(Bloomberg) — The Federal Reserve has managed to do something that’s rarely seen in the U.S. these days: Get members of the Democratic and Republican parties to agree.

At this year’s annual meeting of the American Economic Association, prominent economists from both sides of the political spectrum argued that the Fed is behind the curve in the battle to contain an outburst of inflation in an economy still beset by a pandemic.

And while they generally welcomed the Fed’s pivot toward a tighter monetary stance and expect price pressures to ease this year, they sounded doubtful that inflation will decelerate as much as central bankers are forecasting. They saw it remaining well above monetary policy makers’ 2% target.

Among those chiming in at the three-day virtual conference that winds up on Sunday: Former Treasury Secretary Lawrence Summers and ex-White House chief economist Jason Furman — both Democrats — and noted monetary economist John Taylor and former Council of Economic Advisers Chairman Glenn Hubbard, who served in Republican administrations.

To be sure, not all economists — especially some on the left — are raising alarms about the inflation threat and the Fed’s delayed response to it.

Nobel Prize laureate Joseph Stiglitz, who was chief White House economist for Democratic President Bill Clinton, called for caution by the central bank. He argued that higher interest rates wouldn’t solve the supply snafus and global shortages that have helped push up inflation. In addition, labor-force participation remains well short of what it could be.

Fed Chair Jerome Powell is likely to be pressed about what he intends to do to stem inflation when he appears Tuesday before the Senate Banking Committee for a hearing on his nomination by President Joe Biden for another four-year term. Powell, a Republican, won favor from Biden and some other Democrats for his emphasis on the importance of the Fed achieving maximum employment that is broad-based and inclusive.

Faster Pace

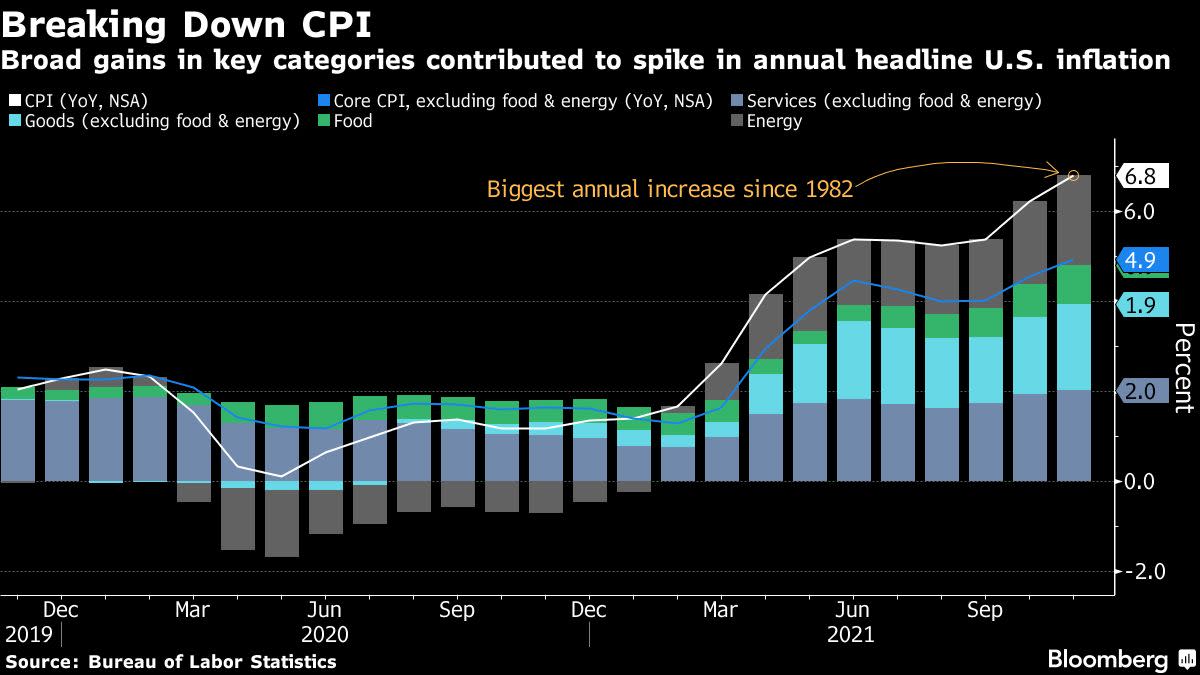

Data due out on Wednesday will probably show that consumer prices rose 7% in December from a year earlier, according to the median forecast of economists surveyed by Bloomberg. That would top November’s 6.8% annual rise and be the largest increase since 1982.

Here are some of the points on inflation and the Fed made by a number of well-known economists in panels at the AEA conference:

Furman, a Harvard University professor, said he expects inflation to remain elevated this year, with a mean forecast of 3.2% for the core personal consumption expenditures price index. That’s above the median 2.7% forecast of Fed policy makers at their Dec. 14-15 meeting.

Meanwhile, Furman saw a 15% chance that inflation will come in higher this year than last. He also averred that the three nominees that Biden is reportedly considering for the central bank’s board “are considerably more dovish than anyone who’s been on the Fed” for a long time.

Taylor, whose monetary-policy rule has been a guidepost for central banks worldwide for years, said the Fed is “way behind” the curve. Depending on the assumptions made, he suggested the federal funds rate should be anywhere from 3% to 6%, not the near-zero percent level now targeted by the central bank.

Noting that yields on Treasury securities jumped last week, the Stanford University professor predicted seeing “more of that down the road.”

Summers, a Harvard University professor and paid contributor to Bloomberg, also foresees Treasury yields rising further.

“As the reality of the need for balancing supply and demand becomes clear, interest rates will rise substantially over the next year and a half,” he said.

Summers got into a spirited back-and-forth with Stiglitz at the conference, arguing that the Columbia University professor was placing too much emphasis on supply-chain kinks for the run-up in prices.

Gregory Mankiw, who was chief White House economist for Republican President George W. Bush, said “a lot” of the increase in inflation could be blamed on temporary dislocations in supply. “We also have a very tight labor market and you’re starting to see it in wage growth,” he said.

The Harvard professor, who is now a self-described political independent because of opposition to former President Donald Trump, said that although inflation isn’t going to stay at 7%, he’d be “surprised” if it falls back to 2% very quickly.

Former Fed Vice Chairman Alan Blinder said he still counts himself as a member of “Team Transitory” in the debate over inflation.

But Blinder, who served in the White House under Clinton and now teaches at Princeton University, has said it could take some time for “bottleneck inflation” to ease. Fed policy makers have been slow to recognize the bubbling price pressures in their forecasts, he’s added.

The soft landing that Powell and his central bank colleagues are trying to engineer for the economy “will require the Fed to be both lucky and smart,” Hubbard told the conference.

Pointing to inflationary pressures from rising rents and home prices and increasing wages, the Columbia University professor doubted whether the three quarter-percentage-point rate increases Fed policy makers have penciled in for this year will be enough.

©2022 Bloomberg L.P.