(Bloomberg) — Pilbara Minerals Ltd., one of Australia’s top lithium miners, slashed its forecast for shipments, further exacerbating tight supply for the key ingredient in electric-vehicle batteries.

The Perth-based company cited a raft of issues — from delays in commissioning and ramping up more processing capacity, to unplanned shutdowns and skilled worker shortages — in lowering its guidance for spodumene concentrate shipments to between 380,000 and 440,000 tons in the year ending June 30, from 440,000 to 490,000 tons previously.

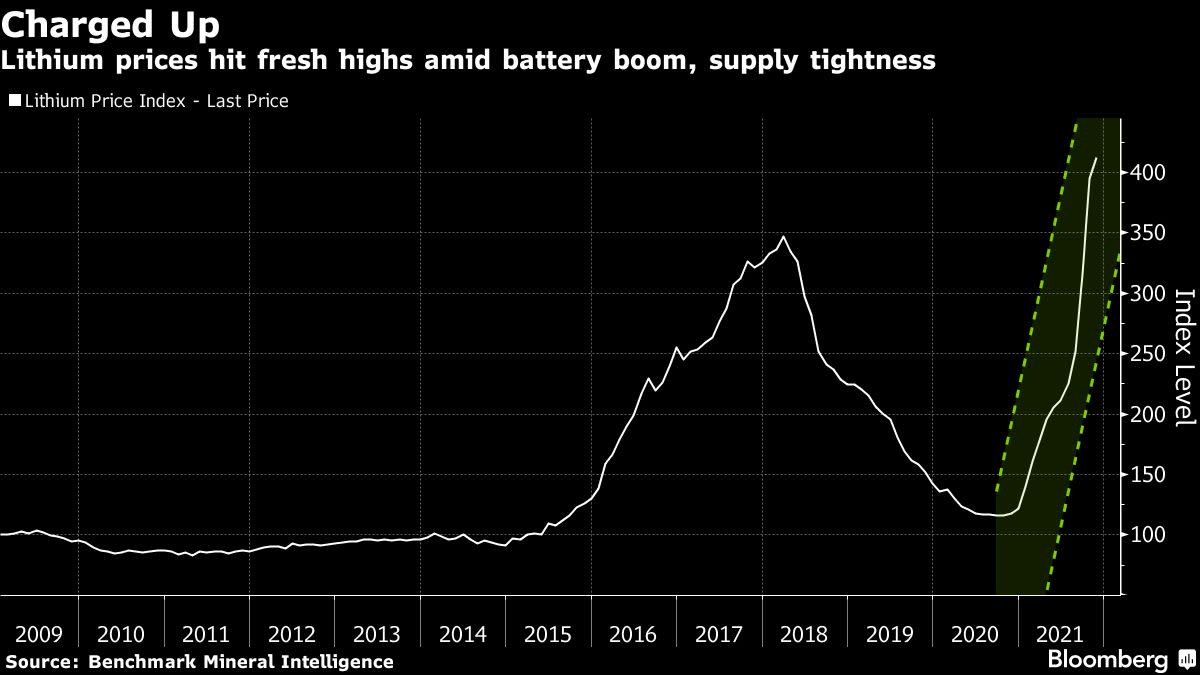

The global push toward electrified transport has fired up consumption for lithium and the battery material’s prices have more than tripled this year to a record. Miners are scurrying to expand capacity, but they can’t keep up with demand and market tightness is likely to persist in the near term.

READ: Metals Key for EVs Will Be Pricier for Longer After Record Year

“We expect both lithium chemicals and spodumene prices to continue to go up,” said Dennis Ip and Leo Ho, analysts at Daiwa Capital Markets. Spodumene — lithium-bearing hard rock and the material Pilbara produces — is in particularly short-supply, they added, with ongoing price hikes likely.

Pilbara Minerals is looking to expand processing capacity at its Pilgangoora operation in Western Australia, but “has not been immune to the skilled labor shortages currently impacting the WA resources sector,” said Managing Director Ken Brinsden. Other lithium producers as well as mining industry giants BHP Group and Rio Tinto Group have also been affected as Covid-related border restrictions in the state curb the inflow of migrant workers on which the industry relies.

“We will not be surprised if there is future delay in the commencement of greenfield projects on both mining and refinery side,” said Daiwa’s Ip and Ho.

Read more: Tesla Trounced by Obscure EV Suppliers With 200% Returns

Pilbara Minerals said its average price received in the December quarter was likely to be at the high end of its previous guidance range of $1,650 to $1,800 per dry metric ton. Earlier this year, the company began selling spot cargoes on an online auction platform, achieving a price of $2,350 a ton in October. Meanwhile, the market’s long-term fundamentals are bullish, with demand for the mineral estimated by BloombergNEF to jump fivefold by end of the decade.

Shares in Pilbara Minerals plunged 13% in Sydney on Tuesday following the announcement, although the stock is still one of the best performers on the bourse this year, rising almost threefold.

©2021 Bloomberg L.P.