Here are the 15 stocks they say investors should consider.

The S&P 500 is up nearly 17% since its low hit on Christmas Eve when the index briefly dropped into bear market territory, but Goldman Sachs (NYSE: GS) is warning that this rally is about to stall.

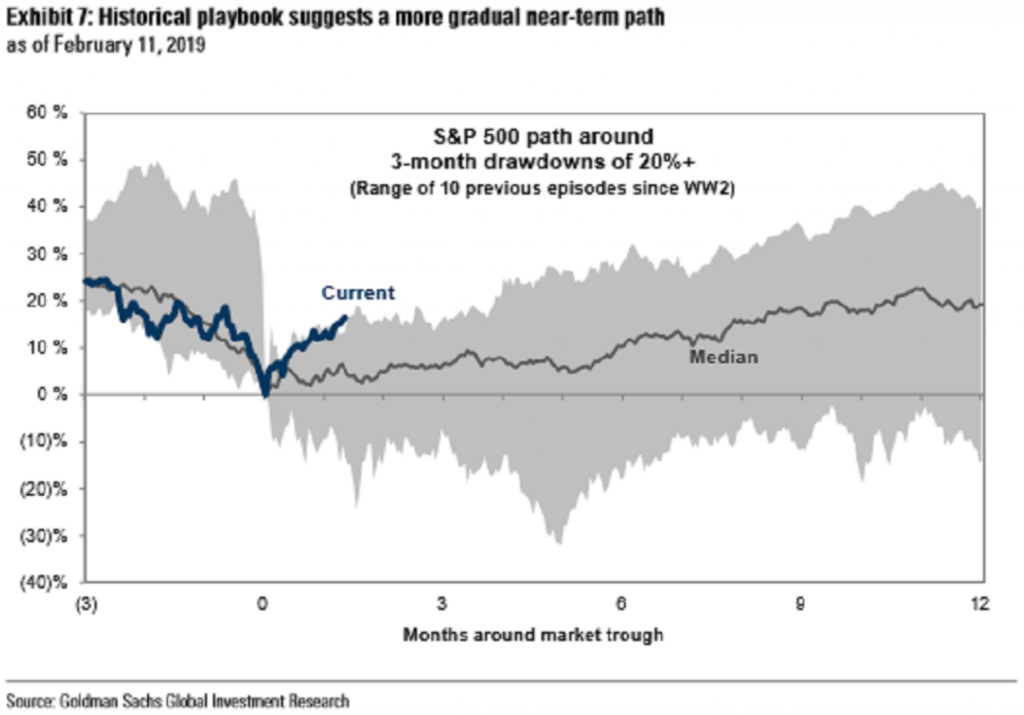

This surge since December 24 marks the fastest rebound in the last 10 recoveries from declines of 20% since World War II, according to Goldman. And if history is any guide, the index is likely to stay flat over the next three to six months, according to the bank.

Goldman’s economic activity and financial market performance models suggests concerns about an incoming recession and more monetary tightening from the Fed that investors were worried about late last year have all but evaporated. Investors are now more confident about stable growth and a dovish central bank which, according to strategists led by Ryan Hammond and David Kostin, doesn’t leave much room for positive surprises.

With upside likely stalled for now, the strategists say investors should turn to picking individual stocks in order to have the best chance at capturing returns.

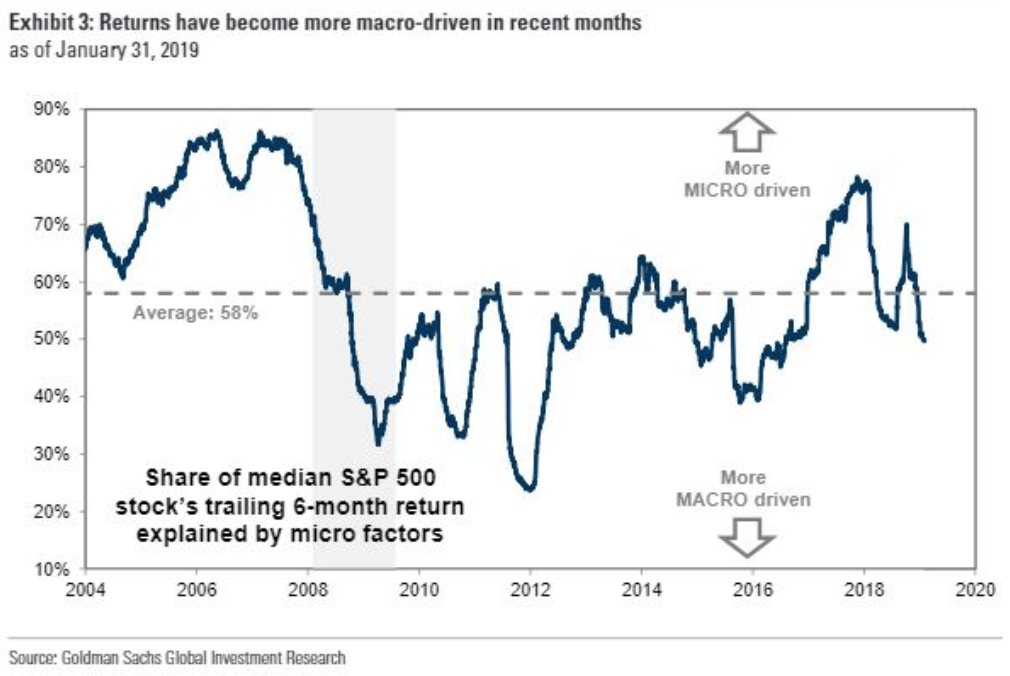

“S&P 500 returns will be more modest in the near term,” the strategists wrote in a note to clients Tuesday. “We expect stock returns will become more micro-driven and recommend investors focus on relative value and idiosyncratic (‘alpha’) opportunities.”

