As the broad stock market has rallied this year, so also has the price of oil. West Texas Intermediate crude, the benchmark for U.S.-produced oil, has rallied from around $42 per barrel to its current price a little below $60. Even with that increase, however, crude remains more than 21% below its September 2018 highs, which is why a lot of stocks in the energy industry have underperformed the rest of the market.

Economists and analysts like to try to forecast the direction of commodities that are likely to have an impact on the finished goods produced by other sectors and industries. That makes sense, because an increase in price for a commodity that contributes to that finished product increases the costs the manufacturer of that product must incur. Another element that I think is interesting is the difference (also called the spread) in price between similar commodities, like Brent crude versus WTI crude. The U.S. actually imports more oil from outside the U.S. than it uses its own supply, which means that changes in the spread can also have a direct impact on those finished goods.

Late last week, I highlighted oil refining as an industry where that spread makes a big difference in the ability of U.S. refineries to be profitable. A wider spread usually works in their favor, since refineries can get U.S. crude at a bigger discount than they can from overseas. In 2016 when both commodities bottomed, that spread was practically zero, which was one of the dynamics that challenged refinery stocks. The spread started to widen in mid-2017, however and has been running between $8 to $10 per barrel pretty consistently since that time.

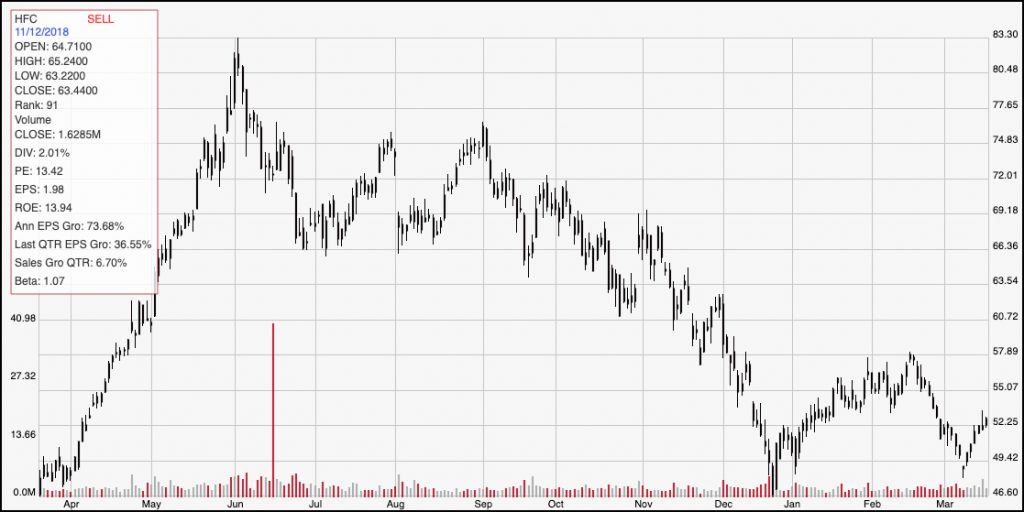

Analysts and industry experts expect that spread to remain around $8 per barrel through the rest of this year, which increases the chances the industry will be able to keep increasing their profitability. That’s good news for refiners like HollyFrontier Corp (HFC). The stock is significantly below its June 2018 high levels around $83 per share. The stock dropped to a low around $46 in December and appears to be showing signs of stabilization between $49 and $57 per share. With solid, and improving fundamentals along with an impressive value proposition, the stock could represent an attractive long-term opportunity right now. Check it out.

Fundamental and Value Profile

HollyFrontier Corporation is an independent petroleum refiner. The Company produces various light products, such as gasoline, diesel fuel, jet fuel, specialty lubricant products, and specialty and modified asphalt. It segments include Refining and Holly Energy Partners, L.P. (HEP). The Refining segment includes the operations of the Company’s El Dorado, Kansas (the El Dorado Refinery); refinery facilities located in Tulsa, Oklahoma (collectively, the Tulsa Refineries); a refinery in Artesia, New Mexico that is operated in conjunction with crude oil distillation and vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the Navajo Refinery); refinery located in Cheyenne, Wyoming (the Cheyenne Refinery); a refinery in Woods Cross, Utah (the Woods Cross Refinery), and HollyFrontier Asphalt Company (HFC Asphalt). The HEP segment involves all of the operations of HEP. HEP is a limited partnership, which owns and operates logistic assets. HFC has a current market cap of about $9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 221%, while revenues grew by almost 9%. in the last quarter, earnings improved by about 13.5% while sales declined by nearly -9%. The company’s margin profile is narrowing, with Net Income as a percentage of Revenues in the last quarter at 3.26% versus 6.19% over the last twelve months.

Free Cash Flow: HFC’s free cash flow is adequate, at $1.246 billion. That translates to a Free Cash Flow Yield of 13.7%. It is worth noting that Free Cash Flow has improved from less than zero in the last quarter of 2016 and from about $900 million in June of last year.

Debt to Equity: HFC’s debt to equity is .37, which is generally considered a conservative number. The company’s balance sheet indicates operating profits should be adequate to service their debt, and it also indicates the company’s liquidity is very healthy, with more than $1.15 billion in the last quarter versus about than $2.4 billion of long-term debt.

Dividend: HFC’s annual divided is $1.32 per share, which translates to a yield of about 2.5% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for HFC is $37.28 and translates to a Price/Book ratio of 1.42. The stock’s historical average Price/Book ratio is 1.53, which puts the stock’s long-term target price at about $57.16 per share, or only a bit more than 4% above the its current price. However, the stock is also trading more than 58% below its historical Price/Cash Flow ratio, and offers up a far more attractive target price near to the stock’s highs from last year at around $83.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. After rallying from a low around $46 to a high around $57, the stock dropped back until about a week ago to about $49 before rallying to its current price around $52. The stock would need to break above $58 per share to build an actual new upward trend. A drop below major support at $47 could see the stock drop to around $42, a low the stock last saw in late February of 2018.

Near-term Keys: Seeing the stock rally to test its all-time highs around $83 may be highly optimistic given the strength of the stock’s long-term downward trend as well as the limits of its current trading range; however the stock has solid fundamentals driving it, and even its narrowing margin profile looks like it is likely to only be a short-term headwind that should see material improvement through the rest of the year. If you prefer to work with a short-term trade, your best bet would be wait for either a break above $58 for bullish trade with call options, or a drop below $47 to think about shorting the stock or working with put options.