Shares of Kohl’s Corp. (KSS) surged to fresh highs on Tuesday thanks to a stronger-than-expected fourth-quarter earnings report. The department store chain surprised on just about every level, which galvanized investors formerly discouraged by the stock’s rocky performance over the last year.

While it’s easy to forecast the company’s demise as Amazon.com Inc. (AMZN) expands the ongoing “retail apocalypse,” Kohl’s stands out by having a particularly cozy relationship with Amazon. That being said, investors remain skittish over whether or not the partnership may actually yield long-term success for the once-thriving retailer.

Let’s take a deeper dive into the Q4 financials and the Amazon partnership in order to determine if KSS stock can be a valuable addition to your portfolio this year…

The Numbers

The company’s revenue and earnings per share (EPS) numbers surpassed Wall Street’s expectations. Kohl’s also reported shocking growth in same-store sales, a metric whose relevancy appears to be inversely related to the rising number of retail closures.

Adjusted EPS came in at $2.24, handily beating the analyst estimate of $2.18 by 2.75% despite decreasing more than 22% from the year-ago EPS of $2.81. The company raked in revenue of $6.82 billion, which was down 3.3% from $6.6 billion in Q4 2017. However, that $6.82 billion topped Wall Street’s estimated $6.58 billion by 3.6%. As for guidance, Kohl’s expects annual EPS to hit somewhere between $5.80 and $6.15 for full-year 2019. This defied analysts’ expected $5.75 EPS for 2019.

But outlets mainly assert today’s rally stemmed largely from the company’s estimate-crushing same-store sales growth. Kohl’s posted same-store sales growth of 1% during the October-December period. While that may not sound like much, it soared past Wall Street’s estimate of a 0.5% decline. That had many market participants doing a double take while simultaneously pouring capital into the stock for a record-breaking daily gain.

How Investors Reacted

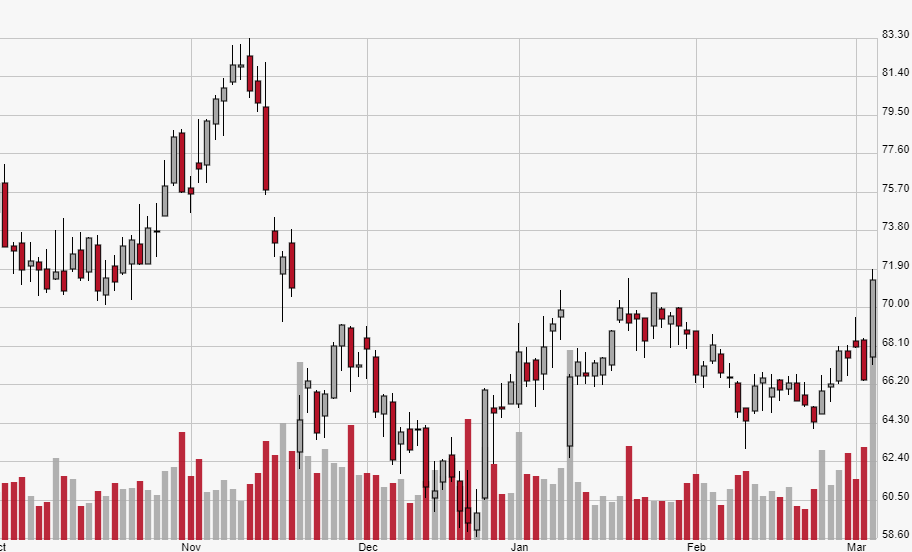

Investors on Tuesday pushed KSS stock up 7.3% to a closing price of $71.33 per share. That settlement was the best since Nov. 16, 2018 when shares closed at $72.49 each. Kohl’s is now up 7.5% this year from $66.34 on Dec. 31.

The Bigger Picture

Despite the strong financials, Kohl’s isn’t the first traditional retailer to baffle analysts and stave off the e-commerce trend with exceptional Q4 earnings. Walmart Inc. (WMT), for example, beat EPS expectations by 6% in its Feb. 19 earnings report while also recording astonishing online sales growth of 43%. Best Buy Co. Inc. (BBY) also had a strong quarter, as overall earnings increased 38% and online revenue climbed 9.3% year-over-year.

Although Kohl’s doesn’t have much to boast about in the e-commerce department, its impressive earnings are the latest evidence that traditional big-box retailers remain more resilient than investors think. The company has been adjusting to constantly shifting consumer habits by opening up smaller retail locations and even providing ways for customers to pick up online orders in-store.

Retail analysts view the shift to smaller stores as one of the stronger benefits for companies like Kohl’s since it pulls the average shopper away from the larger, more intimidating department stores typically found in shopping malls. Poonam Goyal, a retail analyst for Bloomberg Intelligence, explained “off-mall retailers have been outperforming on-mall retailers if you look back over the past five years, and that probably will continue to be the case.”

But Kohl’s real edge is its interesting partnership with Amazon. The agreement involves Kohl’s selling popular Amazon products – including the Echo – at retail locations and even processing returns for products bought on Amazon.com. In the earnings call Tuesday, Kohl’s stated it plans to expand this partnership to about 200 stores, marking an enormous 567% increase from 30 stores as of last quarter.

Kohl’s CEO Michelle Gass also noted on the call how her firm wants to create a “more robust wholesale relationship” with the e-commerce titan, which could open up unique growth avenues for Kohl’s. The fact that the retailer is pivoting away from traditional retail – but in a less traditional way than, say, Walmart, which is going all in on boosting online sales of its own products – could forecast more earnings surprises later in 2019.

Looking Ahead

Despite wild swings from as high as $81.97 to as low as $58.38 over the last year, Kohl’s appears to be thriving from its deceptive appearance – that is, the deceptive appearance of an old-school big-box retailer going extinct alongside most of the retail sector. However, with plans to expand to 200 stores, its strong relationship with Amazon only appears to be getting stronger. Amazon is arguably the best company to have on your side in the current business environment, so any ties to the e-commerce giant can only lift earnings – and the share price – as markets move forward in 2019.