They noted that stock-picking opportunities are the most plentiful among stocks in the communications services, consumer discretionary, and health care sectors, and highlighted such stocks as Monster Beverage (NASDAQ: MNST), Incyte (NASDAQ: INCY), Nvidia (NASDAQ: NVDA), Twitter (NYSE: TWTR), and WellCare Health Plans (NYSE: WCG).

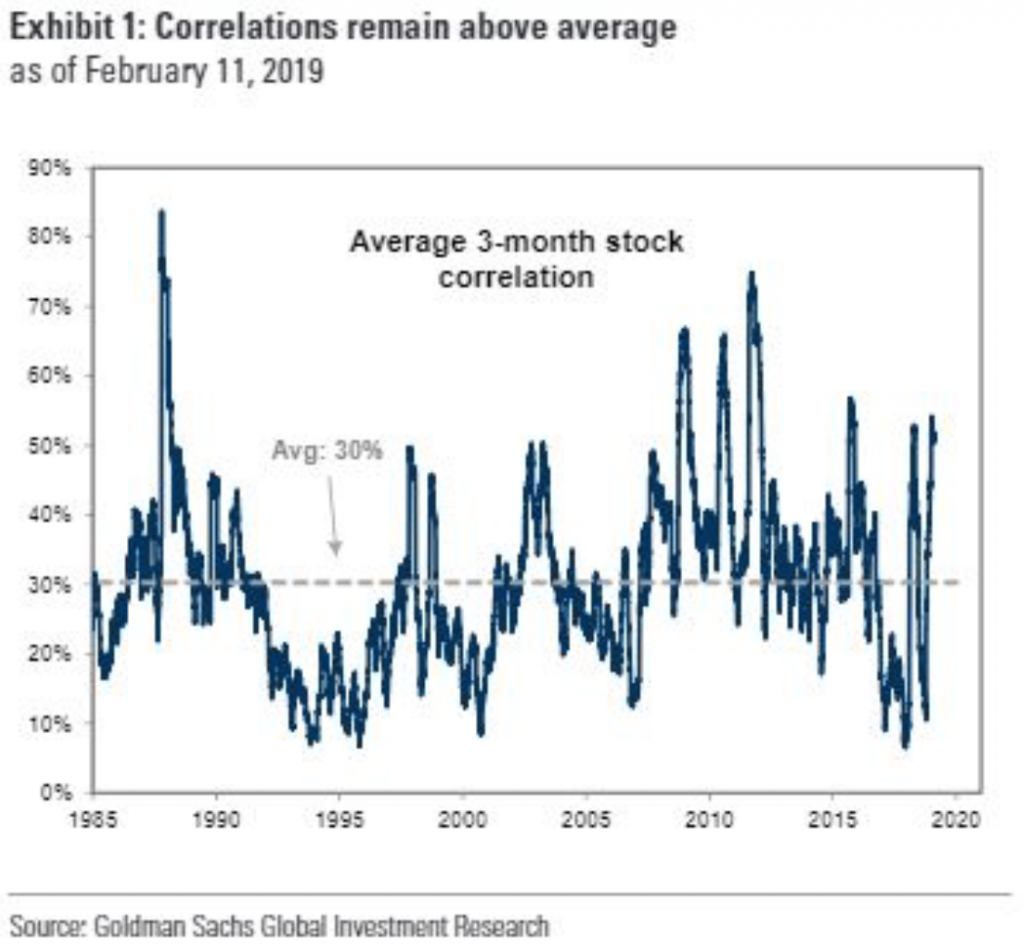

Since the December low, the market’s surge higher has been a ‘macro’ trade, where the entire market rose, defensives lagged, and cynicals led the way. As a result, stocks are now extremely correlated to each other and the market. This correlation, now at the 94th percentile, is the fourth largest on record, and as such, Goldman recommends stocks that have a high ‘dispersion,’ or are bucking the trend.

“We forecast a stable macro environment in the near-term, characterized by steady U.S. economic activity and a patient Fed, which we believe has been priced in the market,” wrote the Goldman strategists. They are expecting a limited move to 2,750 by midyear, and see the S&P 500 climbing to 3,000 by the end of the year.

With a flat market for the next three to six months, stock pickers may fair better than those who buy the market or sector ETFs.

“We have seen nascent signs of this rotation to ‘alpha’ with ETF outflows that have exceeded mutual fund outflows. Consistent with the ongoing transition from active to passive, ETFs saw inflows throughout much of 2018, while mutual funds experienced substantial outflows,” the strategists wrote. In January, stocks gained 8% while investors ditched ETFs, with outflows swelling to $32 billion compared to $8 billion flowing out of mutual funds.

The Goldman strategists also came up with a list of stocks that have high ‘dispersion scores,’ or stocks that are driven more by micro factors than they are associated with big macro moves.

“Stocks with high dispersion scores are more likely to have heightened responses to idiosyncratic news and present the best alpha generation opportunities,” they wrote. “Importantly, high dispersion scores do not necessarily suggest outsized returns alone, but rather that deviate most from market returns in either direction,”

Stocks on the high ‘dispersion scores’ list include, Advanced Micro Devices (NASDAQ: AMD), Activision Blizzard (NASDAQ: ATVI), Best Buy (NYSE: BBY), Dish Network (NASDAQ: DISH), Gap (NYSE: GPS), Newell Brands (NASDAQ: NWL), Newmont Mining (NYSE: NEM), Nordstrom (NYSE: JWN), UnderArmour (NYSE: UAA), and United Continental (NASDAQ: UAL).