(Bloomberg) — A valuation case that has fueled a near-tripling in the Nasdaq 100 Index is coming under increasing pressure, with surging interest rates threatening to dent equities’ there-is-no-alternative argument.

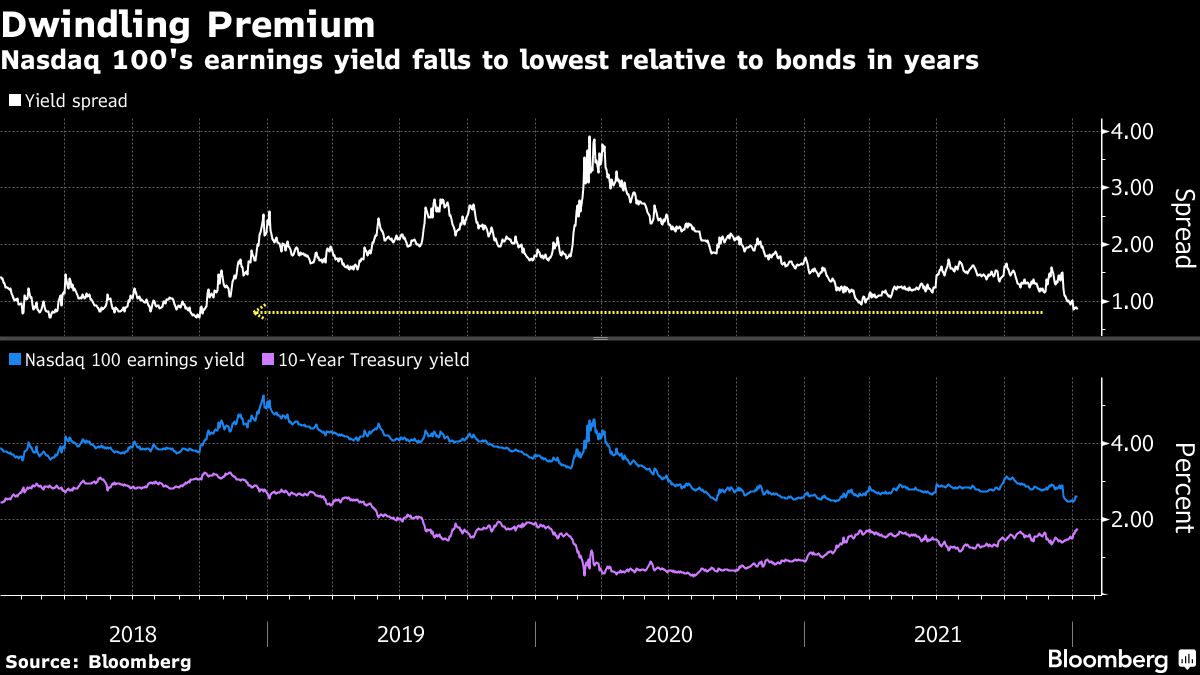

While the stock-bond valuation picture still leans toward shares from a longer-term historical lens, it is currently being clouded by the biggest weekly run-up in 10-year Treasury yields in a year. Their surge has shrunk the advantage of the tech-heavy index’s earnings yield relative to the benchmark rate to the lowest level in over three years.

The differential, a version of a something called the Fed model that is the subject of significant analytic controversy, at least gives a back-of-envelope glimpse into shifting valuations in two markets whose relationship defies easy quantification. Put simply, the more bonds sell off, the higher their payouts become relative to the cash flow generated by big tech companies. This potentially complicates the buy-the-dip reflex that has defined equity markets for more than a decade.

“For years, markets have placed exorbitant multiples on growth stocks because ‘there was no alternative.’ Seemingly overnight it is beginning to appear as if there will be ample alternatives by year-end,” said Michael O’Rourke, chief market strategist at JonesTrading. “It will be hard to identify at which levels high-growth names will stabilize in an environment where the Fed is raising rates and shrinking its balance sheet. The ‘alternatives’ that are re-emerging provide a greater degree of stability.”

Rates on 10-year Treasuries rose as high as 1.8% this week — levels not seen since last March — on a bond selloff that kicked into high gear after the release of surprisingly hawkish minutes from the Federal Reserve’s December meeting. The surge in yields slammed speculative assets and cash-generating tech giants alike. A basket of nonprofitable tech shares plunged 10% this week, while the Nasdaq 100 dropped 4.5% in its worst week since February.

As a result, the Nasdaq 100’s earnings yields — a measure of profits relative to share prices — has been whittled down to 0.85 percentage point above the 10-year Treasury rate, the smallest advantage since October 2018. And this has happened quickly. At the beginning of 2021, there were there were 83 companies in the Nasdaq 100 with a higher corporate profit payout than the 10-year Treasury yield, according to data compiled by Bloomberg. By Friday, that dwindled to 64 companies.

Investor nail-biting over the yield spike is further fueled by the fact that it’s being driven by real rates, not inflation. This means the prospect for an economic acceleration has caused bond traders to push up their rate expectations. While that’s not bad news for all equity investors, it’s an ominous signal for tech stocks, whose promises for faster growth had lured investors during the last decade during a sluggish economic period.

While all this has been churning, there are signs that ever-present dip buyers attempted to unsuccessfully catch the falling knife. Nearly $18 billion has flooded into equity-focused exchange-traded funds over the past week, according to data compiled by Bloomberg. Yet the $208 billion Invesco QQQ Trust Series 1 ETF (ticker QQQ), which tracks the Nasdaq 100, was on track to shed nearly $700 million.

The question looming on investor minds is, can tech earnings weather further rate shock should 10-year Treasury yield rise to 2%, as many now predict? While it’s not exact science, a simple math exercise shows profits from Nasdaq 100 firms would need to climb 9% for the benchmark’s price to stay where it is and maintain its current valuation relationship with bonds.

That might be a high hurdle to clear. Analysts expect software and Internet companies to report a 5.9% increase in 2022 profits, data compiled by Bloomberg Intelligence show.

Even still, Ally’s Lindsey Bell isn’t too fussed. The Fed’s hiking cycle, while perhaps kicking off more quickly than previously thought, is only expected to take the federal funds rate to 1.75% by 2025. That’s hardly a level that would kill the equity rally or seriously threaten lofty valuations, she said.

“Interest rates are still going to be extremely low and they’re not even going to reach the peak of the last cycle when the Fed was raising rates, and we saw that tech, stocks were able to perform well in that environment,” said Bell, Ally’s chief markets and money strategist. “Ultimately once the Fed gets through its cycle, because interest rates aren’t going to go to the moon, I think that stocks are still going to be a good place to be.”

©2022 Bloomberg L.P.