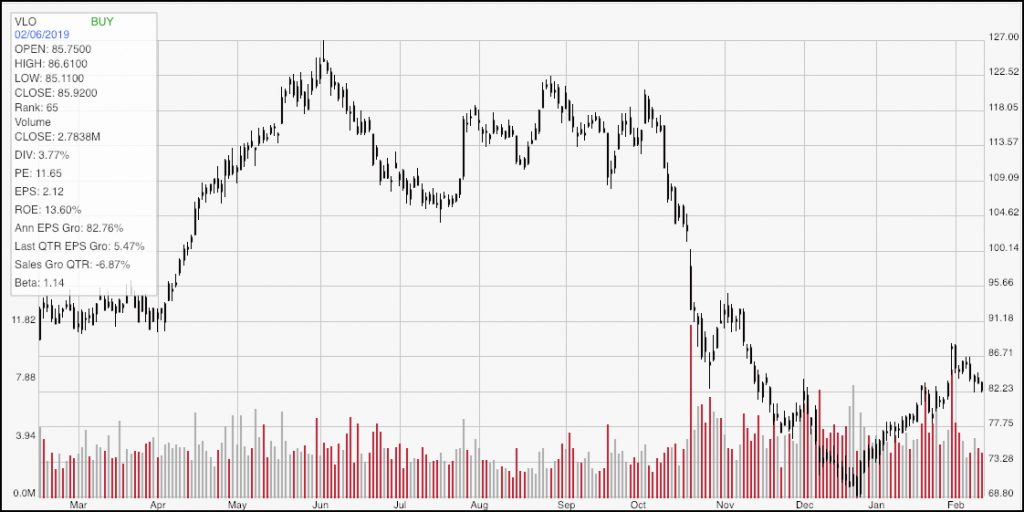

Valero Energy Corp. (VLO) is a good example of the kind of dividend-paying stock I’m referring to. Since hitting a high around $127 in June of last year, the stock dropped more than 50% at the the end year to a low around $69. From that point, the stock has rebounded nicely to its current level, but still remains more than 35% below that peak price. This is an oil refining company that pays a dividend that translates to an income yield of more than 4% at its current price. It’s true that when you buy a stock – even a dividend-paying stock – you have to also accept the fact that the stock is going to fluctuate in price; but having a 4% annual yield to work with makes working with that reality a lot easier, especially if the rest of the stock’s fundamentals are strong.

The other question that I think is important, however is whether the stock’s current price represents a useful value. It’s one thing to recognize the stock’s discount relative to its historical highs, and another to say that there is a strong reason to suggest the stock should revisit those highs at some point in the future. So VLO pays a terrific dividend, and as you’ll see, they have some solid fundamentals to back them up as well; but what about the value story?

Fundamental and Value Profile

Valero Energy Corporation (Valero) is an independent petroleum refiner and ethanol producer. The Company’s segments include refining, ethanol and Valero Energy Partners LP (VLP). The refining segment includes its refining operations and the associated marketing activities. The ethanol segment includes its ethanol operations and the associated marketing activities, and logistics assets that support its ethanol operations. The Company owns logistics assets (crude oil pipelines, refined petroleum product pipelines, terminals, tanks, marine docks, truck rack bays and other assets) that support its refining operations. Some of these assets are owned by VLP, which is a midstream master limited partnership owned by the Company. VLP’s assets include crude oil and refined petroleum products pipeline and terminal systems in the United States Gulf Coast and the United States Mid-Continent regions. Its refineries produce conventional gasolines, premium gasolines and lubricants, among others.VLO’s current market cap is $34.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both grew, with earnings increasing nearly 83%, and sales growing just under 9%. Growing earnings faster than sales is hard to do, and generally isn’t sustainable in the long term; but it can also be a positive mark of management’s ability to maximize their business operations. The company operates with a narrow margin profile; over the last twelve months, Net Income was 2.66% of Revenues over the past year; however it did increase in the last quarter to about 3.33%. These are pretty tight numbers, to be sure, but this does seem to be a normal part of the way VLO does business.

Free Cash Flow: VLO’s free cash flow is pretty healthy given their narrow operating margins, at $2.6 billion. That translates to a Free Cash Flow Yield of 7.43%.

Debt to Equity: VLO has a debt/equity ratio of .39. This is a low number that generally suggests debt management shouldn’t be a problem. The company’s balance sheet shows $3.5 billion in cash and liquid assets against about $8.8 billion in long-term debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for VLO is $54.07 per share, and which translates to a Price/Book ratio of 1.52. Their average Price/Book Value ratio is 1.56, which means the stock is pretty fairly valued, and is only about 2.45% below that “fair value” measurement. By contrast, however, the stock is trading more than -29% below its historical Price/Cash Flow average. That puts a long-term “fair value” price for the stock somewhere around $59.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year’s worth of price movement for VLO. The stock’s rally from its December downward trend low is impressive by itself, and the recent pullback from a high around $87 looks like the beginning of the B leg of a good bullish ABC retracement pattern. If the stock can break above that pivot high at $87, it should have good bullish momentum to push into the $100 to $1004 range. The stock’s most immediate support is around $78, and a drop below that level should see the stock retest its trend low in the $69 range.

Near-term Keys: There could be some useful, short-term, momentum-based opportunities in the stock, provided it breaks above the $87 pivot high point I just mentioned. That would be an excellent signal for a bullish, momentum-based trade, by either buying the stock outright or working with call options. If the stock pushes below support at around $78, there could be a good short-term opportunity to short the stock or work with put options. From a value-oriented standpoint, the stock really doesn’t offer a great value unless it drops back below $70; at around $67, it would mark a significant discount to its historical Price/Book ratio. Without that discount, even with the stock’s generally solid fundamental profile and excellent dividend, it’s hard to forecast much more long-term upside than its current price level.